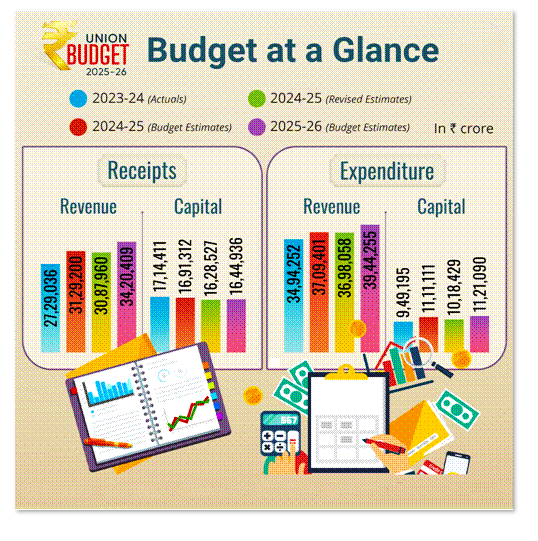

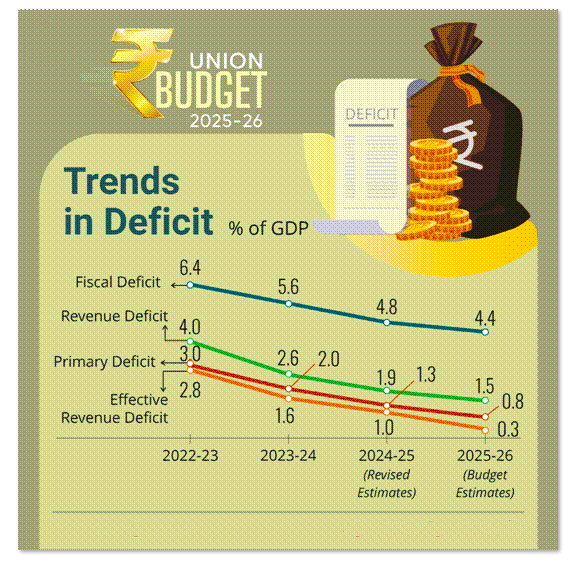

Recently, the Union finance minister presented the Union Budget for FY 2025-26 in the Lok Sabha.

