Union Budget 2024-25 is set to be presented by Finance Minister Nirmala Sitharaman on July 23, 2024 (Today). Check out the Union Budget 2024-25 Live updates, expectations & key features.

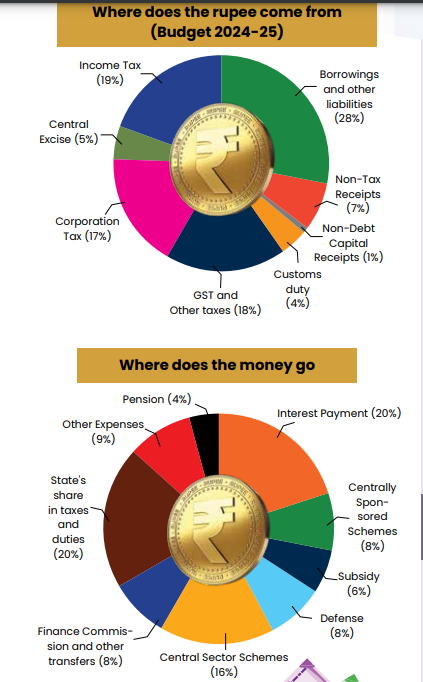

Union Budget 2024-25: The Union Budget has been presented by Finance Minister Nirmala Sitharaman on July 23, 2024 (Today). It addresses the needs and expectations of a diverse range of stakeholders. As per the budget, the fiscal Deficit Target has been reduced to 4.5% for FY25. The budget includes common taxpayers, investors, women, industries, farmers, and major industry sectors such as FMCG, real estate, and technology. The budget increased the standard deduction and revised tax rates for salaried individuals under the new tax regime.

Stay tuned for more detailed analysis and insights once the Union Budget 2024 is officially presented.

Union Budget 2024-25 Highlights

Finance Minister Sitharaman announced an increase in the standard deduction and updated tax rates for salaried employees under the new regime, in addition to reductions in customs duties on gold, silver, mobile phones, and other items. Here is the overall Union Budget 2024-25 Highlights:

The Central Government’s FY25 capital expenditure is projected at ₹11.1 lakh crore, consistent with the Interim Budget, with infrastructure spending targeted at 3.4% of GDP. Check out the Economic Overview here:

In the 2024 Budget, the exemption limit for capital gains has been raised to Rs 1.25 lakh. Additionally, the tax rate on short-term capital gains (STCG) has been increased to 20%, and the rate on long-term capital gains (LTCG) has been raised to 12.5% for specific assets. Here is the overview:

Custom Duties and Industrial Development:

The Union Budget 2024 aims to balance political needs with economic stability, focusing on long-term infrastructure, social development, and fiscal prudence while addressing market and sector-specific challenges.

The Union budget, also known as the Annual Financial Statement, is the annual budget of the Government of India set by the Ministry of Finance. The body responsible for presenting the budget is the budget division of the Department of Economic Affairs (DEA) in the Finance Ministry. The budget comprises two parts: the Annual Financial Statement and the Demand for Grants.

The Annual Financial Statement outlines government revenue while Demand for Grants highlights estimated expenditures, and seeks funds from the Consolidated Fund of India.

Union Budget Components: The Union budget comprises two components:

Capital Budget: It is made up of the government’s capital receipts and capital expenditures during a financial year.

Key Features of a Budget

Check out the key differences between a Full Budget and an Interim Budget. Understanding these differences is essential for grasping how the government plans and allocates resources in different economic and political contexts. Union Budget is set to be presented on July 23, 2024, however, Interim Budget was presented on February 1, 2024.

| Full Budget | Interim Budget |

|

|

|

|

|

|

|

|

|

|

|

|

Interim Budget

|

|---|

Articles |

Provisions |

| Article 112 |

|

| Article 113 |

|

| Article 114 |

|

| Article 266 |

|

| Article 267 |

|

Events Associated With Union BudgetHalwa Ceremony

Lock-in Period

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The full Union Budget 2024-25 will be presented on July 23, 2024.

The Union Budget 2024 will be presented by the Finance Minister of India, Nirmala Sitharaman.

An interim budget is a type of temporary financial plan for the government, which will replace a full budget in case Parliament is short on time or general elections are approaching.

While the exact theme of the Union Budget 2024 will be revealed on the day of its presentation, it is expected to focus on economic recovery post-pandemic, infrastructure development, and digital transformation.

The first Union Budget of independent India was presented by R. K. Shanmukham Chetty on November 26, 1947. This budget was primarily an interim budget as it was presented just a few months after India gained independence.

Former Prime Minister Indira Gandhi was the first woman who presented the Union Budget.

The Union Budget is presented by the Finance Minister of India. It is presented in the Lok Sabha (House of the People).

<div class="new-fform">

</div>