Context:

Electricity consumption is Important indicator of Economic growth, to some extent enhancing the production of capital, labor and technology; economic growth can in turn increase the demand for electricity consumption, which indicates the inherent relationship between them.

More on News:

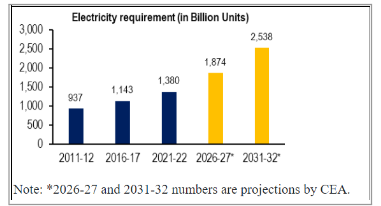

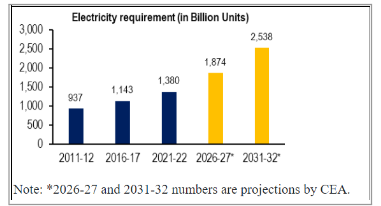

- The Central Electricity Authority (CEA) projects India’s electricity demand to increase 1.8 times between 2021-22 and 2031-32. At this rate, India’s annual per capita electricity consumption will be about 1,700-1,800 units in 2031-32.

- As of 2017, India’s per capita electricity consumption was significantly lower than most developed countries.

- Under the Paris agreement, India updated NDC to achieve about 50 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources by 2030.

Power Sector at a Glance ALL INDIA:

- Total Installed Capacity 4,17,668 MW.(As on 31.05.2023 Source-CEA)

- Installed GENERATION CAPACITY(FUELWISE) Fossil Fuel -2,37,269MW (56.8%) in which Coal and Lignite has largest share 50.7%,

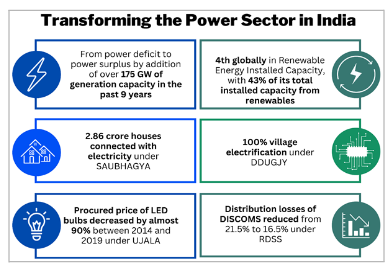

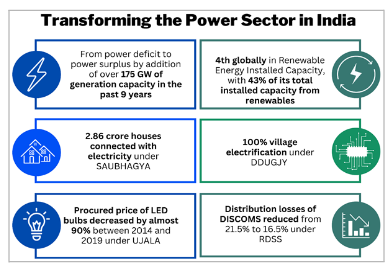

- India’s journey towards a greener future has gained global recognition.Today, India stands 4th globally in Renewable Energy Installed Capacity, with 43% of its total installed electricity capacity (175GW) coming from non-fossil energy sources.(Solar 16.1% and Wind-10.3%).

Challenges In Power Sector:

- Policy and Regulation of sector

- Electricity is listed in a ‘concurrent list’ in seven schedules, therefore there is lack of coordination and cooperation between center and states.

- Government subsidy and cross-subsidy from industrial and commercial consumers attempt to keep electricity affordable for residential and agricultural consumers.

- For example, in 2019-20, while 21% of the total electricity supply was sold to agricultural consumers, their share in the total revenue was only 2%.

- Generation:

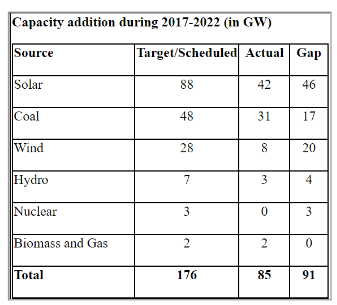

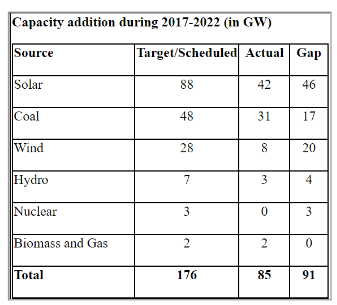

India missed capacity addition targets for almost all major energy sources for the 2017-22 period (up to March 2022).

India missed capacity addition targets for almost all major energy sources for the 2017-22 period (up to March 2022). - In spite of the renewables push, coal still accounts for about 50% of India’s installed power capacity. That means a simultaneous demand and supply shock due to shortage of coal and critical challenges in the coal sector.

- CEA identified land acquisition, fund constraints with contractors, and contractual disputes as some key issues leading to delays.

- No nuclear generation capacity was added during the last five years.

- Transmission: The country’s weak transmission grid remains a serious hurdle.

- Every year, hundreds of renewable energy projects are forced to halt in the advanced planning phases due to transmission line upgrade delays and associated costs

- For example: A planned approach to build huge solar plants in Leh was recently cancelled due to a lack of transmission infrastructure.

