The Centre for Economics and Business Research (CEBR) forecasts the onset of a worldwide economic downturn in 2023. Other agencies also anticipate a global recession beginning in the same year. The implementation of new borrowing measures aimed at combating inflation leads to the contraction of several economies. In this article we will learn about the Global Recession 2023 and Global Recession 2008, and how India tackled the Global Recession each time.

In 2022, the global economy surpassed the milestone of $100 trillion for the first time, as reported by the British consultancy’s annual World Economic League Table. However, this growth will come to a standstill in 2023 due to governments grappling with increasing costs.

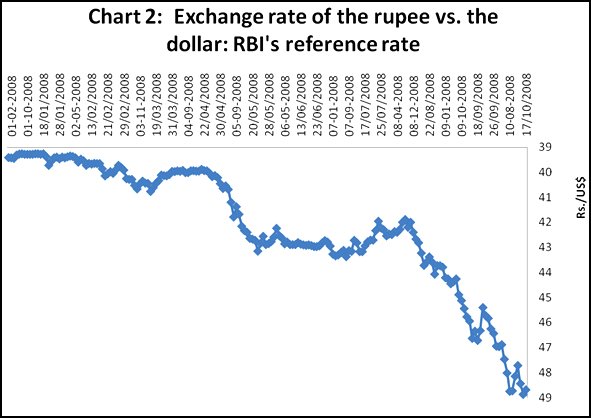

Initially, the Indian economy seemed to be shielded from the worldwide financial crisis that originated in August 2007 with the US sub-prime mortgage crisis. The Reserve Bank of India (RBI) even raised interest rates until August 2008 to control the economy and reduce the GDP growth rate, which had surpassed the potential output growth rate, leading to inflationary pressures.

However, when the collapse of Lehman Brothers occurred on 23 September 2008, the US financial meltdown spread globally, and India felt an immediate impact. External credit inflows dried up, causing the overnight money market interest rate to surge above 20% and remain high for the following month. It is reasonable to assume that the effects of the global economic downturn on the Indian economy are still unfolding.

Considering this situation, this paper aims to analyze the repercussions of the global financial crisis on the Indian economy and propose some policy measures to facilitate economic recovery.

The researcher’s findings present a more pessimistic outlook compared to the latest IMF forecast. Bloomberg reported in October that the IMF warned about a potential collapse in over a third of the world’s economies, with a 25% chance of global GDP expanding by less than 2% in 2023, leading to a worldwide recession.

As per Bloomberg’s projections, the global gross domestic product is expected to double by 2037, mainly due to developing economies catching up with wealthier ones. By that time, the East Asia and Pacific region will account for over a third of the world’s output, while Europe’s share will decrease to less than a fifth, reflecting changing power dynamics.

The Centre for Economics and Business Research’s growth, inflation, and currency rate estimates are built upon data from the IMF’s World Economic Outlook and an internal model.

The report envisions that India’s economy will attain a $10 trillion value by 2035 and will secure the third position globally by 2032. Due to the United States being a major superpower, any level of economic downturn, whether mild or severe, will inevitably have far-reaching consequences across the world.

The crisis eventually escalated and spread, leading to a worldwide economic shock that resulted in several European bank failures, declines in multiple stock indices, and significant devaluation of the Indian market.

As Indian businesses had significant outsourcing agreements with US clients, any slowdown in the US economy was undoubtedly devastating news for India. Over the years, India’s exports to the US have experienced growth. Nonetheless, India was affected by the severe financial crisis in September 2008 but managed to weather its impact and survive.

The Global Recession of 2008, also known as the Great Recession, was a catastrophic worldwide economic downturn that shook the very foundations of the global financial system. The recession, which originated in the United States, spread rapidly to the rest of the world, causing severe economic contractions and significant hardships for millions of people. In this article, we delve into the causes, consequences, and the lessons learned from the most severe financial crisis since the Great Depression.

The housing bubble burst in 2006, leading to a significant decline in housing prices. As a result, many homeowners found themselves unable to make mortgage payments, causing a surge in mortgage defaults. The default of subprime mortgages triggered a chain reaction that reverberated through the global financial system, as the complex financial products tied to these mortgages suffered massive losses.

The Global Recession of 2008 was a watershed moment that highlighted several critical lessons:

The global recession of 2008 had a significant impact on India, although the country was relatively better insulated compared to some other economies. Here are some of the key effects:

Despite facing challenges, India managed to weather the global recession relatively well compared to some other economies. The country’s large domestic market, diverse economy, and policy responses helped in mitigating the impact of the crisis. In the years following the recession, India resumed its growth trajectory, and its economy continued to expand at a significant pace.

During the global recession of 2008, India implemented several strategies to mitigate the impact of the crisis on its economy. While India was not as severely affected as some other countries, it still faced significant challenges due to its integration into the global economy.

The Indian government adopted a mix of fiscal and monetary measures to stimulate economic growth and maintain stability during that period. Some key strategies included:

Overall, India’s strategy against the global recession of 2008 focused on stimulating domestic demand, maintaining financial stability, and attracting foreign investment while ensuring social welfare and employment generation. These measures, along with the country’s resilience and large domestic market, played a role in helping India navigate through the global economic downturn with relatively less severe consequences.

Ramsar sites in India, Complete List till 2023

International Organisations and their Headquarters: The Complete Updated List 2023

Many economists anticipate a recession to take place during the latter part of the year. They believe that the impact of the Federal Reserve's elevated interest rates will be more strongly experienced by both consumers and businesses as time progresses.

Based on the Recession Probabilities Worldwide 2023 report, India is projected to have no chance of experiencing a recession this year. In contrast, the UK and US have relatively higher probabilities of 75% and 65% respectively of facing an economic downturn. India is leading in terms of real GDP growth with a substantial 5.9% annual percentage change, while the US has a growth rate of 1.6% and Canada follows closely with 1.5% real GDP growth.

विश्वव्यापी मंदी आंकड़े 2023 के अनुसार, इस साल भारत के पास मंदी का 0% संभावना है, जबकि यूके और यूएस के पास मंदी के 75% और 65% के चांस हैं। भारत पहले स्थान पर है जिसमें 5.9% वास्तविक जीडीपी (वार्षिक प्रतिशत बदलाव) है, जबकि यूएस के पास 1.6% वास्तविक जीडीपी विकास है और कनाडा 1.5% के साथ इसका पालन करता है।

According to Vanguard economists' mid-year forecast, there is a strong chance of a recession, and they believe it's increasingly likely that it might be postponed from 2023 to 2024. Similarly, JPMorgan Chase economists mentioned in a recent note that a synchronized global downturn could occur sometime during 2024.

<div class="new-fform">

</div>