Union Minister Nirmala Sitharaman presented the Union Budget 2026-27, focusing on three 'Kartavyas' to drive economic growth, fulfil aspirations, and ensure inclusive development. This summary covers major announcements for MSMEs, infrastructure, and the new Income Tax Act.

The Union Minister for Finance and Corporate Affairs, Smt Nirmala Sitharaman, presented the SUMMARY OF UNION BUDGET 2026-27 in Parliament on February 1, 2026. This budget, the first to be prepared in the newly named Kartavya Bhawan, is a roadmap toward ‘Viksit Bharat’ (Developed India). Guided by the principle of “Yuva Shakti,” the budget emphasises the government’s commitment to the poor, underprivileged, and disadvantaged sections of society.

The Union Minister for Finance and Corporate Affairs, Smt Nirmala Sitharaman, presented the SUMMARY OF UNION BUDGET 2026-27 in Parliament on 1 February 2026. This is the first budget prepared in the newly inaugurated Kartavya Bhawan and represents a roadmap toward Viksit Bharat (Developed India).

Guided by the principle of “Yuva Shakti”, the Union Budget 2026–27 summary highlights the government’s commitment to social inclusion, economic growth, and fiscal prudence. The budget is anchored on three key “Kartavyas” (duties):

This Union Budget brief overview 2026–27 outlines strategic reforms, sector-wise allocation, fiscal measures, tax proposals, and social initiatives, aimed at long-term development.

The Union Budget highlights 2026–27 focus on growth, infrastructure, and citizen-centric welfare. Key highlights include:

These Union Budget major highlights 2026–27 demonstrate the government’s focus on inclusive development, technological innovation, and human capital growth.

A detailed Union Budget sector wise allocation 2026–27 shows a strategic focus on infrastructure, MSMEs, education, health, and rural development:

| Union Budget Sector-Wise Allocation 2026–27 | ||

| Sector | Key Initiative | Allocation/Target |

| MSME | SME Growth Fund for “Future Champions” | ₹10,000 Crore |

| Health | Biopharma SHAKTI & Regional Medical Hubs | ₹10,000 Crore (Biopharma) |

| Infrastructure | Public Capital Expenditure | ₹12.2 Lakh Crore |

| Education | AVGC Labs in Schools/Colleges | 15,000 Schools & 500 Colleges |

| Tourism | Upskilling 10,000 Guides via IIMs | 20 Tourist Sites |

Infrastructure and Connectivity:

The Union Budget 2026–27 emphasises green and sustainable cargo movement, operationalising 20 new National Waterways and expanding Dedicated Freight Corridors (Dankuni to Surat).

Agriculture and Rural Development:

The Union Budget tax proposals 2026–27 focus on ease of compliance, foreign investment, and taxpayer relief:

These measures are key Union Budget economic reforms 2026–27 targeting growth, investment, and social welfare.

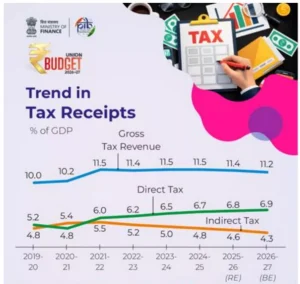

Maintaining fiscal prudence remains a core pillar of the Union Budget important points 2026–27:

These Union Budget key points 2026–27 show a balanced approach between development spending and fiscal responsibility.

The Union Budget schemes and initiatives 2026–27 prioritise social inclusion, technology adoption, and youth empowerment:

The Union Budget revenue and expenditure summary 2026–27 provides a clear picture of fiscal planning:

Key takeaways from the Union Budget quick facts 2026–27 include:

The Union Budget analysis 2026–27 highlights the government’s strategic focus on inclusive growth, infrastructure, and fiscal prudence:

Check Out UPSC CSE Books

Visit PW Store

The Union Budget 2026–27, presented by Finance Minister Smt. Nirmala Sitharaman included several transformative announcements aimed at boosting economic growth, promoting inclusivity, and strengthening India’s global competitiveness. Here are the Union Budget top announcements 2026–27:

1. New Income Tax Reforms

2. Public Capital Expenditure

3. Biopharma SHAKTI

4. MSME Growth

5. High-Speed Rail & Connectivity

6. Education & Skills Development

7. Agriculture & Rural Development

8. Sports & Youth Empowerment

9. Ease of Doing Business & Digital Governance

10. Customs & Trade Facilitation

11. Social Inclusion & Health

12. Fiscal Prudence

These Union Budget important announcements 2026–27 collectively focus on economic reforms, social welfare, infrastructure development, and fiscal prudence, reinforcing India’s path toward Viksit Bharat.

Ready to boost your UPSC preparation? Join PW’s UPSC online courses today!

The government has targeted a fiscal deficit of 4.3% of GDP for the financial year 2026-27, continuing its path of fiscal consolidation.

Key changes include the introduction of the New Income Tax Act 2025, a reduction in TCS rates for overseas travel and education to 2%, and customs duty exemptions on 17 life-saving drugs.

Bharat-VISTAAR is a multilingual AI tool designed to integrate agricultural portals and provide AI-based customised advice to farmers to improve productivity.

The Union Budget revenue and expenditure summary 2026–27 outlines the government’s projected income from taxes and other sources, and planned spending across sectors like infrastructure, healthcare, education, and welfare programs for FY 2026–27.

<div class="new-fform">

</div>