![]() April 5, 2024

April 5, 2024

![]() 38390

38390

![]() 0

0

India initially embraced a mixed economy post-independence, integrating aspects of capitalism and socialism. In 1991, an economic crisis, marked by external debt challenges and declining foreign reserves, prompted a pivotal shift. The government initiated Liberalization, Privatisation, and Globalization (LPG) reforms, redirecting India towards a new developmental trajectory.

Navratnas and Public Enterprise Policies

Historical Context and Original Objectives of PSEs

|

|

|

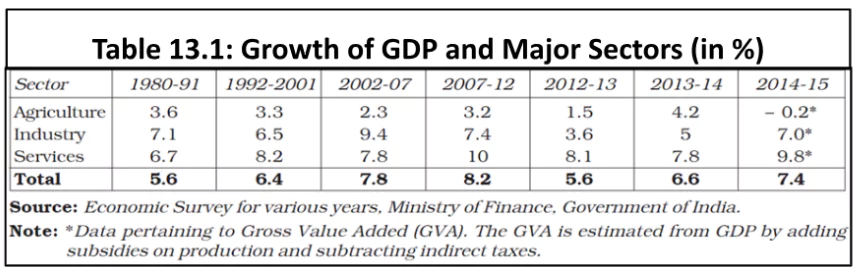

Post-1991: India saw a substantial rise in GDP growth, from 5.6% during 1980-91 to 8.2% during 2007-12, mainly driven by the service sector. Refer to table 13.1

Post-1991: India saw a substantial rise in GDP growth, from 5.6% during 1980-91 to 8.2% during 2007-12, mainly driven by the service sector. Refer to table 13.1| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

<div class="new-fform">

</div>

Latest Comments