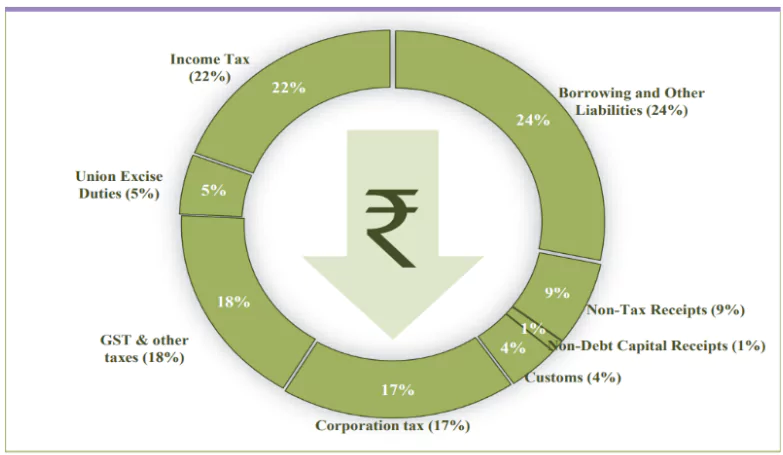

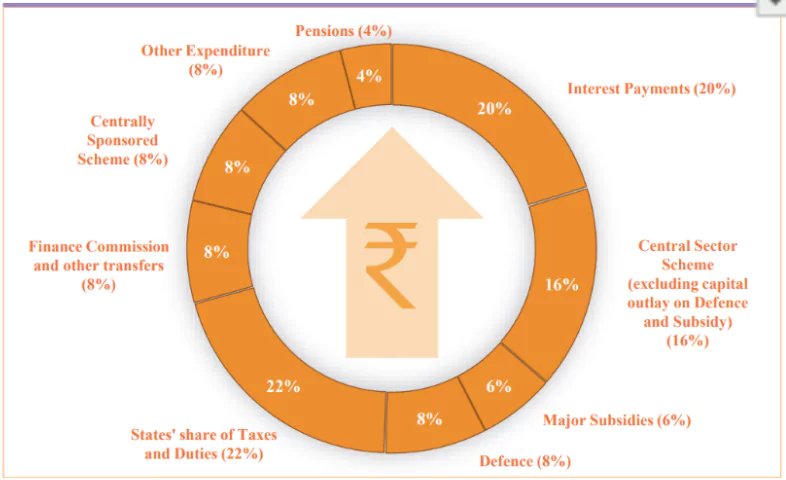

| Where Rupee comes from | Where Rupee goes to |

|

|

The Finance Minister started presenting the budget by quoting Telugu poet and playwright Shri Gurajada Appa Rao’s famous saying, “A country is not just its soil; a country is its people” emphasizing people centric budgets.

Aspiration of Viksit Bharat:

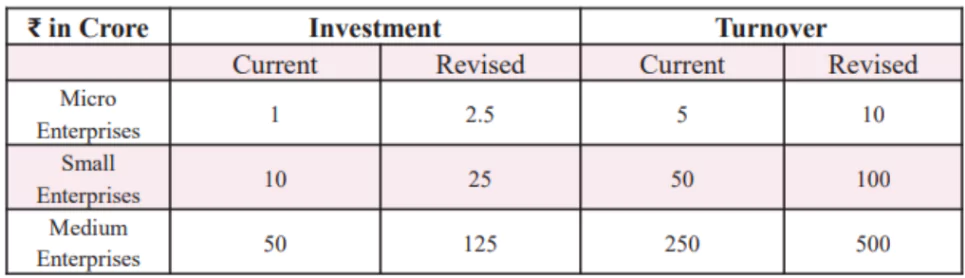

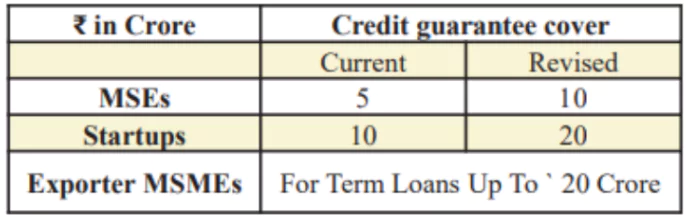

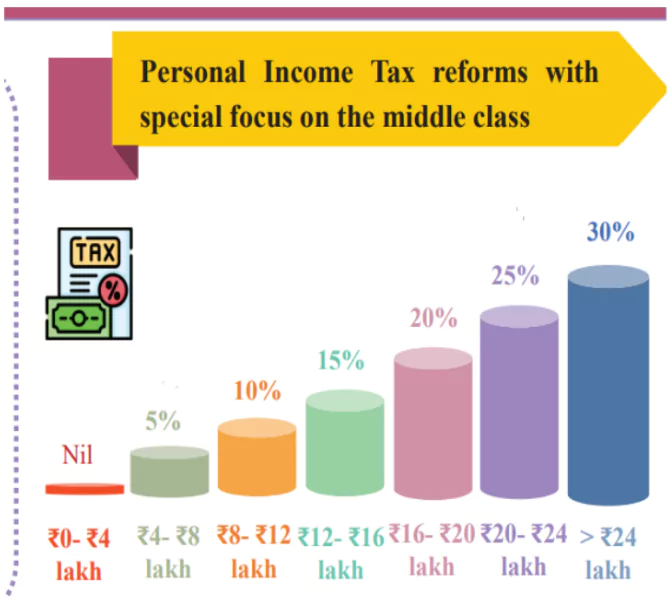

The Union Budget 2025-2026 promises to continue Government’s efforts to accelerate growth, secure inclusive development, invigorate private sector investments, uplift household sentiments, and enhance spending power of India’s rising middle class.

The Budget proposes development measures focusing on the Poor (Garib), Youth, Farmer (Annadata) and Women (Nari).

