Introduction

Tax is a financial charge or levy imposed by a government on individuals, businesses, or other entities to fund public expenditures and government functions. It is a compulsory contribution that citizens and businesses are required to pay, and it is a crucial source of revenue for the government.

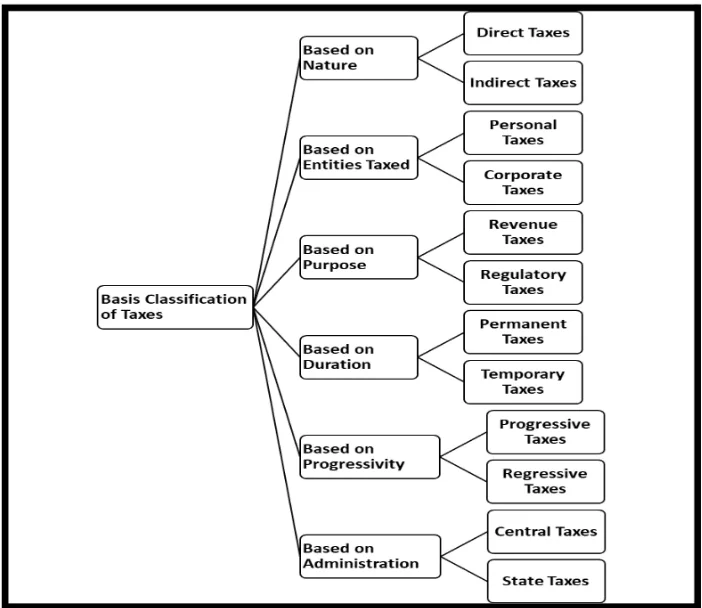

Classification of Taxes

A. Direct Taxes

- A direct tax is a type of tax that is levied directly on the income, wealth, or property of individuals or organizations.

- Unlike indirect taxes, which are levied on goods and services and are paid indirectly by consumers (such as sales tax or VAT), direct taxes are paid directly to the government by the taxpayer.

- Its burden cannot be shifted to others

- It is deducted at source from the income of the person who is taxed.

- It is not desirable to avoid payment of taxes.

| Tax GDP Ratio: Tax-GDP ratio is an indicator of fiscal performance. The higher the ratio, the better is the tax collection, the higher the tax revenue. |

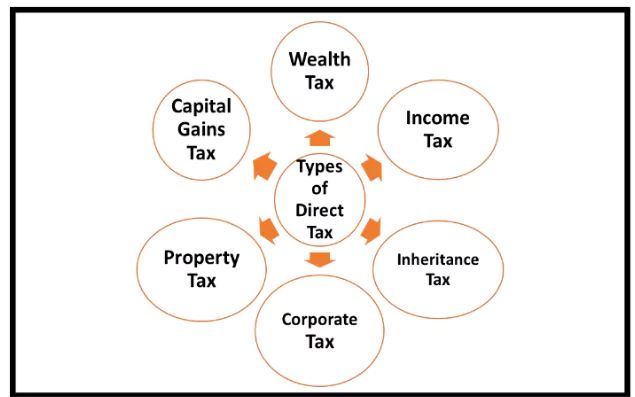

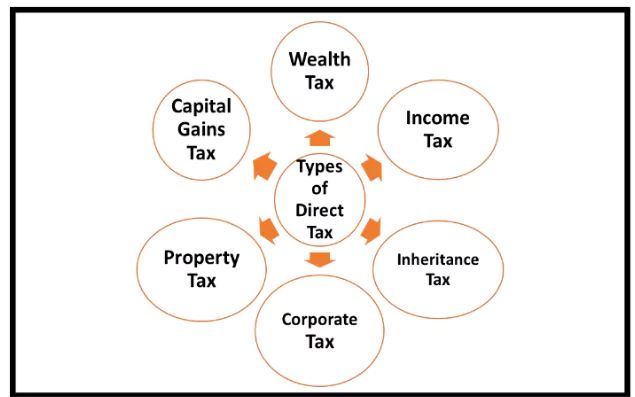

Types of Direct Taxes

- Income Tax: Imposed on Individual, Liable to pay the tax directly to the Government and bear the burden of the tax himself.

- Corporation Tax: Levied on the profit of corporations and companies,

Wealth Tax: Imposed on the property of individuals depending upon the value of property.

Wealth Tax: Imposed on the property of individuals depending upon the value of property. - Gift Tax: It is paid to the Government by the recipient of a gift depending on the value of gift.

- Estate Duty: It is charged from the successor of inherited property.

