![]() June 11, 2024

June 11, 2024

![]() 1591

1591

![]() 0

0

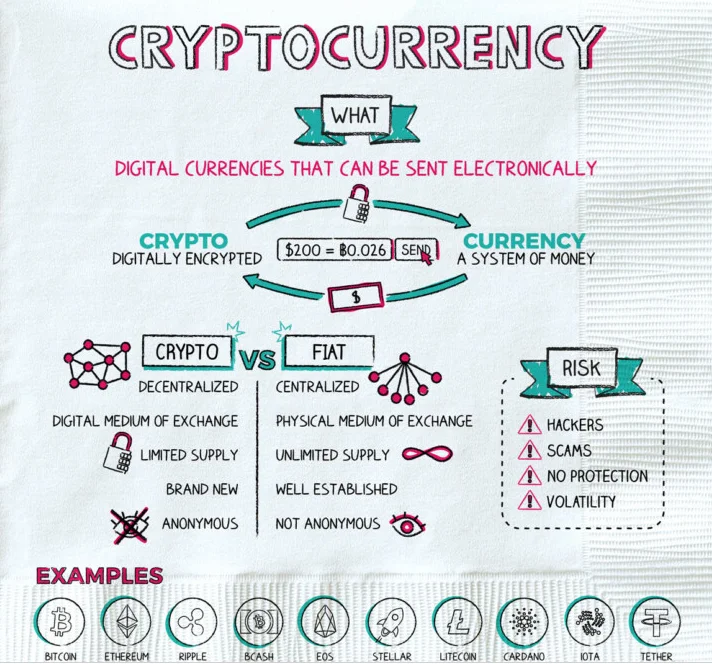

Cryptocurrency is a type of digital currency that uses cryptography to secure and verify transactions and to control the creation of new units. Unlike traditional money, cryptocurrencies operate on decentralized networks without the need for a central authority like a government or bank. They exist only online and are recorded on a public ledger called a blockchain. The first and most well-known cryptocurrency is Bitcoin, created in 2009.

How is Cryptocurrency different from NFT

| Feature | Cryptocurrency | NFT |

| Fungibility | Fungible (interchangeable) | Non-fungible (unique) |

| Purpose | Medium of exchange and store of value | Ownership of digital assets |

| Value | Derived from market demand and supply | Subjective, based on underlying asset and market sentiment |

| Trading | Traded on cryptocurrency exchanges | Traded on NFT marketplaces |

| Examples | Bitcoin, Ethereum, Litecoin | CryptoPunks, Bored Ape Yacht Club, NBA Top Shot |

CBDC (e₹): The e₹ is a digital form of Indian rupee issued by the RBI.

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Cryptocurrencies represent a new and evolving form of digital money, offering various uses from online payments to investments. Despite their potential, they also face challenges such as volatility and regulatory issues.

| Related Articles | |

| Mining : Method, Historical Significance, Modern Practise | CRYPTOCURRENCY |

| What is Bitcoin Halving and What It Means to the Crypto Community? | Digital Economy |

<div class="new-fform">

</div>

Latest Comments