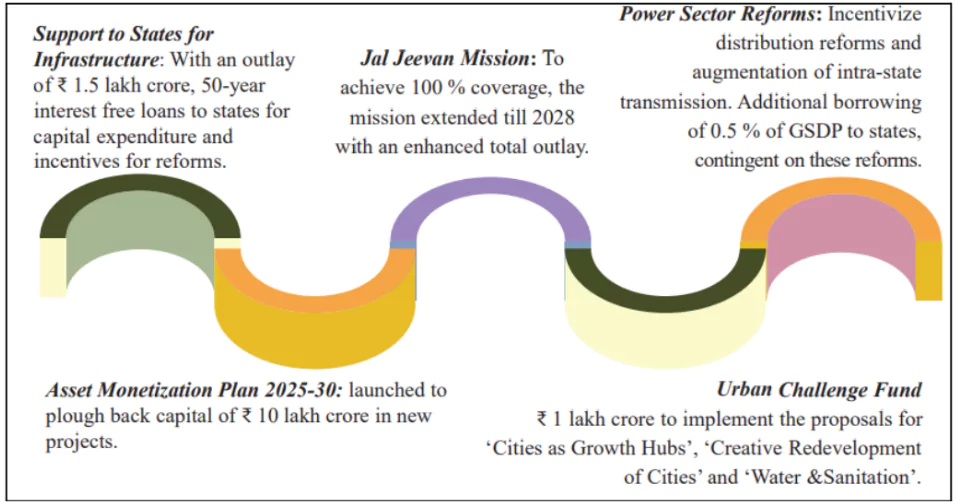

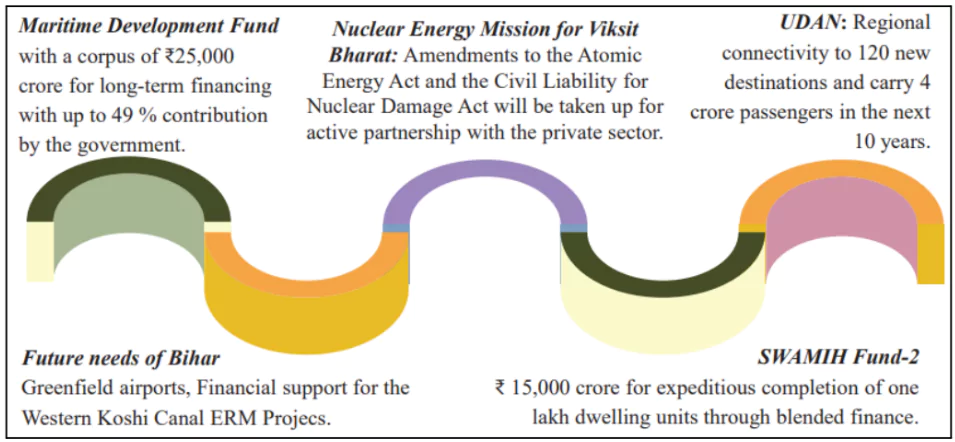

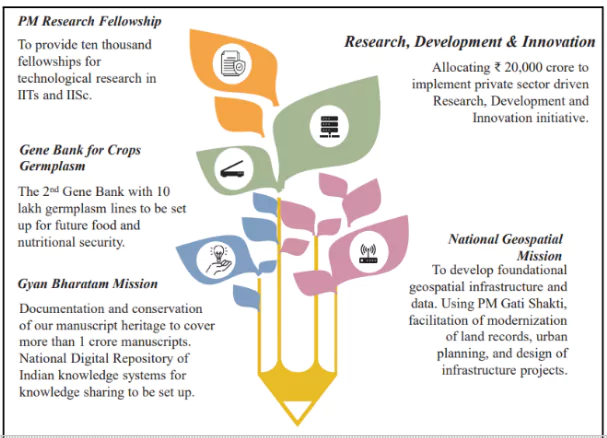

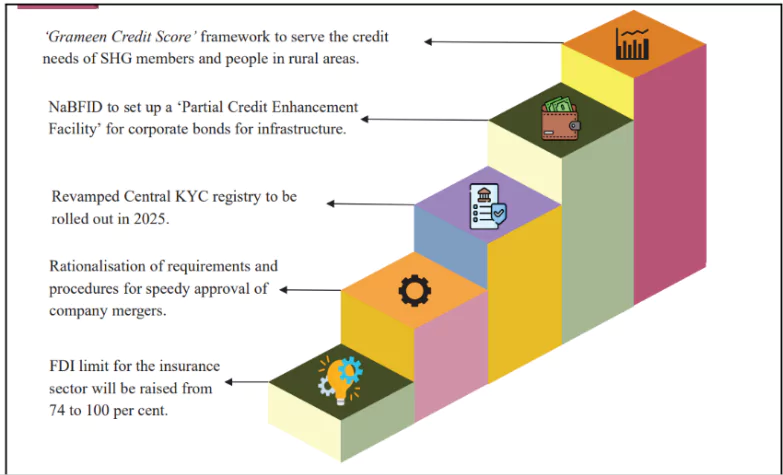

The Budget aims to initiate transformative reforms in Taxation, Power Sector, Urban Development, Mining, Financial Sector, and Regulatory Reforms to augment India’s growth potential and global competitiveness

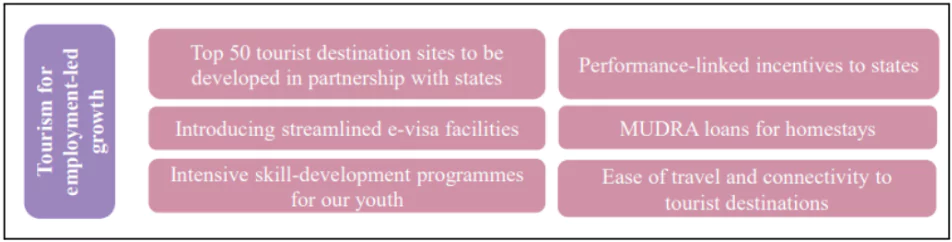

The Union Budget highlights that Agriculture, MSME, Investment, and Exports are engines in the journey to Viksit Bharat using reforms as fuel, guided by the spirit of inclusivity.

Recognizing reforms as the driving force behind economic growth, the Union Finance Minister emphasized the Government’s continuous efforts over the past decade to enhance ease of doing business, simplify taxation, and strengthen the financial sector.

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

The Enforcement Directorate has filed an Enforcement Case Information Report (ECIR) against 16 cooperative banks and societies under the Prevention of Money Laundering Act.

Money laundering

|

|---|

Enforcement Directorate

|

|---|

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

A recent study has revealed that the fur of polar bears contains a unique oily substance that helps them stay dry even when sliding on ice or diving into water.