- Minimum Alternate Tax (MAT): It is a provision introduced by the Finance Act of 1987, to address situations where a company, despite generating income, manages to reduce its tax liability or avoids paying any taxes altogether (referred to as “zero tax companies“).

- Capital Gain Tax: Pertains to the taxation of profits or gains obtained from selling an asset at a price higher than its initial purchase cost.

- Such gains typically arise when assets like stocks, bonds, precious metals, art, or real estate are sold. (UPSC 2012)

- Dividend Distribution Tax (DDT): It is used to be a taxation in India imposed on the dividends that a company distributes to its shareholders, representing a portion of its profits.

- However, in the 2019-20 budget, DDT was eliminated, and instead, dividends became taxable directly in the hands of the shareholders.

- Securities Transaction Tax (STT): It is a tax imposed during the buying and selling of securities such as stocks, bonds, debentures, and mutual funds that are listed on Indian stock exchanges.

- The Equalization Levy: It is also known as “Google Tax,” was introduced in India in 2016 to address taxation challenges posed by the digital economy.

- Introduction: The Equalization Levy is distinct from income tax and was introduced as an independent levy through the Finance Act of 2016.

- Scope: It covers various digital services and became effective at different dates. Initially, it was applied to the “sale of digital services (ads),” and subsequently, from April 1, 2020, it also extended to e-commerce firms.

- Example: if an e-commerce firm like Amazon, which is registered in the US and classified as a non-resident in India, earns revenue (not profit) of Rs. 100 from its online platform by selling to Indian residents, it is required to pay 2% of this revenue (Rs. 2) to the Indian government as an Equalization Levy.

Based on tax rate, taxes can be classified into the following types:

- Proportional Taxes: A taxation that takes the same percentage of income from all income groups.

- Since Proportional tax is charged at a flat rate for everyone, whether earning higher income or lower income, it is also called flat tax.

- Proportional tax is based on the theory that since everybody is equal, taxes should also be charged the same way.

Example: The sales tax Example: The sales tax

- Progressive Taxes: The tax rate increases with the taxpayer’s income.

-

- It takes a larger percentage of income from high-income groups.

- Example: Tax on interest earned, rental earnings.

- Regressive Taxes: Tax rate decreases with an increase in income.

- Takes a larger percentage of income from low-income groups than from high-income groups.

- Examples: Sales tax, Property tax, Excise tax, Tariffs and government fees.

- Degressive Taxes: In degressive taxation, a tax may be progressive up to a certain limit but after that it may be charged at a flat rate.

- It is a mix between the progressive tax and proportional tax.

- This type of taxation is usually applied in income tax.

|

|

The administrative structure for direct taxation in India

Central Board of Direct Taxes (CBDT), which operates under the Ministry of Finance. The CBDT is responsible for the administration of direct taxation laws through the Income Tax Department. Here’s an overview of the structure:

Central Board of Direct Taxes (CBDT)

- The CBDT is a statutory authority functioning under the Central Board of Revenue Act, 1963.

- It provides essential inputs for policy and planning of direct taxes in India and is also responsible for the administration of direct tax laws.

Income Tax Department

- The Income Tax Department is a government agency undertaking direct tax collection.

- It is headed by the CBDT and is part of the Department of Revenue in the Ministry of Finance.

|

Difference Between GAFA tax and Equalisation levy in India

| Point of difference |

GAFA Tax

(Global Tax on Digital Giants) |

Equalisation Levy |

| Definition |

GAFA Tax refers to taxation types specifically designed to target major digital corporations like Google, Apple, Facebook, and Amazon (hence GAFA). |

The Equalisation Levy is a taxation imposed on non-resident e-commerce operators for digital services provided in a country. |

| Purpose/

Objective |

Aims to ensure that tech giants pay a fair share of taxation in the countries where they have significant user bases but may not have a physical presence. |

Intended to equalize the tax situation between foreign and domestic e-commerce companies and capture taxation on digital transactions. |

| Primary Focus |

Primarily focused on large technology companies with significant digital revenues. |

Targets a broader range of digital services and e-commerce transactions. |

| Geographical Origin |

Initiated by individual countries like France, aiming to tax profits made in their jurisdictions by large multinational tech companies. |

Originating in India, it is designed to tax digital transactions involving foreign e-commerce companies. |

| Tax Base |

Based on the revenues generated from digital services in a specific country. |

Levied on the gross revenue from digital services provided by non-resident companies. |

| Rate of Taxation |

Varies depending on the country implementing it.