- Transmission lines overloading :Due to higher loads during peak hours, transmission lines frequently experience issues.

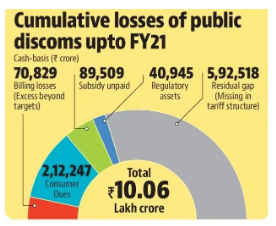

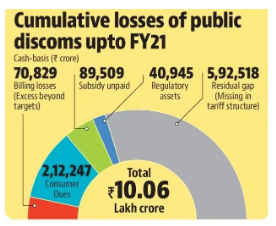

Distribution: Discoms are the weakest link in India’s Power sector.

Distribution: Discoms are the weakest link in India’s Power sector.

- Discoms continue to register financial losses, technical and commercial losses remain high. (Refer-Image).

- Although private participation is permitted, their presence among discoms is limited. (State owned DISCOMS-93% share).

- Climate Finance and decarbonization:

- India’s pledge at the COP-26 summit to have 500 GW of non-fossil generation capacity by 2030. These will require investments of about Rs 32 lakh crore.

- Underutilization of Renewable Energy Potential:

- The National Electricity Plan (NEP) projects a compounded annual growth rate (CAGR) of 7% in energy demand from FY22 to FY27.

- To achieve sustainable growth, the revised energy mix places greater reliance on solar energy.

- The report estimates that the pace of solar installations will need to double to over 30 GW per year to meet the NEP targets.

Way forward:

- Regulation and Policy:

- The state governments should promote autonomy, competence, and transparency of the State Electricity Regulatory Commission (SERC).

| Government Initiatives to Reform Power Sector

The Pradhan Mantri Sahaj Bijli Har Ghar Yojana (SAUBHAGYA)

- It aims to achieve universal household electrification by providing electricity connections to all un-electrified households.

Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJU):

- The DDUGJY launched in 2014 a program to achieve 100% village electrification.

The Unnat Jyoti by Affordable LEDs for All (UJALA) scheme:

- To provide energy efficient LED bulbs to domestic consumers at an affordable price.

Restructured Distribution Sector Scheme (RDSS):

- To enhance the efficiency of power distribution.

UDAY Scheme:

- Launched in 2015 for Operational and Financial Turnaround of Power Distribution Companies.

|

-

- Subsidy Structure: Many states provide subsidised and sometimes free electricity for agriculture. The status quo with subsidies that are financed using deficits and debt need reforms.

- Decentralized Power Generation:

- The transition from centralised power plants to decentralised power plants, which means that energy is now created, stored, and delivered.

- Separation of Feeders: Some states, with large agricultural consumer bases such as Rajasthan, Andhra Pradesh, Gujarat, Karnataka, and Maharashtra, have reduced leakages by separating feeders for agricultural use from non-agricultural use.

Case Study: Gujrat Model:

- In Gujarat, discoms were able to significantly reduce their technical losses through investment in improving their grid.

- The Jyoti Gram Yojana (JGY) — feeder bifurcation scheme — that ensured round-the-clock three-phase power supply for domestic and commercial users need to be replicated at Pan India level.

|

- Reforms In Coal Sector: Increase Production and competition leveraging producing mines to enable more world-scale operation.

- Privatization of Discoms:

- In Delhi, after power distribution was taken over by three private licensees, the Aggregate Technical and Commercial (AT&C) losses have come down from about 55 percent in 2002 to about 9 percent in 2019.

- Make a suitable case for privatization to enhance efficiency and reduce financial losses.

- Other reforms include Reducing power procurement costs, Billing efficiency, Collection efficiency and Agricultural demand management.

- Renewable Energy Integration Reforms:

- There is news to show urgency of timely completion of tendering processes, risk mitigation during execution, and strengthening the domestic solar supply chain to successfully reach the capacity targets.

- Technology Upgradation:

- Intelligent metering and a digital network infrastructure allow consumers and utility companies to monitor and better control allowing for more efficient consumption and cost management.

Source: Business Standard

![]() 18 Sep 2023

18 Sep 2023

India missed capacity addition targets for almost all major energy sources for the 2017-22 period (up to March 2022).

India missed capacity addition targets for almost all major energy sources for the 2017-22 period (up to March 2022).  Distribution: Discoms are the weakest link in India’s Power sector.

Distribution: Discoms are the weakest link in India’s Power sector.