Polar Bears

|

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

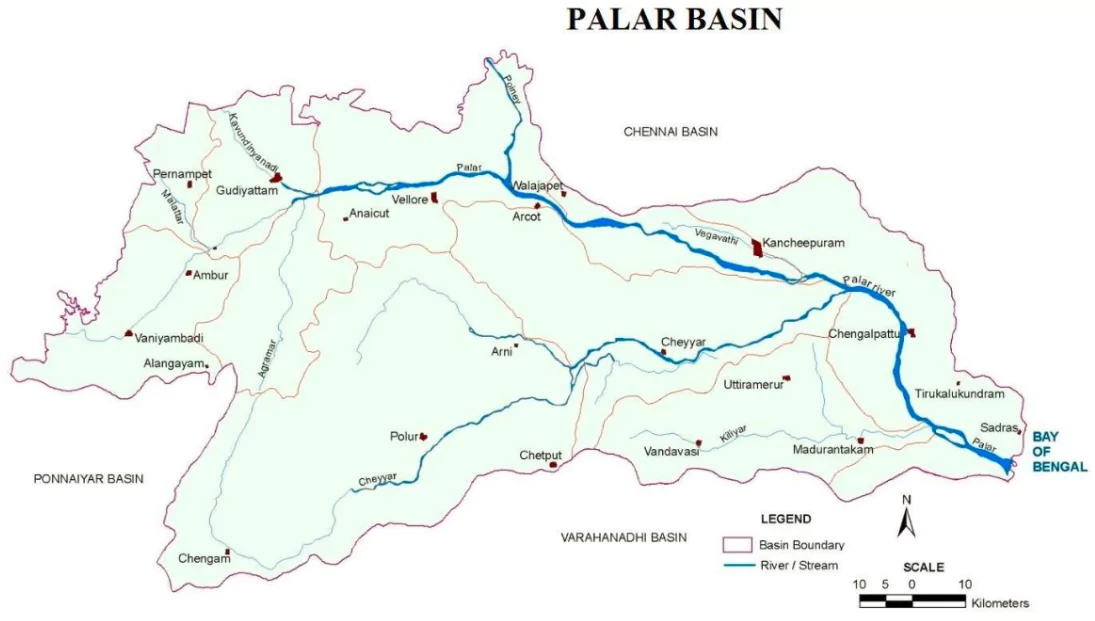

The Supreme Court has held that tanneries in Vellore district, Tamil Nadu, have caused irreversible environmental damage by discharging untreated or partially treated effluents into the Palar River.

Landmark Supreme Court Judgments on Environmental ProtectionRural Litigation and Entitlement Kendra vs. State (1988)

M.C. Mehta vs. Union of India (1987)

T.N. Godavarman Thirumulpad vs. Union of India (1996)

|

|---|

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

Ahead of World Wetlands Day on 2nd February, four more wetlands in India have been recognized as Ramsar sites under the Ramsar Convention.

According to the Ramsar Convention on Wetlands, wetlands are defined as:

Montreux Record

|

|---|

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

A woman in Kerala was awarded the death sentence for poisoning her boyfriend in 2022 with a chemical herbicide called paraquat.

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

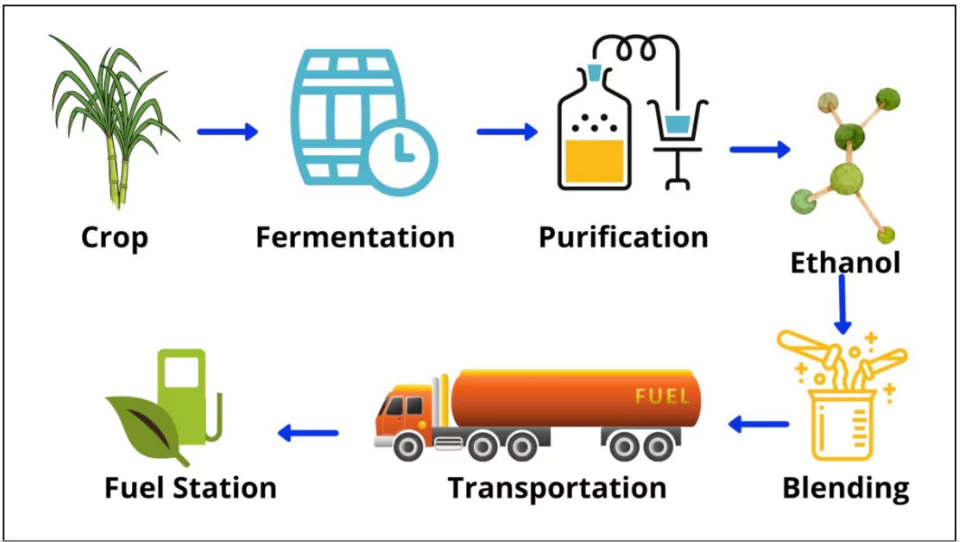

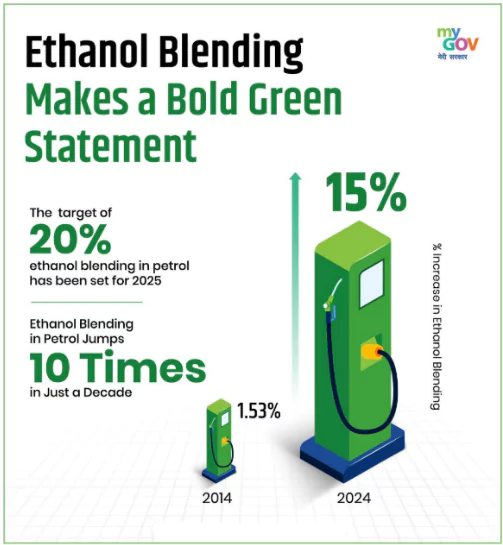

The Cabinet Committee on Economic Affairs (CCEA) has approved an increase in the ethanol procurement price for public sector oil marketing companies (OMCs) from ₹56.58 per litre to ₹57.97 per litre.