Example: France proposed a 3% tax rate. |

In India, the rate is 2% (as of my last update) on the revenues of select digital services. |

| Implementation |

Implemented by individual countries according to their tax laws and regulations. |

Implemented as part of the broader tax code of the country, like India’s Finance Act. |

| Global Acceptance |

The concept has faced opposition from some countries and tech companies, leading to discussions for a broader global solution under the OECD. |

Mainly a country-specific measure, it has not been widely adopted or discussed in global tax reform debates like the OECD’s initiatives. |

| RATE OF GROWTH OF TAXES (%) VS GROWTH IN NOMINAL GDP |

|

Nominal GDP |

Corporate Tax Growth |

Growth in Income Tax |

Tax Buoyancy |

| 2021-22 |

19.5 |

55.6 |

43 |

2.52 |

| 2022-23 |

15.4 |

16 |

20 |

1.1 |

| 2023-24(Apr-Aug ) |

8 |

15 |

35.7 |

– |

| India’s direct tax to GDP ratio has been slowly crawling up from an average of 5.5% from

FY12 to FY21, to a high of 5.97% in FY22 and 6.08% in the last fiscal. But this is still lower than the 6.3% direct tax-to-GDP ratio that the country achieved in 2007-08. |

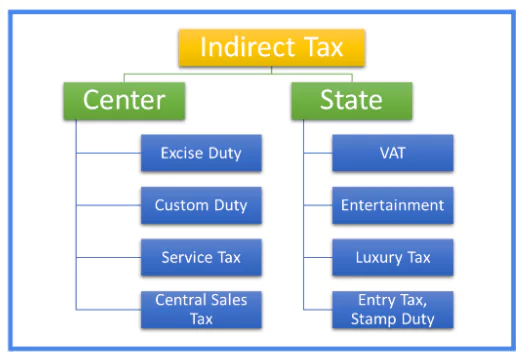

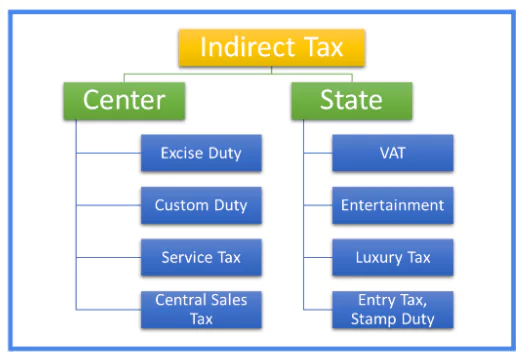

B. Indirect Taxes

- An indirect tax is a tax wherein (i) the liability to pay a tax is on one person and (ii) the burden of that tax falls on some other person.

- Indirect tax is the tax levied on the consumption of goods and services. It is not directly levied on the income of a person.

- Indirect tax is generally imposed on suppliers or manufacturers who pass it on to the final consumer.

Types of Indirect Taxes

- There are different types of indirect taxes that exist in India, but following the implementation of GST, they were subsumed into a single unified tax system for the nation’s citizens.

- Excise Duty: Used to be applied to manufactured goods, with taxation occurring when the goods left the factory premises

- Customs Duty: It is imposed on the import and export of commodities.

- Service Tax: It was levied on the provision of services.

Central Sales Tax (CST): This was imposed by the Central government on the sale of products between different states.

Central Sales Tax (CST): This was imposed by the Central government on the sale of products between different states. -

- However, the tax revenue was collected and retained by the state where the transaction originated, which is why it was referred to as an origin-based tax.

- Value Added Tax (VAT): Applied to the sale of goods within a state.

- The Central government did not have the authority to tax intrastate sales, and VAT was only imposed on the value added at each stage of production.

- Under the VAT system, every entity in the value chain was required to remit taxes to the government based on their respective value additions. (UPSC 2011)

- Entry Tax: Previously enforced by Indian state governments, applied to the inter-state movement of goods.

- It was imposed by the receiving state to safeguard its tax revenue base

- Stamp Duty: Tax that pertains to all legal property transactions.

- It required the affixing or imprinting of a physical stamp on the document to signify payment of the stamp duty.

- As it is imposed by individual states, the tax rate varies from one state to another.

Conclusion

- India’s taxation system encompasses various types of taxes, including direct and indirect taxes.

- These taxes play an important role in generating revenue for the government and financing public services and infrastructure.

- While the introduction of GST revolutionized the indirect tax landscape, other taxation types such as income tax, corporate tax, customs duty, and excise duty continue to contribute significantly to the country’s revenue stream and fiscal policies.

Wealth Tax: Imposed on the property of individuals depending upon the value of property.

Wealth Tax: Imposed on the property of individuals depending upon the value of property.  Central Sales Tax (CST): This was imposed by the Central government on the sale of products between different states.

Central Sales Tax (CST): This was imposed by the Central government on the sale of products between different states.