Context:

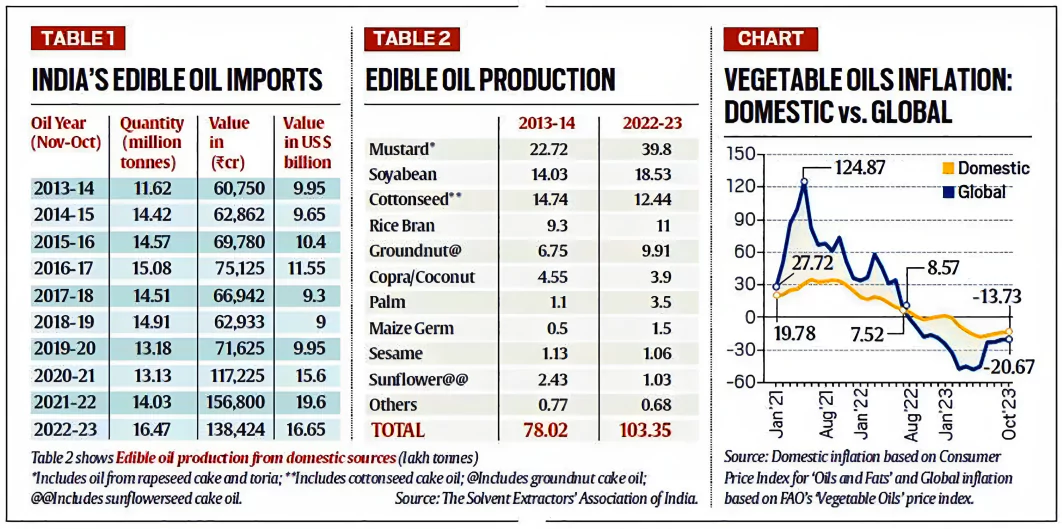

- This article is based on an Editorial “The other oil imports India needs to worry about” which was published in the Indian Express. India’s edible oil imports have risen almost 1.5 times and more than doubled in rupee value terms during the last 10 years.

| Relevancy for Prelims: Edible Oil Crops and Countries from where India imports these oils.

Relevancy for Mains: Edible Oil Crops, Associated Challenges and the Way Forward. |

What are the statistics related to the import of edible oils?

- High Import: India is importing a lot of edible oil, which is the oil used for cooking and other food purposes. Over the past 10 years, these imports have increased from 11.6 million tonnes to 16.5 million tonnes.

- Import From: India’s imports include palm oil (9.8 million tonnes from Indonesia, Malaysia, and Thailand), soybean oil (3.7 million tonnes from Argentina and Brazil), and sunflower oil (3 million tonnes from Russia, Ukraine, and Argentina).

- Decline in Production: In 2022-23, domestic production of edible oil was around 10.3 million tonnes (adding the imports, the total availability becomes 26.8 million tonnes).

- Only 38.6% of this comes from domestic production, whereas back in 2004-05, it was close to 60%.

- Crops in India’s Edible Oil Production: Majorly mustard and soybean, followed by cottonseed and rice bran.

- However, there have been issues with falling cotton output and yields, affecting cottonseed oil production.

- Other traditional oilseeds like coconut, sesame, sunflower, and safflower have seen declines in domestic output.

What are the issues associated with the high import of edible oils?

- Lack of Self-Sufficiency: This is a concern because it means India is becoming less self-sufficient in producing its own edible oil.

- Burden on Future: The concern is not just about meeting current demand but also projections for the future. If efforts are not made to boost production, annual imports could exceed 20 million tonnes, further reducing India’s self-sufficiency in edible oil.

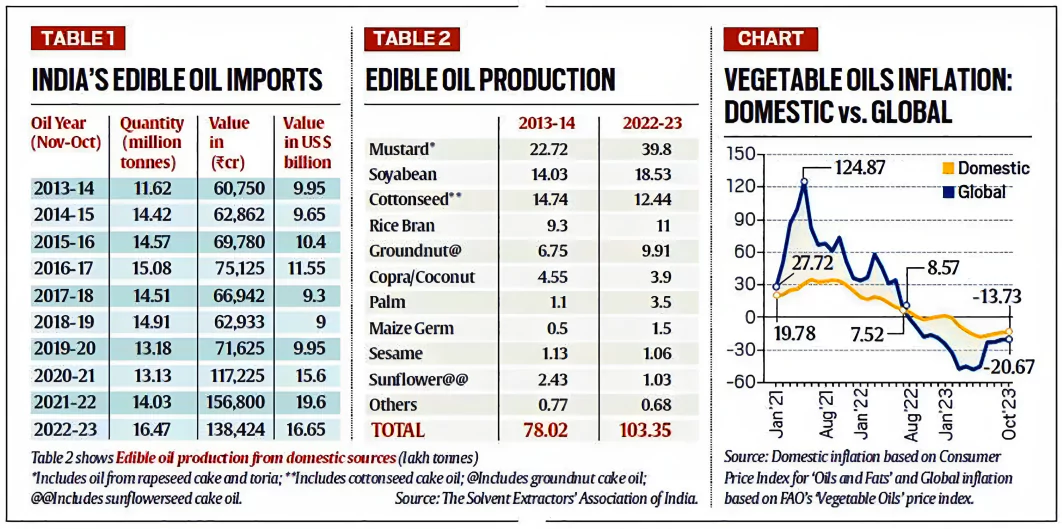

- Price Fluctuations: High dependence on imports makes both producers and consumers vulnerable to international price fluctuations.

- Edible oil inflation in India tends to follow global trends, but the extent of volatility is more pronounced internationally.

The Path Ahead:

- Self-Sufficiency by Production Increase: Increasing domestic edible oil production and reducing reliance on imports would help insulate Indian farmers and households from excess global price volatility.

- Support of Government and Technology: To achieve the desired results, it would require embracing technologies like genetically modified hybrids in mustard and soybean, and the government providing some kind of price support to oilseed growers, whether through procurement or tariff policy.

For more details refer to the editorial of February 21st, 2023 (Revitalizing the Oilseeds Sector)

Conclusion:

India’s escalating edible oil imports pose a significant threat to its self-sufficiency, emphasizing the urgent need for increased domestic production supported by technological advancements and government intervention to mitigate vulnerabilities to international price fluctuations.

![]() 21 Nov 2023

21 Nov 2023