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

The Aadhaar Authentication for Good Governance (Social Welfare, Innovation, Knowledge) Amendment Rules, 2025 has been recently notified by The Unique Identification Authority of India (UIDAI).

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

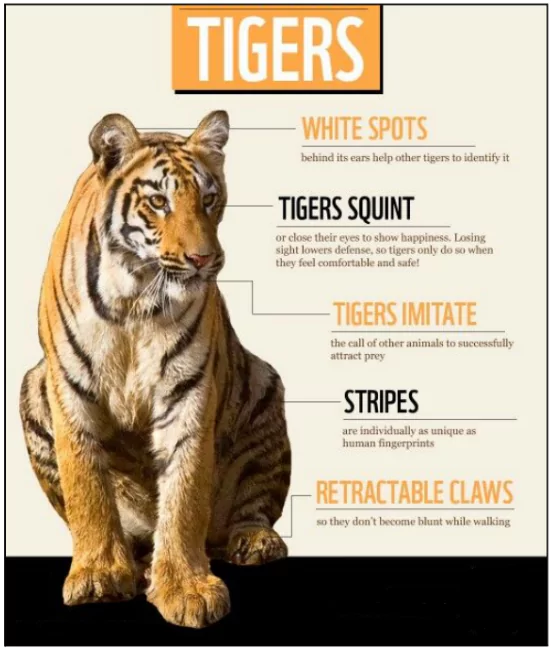

A new study has found that the tiger population in India has increased by 30% over the past two decades.

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

Context: The RBI’s Digital Payments Index (RBI-DPI) has been released recently.

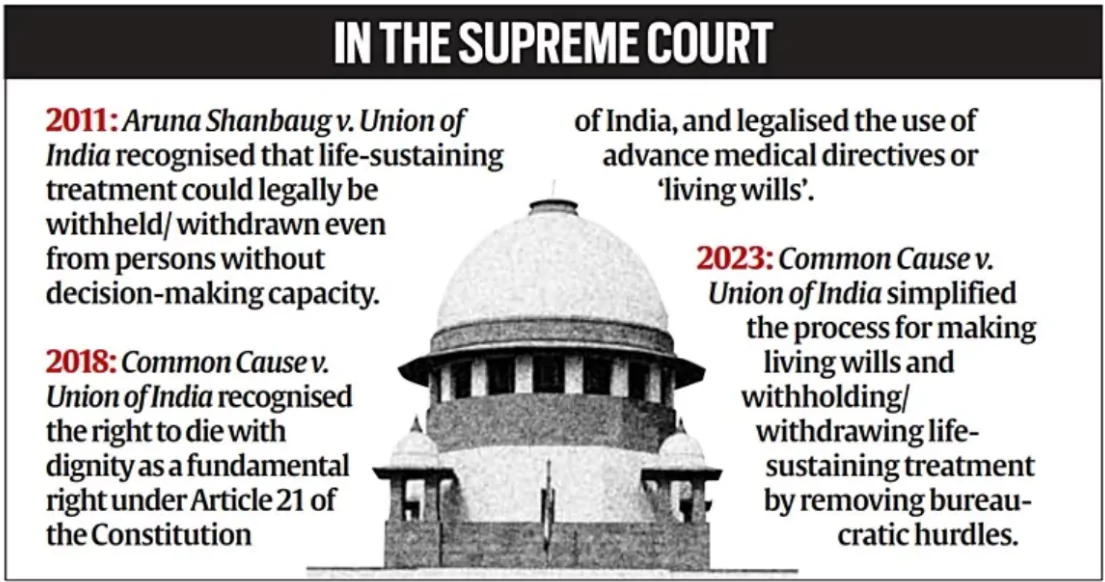

Context: The Karnataka Health Department has issued an order to implement the Supreme Court’s ruling allowing terminally ill patients to die with dignity.

It recognises the rights and duties of both doctors and patients, and allows for extensive independent expert opinion and the informed consent of next-of-kin/ surrogate decision-makers.

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

<div class="new-fform">

</div>