Answer:

| Approach:

Introduction

- Briefly describe the Satyam Scandal of 2009, emphasizing its impact on the corporate world and its role in highlighting the need for stricter corporate governance norms in India.

Body

- Discuss the changes brought about in corporate governance post the Satyam Scandal.

Conclusion

- Write a relevant conclusion.

|

Introduction:

The Satyam Scandal, often referred to as “India’s Enron,” was a corporate scandal affecting India-based company Satyam Computer Services in 2009, where the chairman Ramalinga Raju confessed that the company’s accounts had been falsified.

Body:

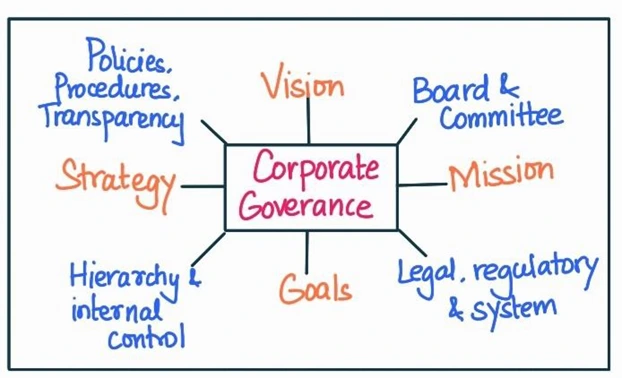

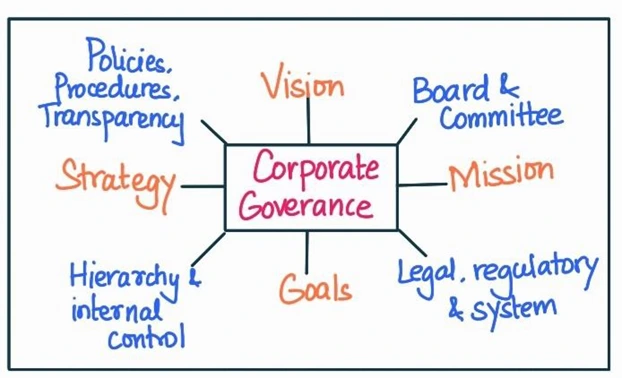

This scandal led to a deep introspection on corporate governance practices in India and triggered several changes to ensure transparency and accountability.

- Role of Independent Directors: The scandal highlighted the role of independent directors in ensuring checks and balances. Post Satyam, the Companies Act 2013 emphasized the role of independent directors and laid down specific duties and responsibilities for them. The Act mandates at least one-third of the board to comprise independent directors for public companies.

- Auditing Reforms: The role of auditors came under scrutiny after the scandal. The Companies Act, 2013 introduced rotation of auditors and audit firms for listed companies every five and ten years, respectively, to prevent over-familiarity and conflict of interest.

- Establishment of NFRA: The government established the National Financial Reporting Authority (NFRA) to oversee the auditing profession. This independent body was empowered to investigate professional misconduct and ensure compliance with accounting and auditing standards.

- SEBI Reforms: The Securities and Exchange Board of India (SEBI) also tightened norms related to corporate governance. It issued guidelines for enhanced disclosure by listed companies and initiated steps for stricter enforcement and quicker redressal of investor complaints.

- Whistleblower Policy: The Companies Act, 2013 made it mandatory for all listed companies to establish a vigilance mechanism for directors and employees to report concerns about unethical behavior, actual or suspected fraud, or violation of the company’s code of conduct.

- Enhanced Disclosure Requirements: The Act increased the disclosure requirements for companies. Directors are now required to disclose their interest in other entities, and financial statements need to disclose related-party transactions, remuneration of directors and key managerial personnel, among others.

- Class Action Suits: For the first time, provisions for class action suits were introduced in India, allowing shareholders and depositors to claim damages or demand suitable action against the company for any fraudulent, unlawful, or wrongful act.

Conclusion:

The Satyam Scandal was a turning point in India’s corporate governance history, leading to several reforms to ensure transparency, accountability, and better protection for stakeholders. However, the effectiveness of these changes would ultimately depend on how well they are enforced and adopted in practice by the corporate sector.