![]() December 1, 2023

December 1, 2023

![]() 440

440

![]() 0

0

In a mixed economy, both the government and private sector play pivotal roles. This chapter explores the government’s financial activities through its budget, stating the sources of government revenue and avenues of spending. It gives us the notions of balanced, surplus, and deficit budgets, their implications, and measures to manage them. Fiscal policy and the multiplier effect are introduced, showing the government’s influence on economic activity.

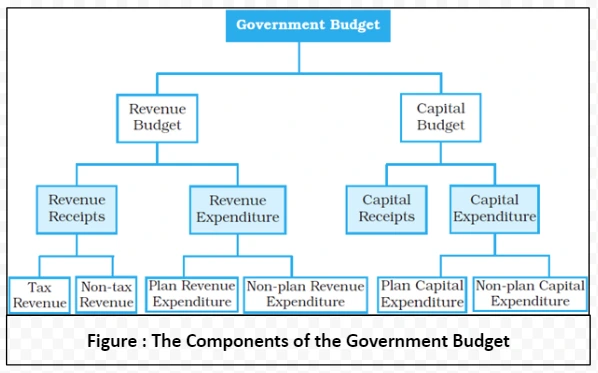

The Government budget is bifurcated into two main accounts: (Refer to Figure )

The government plays a very important role in increasing the welfare of the people. In order to do that, the government intervenes in the economy in the following ways.

How does the Government’s Stabilization Function Counter Economic Fluctuations within the Government Budget Framework?

<div class="new-fform">

</div>

Latest Comments