![]() April 8, 2024

April 8, 2024

![]() 5341

5341

![]() 0

0

Macroeconomics is a branch of economics that focuses on the behavior, structure, and performance of an economy as a whole. It deals with large-scale economic factors such as national output, unemployment rates, inflation, and economic growth. Macroeconomists study how government policies, such as fiscal and monetary policies, affect these key economic indicators and how they can be used to promote economic stability and growth. They also analyse long-term economic trends and factors that influence the overall performance of an economy, such as technological progress, international trade, and demographic changes.

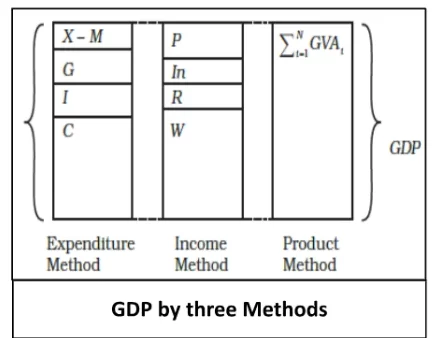

Refer to Figure to understand the GDP by three methods.

Refer to Figure to understand the GDP by three methods.

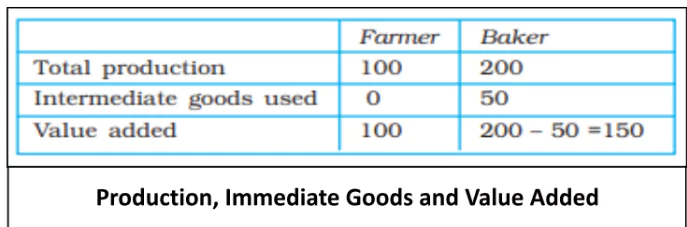

Value Added

Value AddedGross Value Added and Net Value Added

Inventory

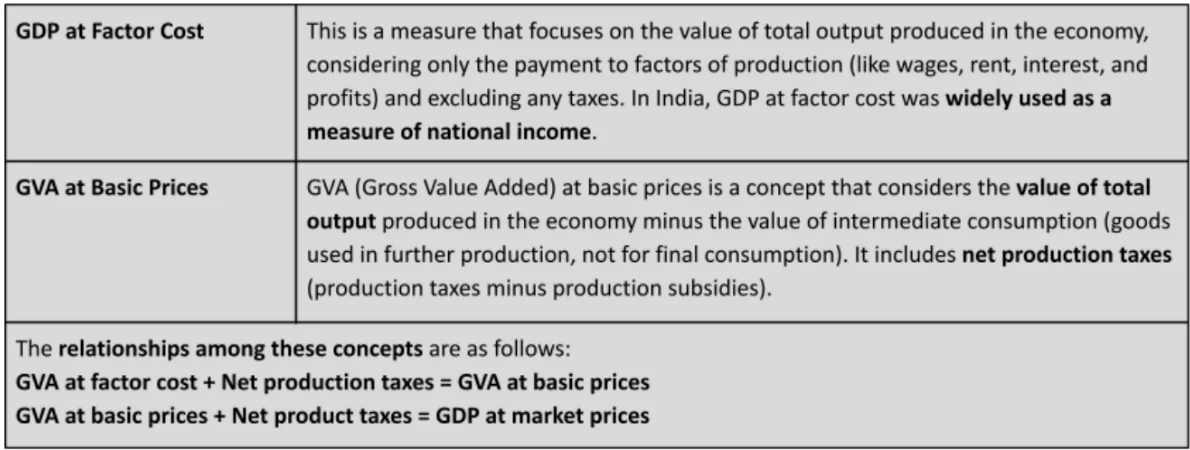

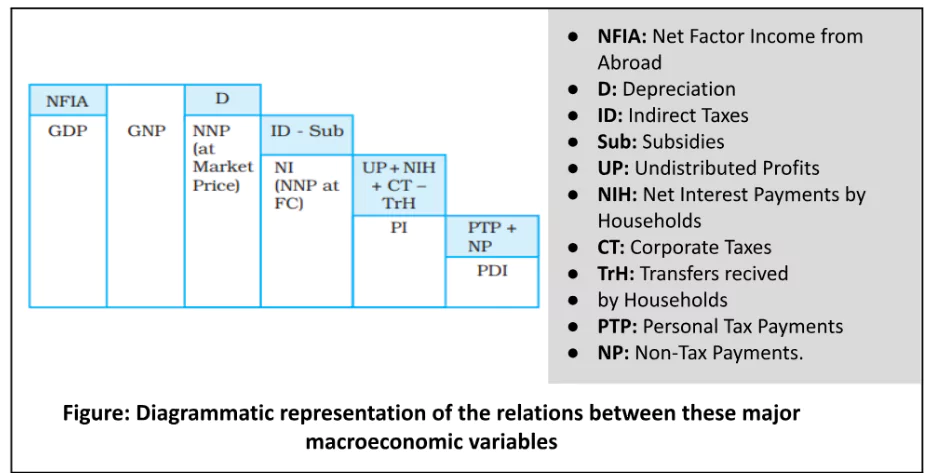

GNP = GDP + Net Factor Income from Abroad

NNP = GNP – Depreciation

NI = NNP at Market Prices – Net Indirect Taxes (Indirect Taxes – Subsidies)

Note

|

PI = NI – Undistributed Profits – Net Interest Payments Made by Households – Corporate Tax + Transfer Payments to Households.

|

PDI = PI – Personal Tax Payments – Non-Tax Payments

Real GDP = (Nominal GDP / GDP Deflator) * 100

GDP Deflator = (Nominal GDP / Real GDP) * 100

CPI = (Cost of Basket in Current Year / Cost of Basket in Base Year) * 100

| CPI | GDP Deflator |

|

|

|

|

|

|

| 1 | Gross Domestic Product at Market Prices (GDPMP) |

|

| 2 | GDP at Factor Cost (GDPFC) |

|

| 3 | Net Domestic Product at Market Prices (NDPMP) |

|

| 4 | NDP at Factor Cost (NDPFC) |

|

| 5 | Gross National Product at Market Prices (GNPMP) |

|

| 6 | GNP at Factor Cost (GNPFC) |

|

| 7 | Net National Product at Market Prices (NNPMP) |

|

| 8 | NNP at Factor Cost (NNPFC)

Or National Income (NI) |

|

| 9 | GVA at Market Prices |

|

| 10 | GVA at basic prices |

|

| 11 | GVA at factor cost |

|

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

| Related Articles | |

| Indian Economy: Evolution | Basics of Money |

| Banks in India | Financial Market |

| Indian Insurance Sector | Financial Inclusion |

<div class="new-fform">

</div>

Latest Comments