![]() 2 Feb 2026

2 Feb 2026

The 2026-27 Union Budget represents a significant milestone in India’s economic journey, marking a shift towards a duty-based philosophy and strategic self-reliance in manufacturing.

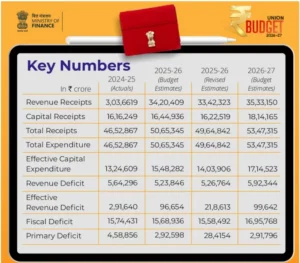

Revenue Receipts: These are government earnings that do not create repayment liabilities, comprising Tax Revenue (such as GST and Income Tax) and Non-Tax Revenue (including PSU dividends, user charges, fees, and fines).

Revenue Receipts: These are government earnings that do not create repayment liabilities, comprising Tax Revenue (such as GST and Income Tax) and Non-Tax Revenue (including PSU dividends, user charges, fees, and fines).

India’s Semiconductor Journey

|

|---|

Check Out UPSC CSE Books

Visit PW Store

| Mains Practice |

|---|

<div class="new-fform">

</div>