Money is the commonly accepted medium of exchange. In economies with multiple individuals, money facilitates market transactions. Money facilitates exchanges by allowing individuals to sell their produce for money, which is then used to purchase necessary commodities. It serves various functions in a modern economy, including the facilitation of exchanges, market transactions, and facilitating the exchange of goods and services.

Money and Banking form an interdependent relationship. Once the money is in circulation, it is mainly the banking sector that gets involved in the transaction process.

Ever wondered why transactions are made in money?

The reason is simple. A person holding money can easily exchange it for any commodity or service that he or she might want.

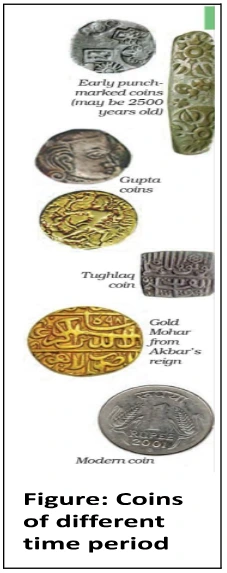

Money has served as a medium of exchange, with Indians using grains and cattle since ancient times. Metallic coins like gold, silver, and copper were introduced in the last century.

What roles do Modern Money and Banking play in today’s financial landscape?

Relationship between money and banking: Why do people hold money in deposits with banks?

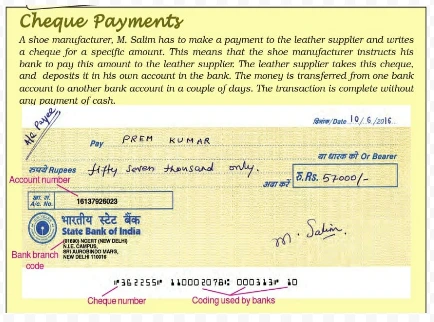

Cheque

Factors influencing Money Demand:

Money in a modern economy includes cash and bank deposits. These are created by the central bank and commercial banking system.

Let’s have a look at them in detail.

<div class="new-fform">

</div>