Context:

This editorial is based on the news “Changing central bank mandates” which was published in The Financial Express. The article highlights the role of central banks in devising monetary policy and explores whether central banks can be assigned other functions.

What Is Monetary Policy?

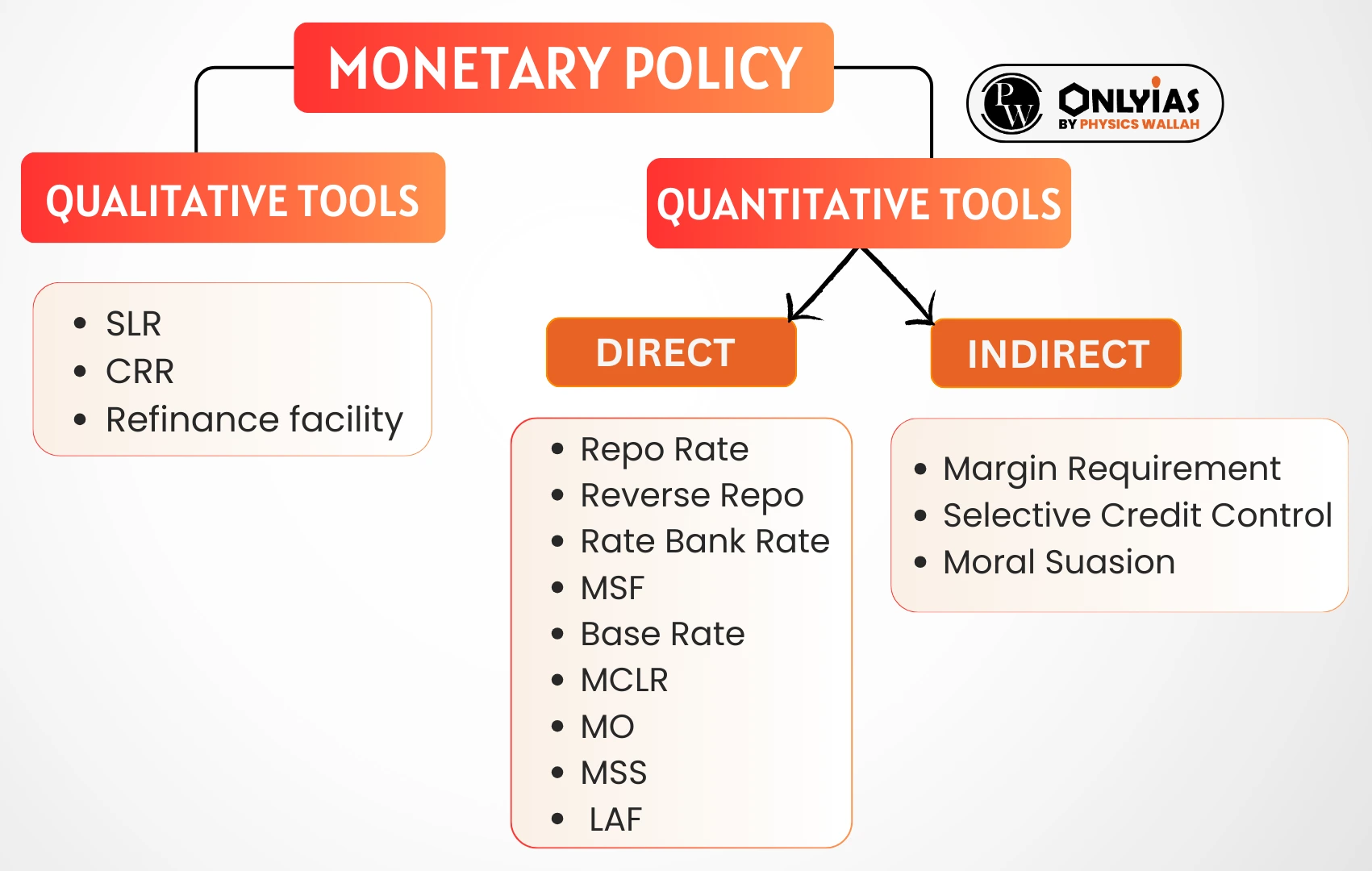

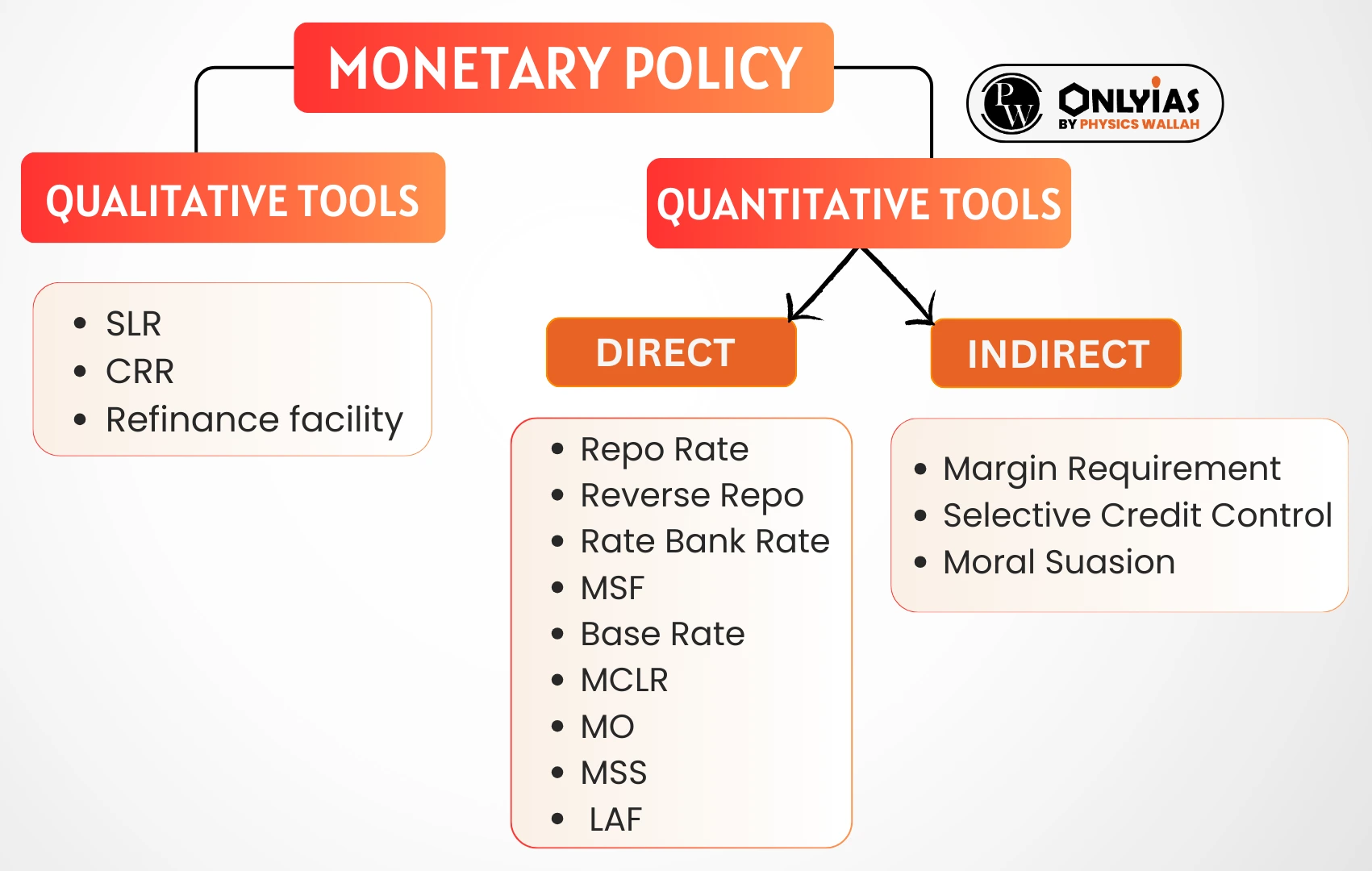

- Monetary policy is a set of tools used by a nation’s central bank to control the overall money supply and promote economic growth and employ strategies such as revising interest rates and changing bank reserve requirements.

Milton Friedman Views on Economic Policy

- In a 1968 speech, He said there are three major goals of economic policy: high employment, stable prices, and rapid growth

Debate on Central Bank Mandate

- Experts have divided opinion on whether central banks should have a single mandate of price stability or multiple mandates (of, say, price stability along with other goals).

- Proponents of Single Mandate: Single-mandate central banking was pioneered by the RBNZ in 1989 , followed by the central banks of Canada, Australia, England.

- Proponents of Multiple Mandate:The US Federal Reserve remained a dual mandate central bank, with the goals of maximum employment and stable prices.

2008 Financial Crisis

- The 2008 crisis challenged all pre-crisis doctrines as the discussion called for a broader mandate including employment and financial stability along with price stability.

RBI Mandate

- 1935- 2015: The Reserve Bank of India’s (RBI’s) mandate included multiple objectives with no clear hierarchy: regulate bank notes, establish monetary stability, operate the currency and credit system.

- 2016: The government modified the mandate and the RBI became a flexible inflation targeting (FIT) central bank.

- The RBI was given an inflation target of 4+/- 2% while also keeping the “objective of growth in mind”.

| Functions of RBI: It is the regulator of banks, the banker to the government, the manager of currency, government debt & foreign exchange, and also must facilitate financial inclusion. |

Conclusion

The history of central bank mandates suggests it is best to have single mandates. However, the developments in the last few years suggest central banks have to be flexible not just in terms of inflation targets but in their overall approach as well.

Also Refer: Asset Quality Of Indian Banks Improves To Decadal High

![]() 17 Jan 2024

17 Jan 2024