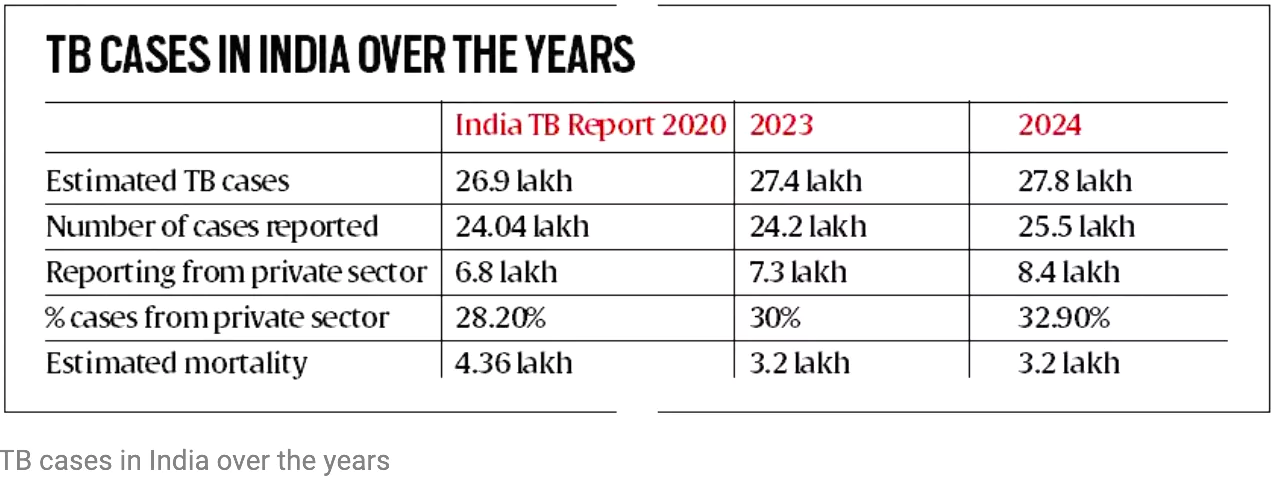

According to the India TB Report 2024 released by the Union Health ministry The gap between the estimated number and actual cases of tuberculosis (TB) is closing.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

The Union government recently notified the revised wages under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS).

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently,the Kerala Kalamandalam, a deemed university for arts and culture, has lifted gender restrictions to learn Mohiniyattam.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently, Pakistan’s Foreign Minister said his country may “seriously examine” the question of resuming trade with India.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

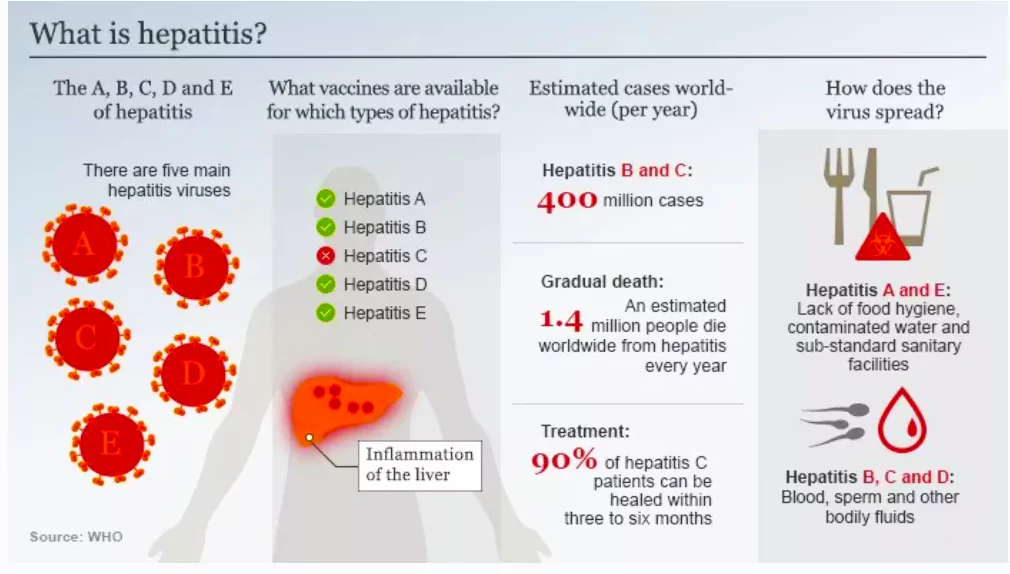

A study conducted by Sir Ganga Ram Hospital in New Delhi showed that public knowledge regarding Hepatitis B is considerably deficient in India.

Nobel Prize in Hepatitis C Vaccine

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Recently, Supreme Court in the Nenavath Bujji vs State of Telangana and ors observed that Inability Of State’s Police Machinery To Tackle Law & Order Situation should not be an excuse to Invoke power Of Preventive Detention.

| Data Point: NCRB data shows that out of the total 1,48,20,298 arrests made in 2021, 89,00,174 (60.5%) were made under the preventive arrests provisions of section 151 of CrPC (now section 170 of BNSS). |

|---|

| Preventive Detention | Punitive Detention |

| The detainee should be informed of the grounds for their detention. Nevertheless, information deemed detrimental to the public interest does not need to be divulged. | Right to be informed of the grounds of arrest. |

| The detainee should be given a chance to present their case against the detention order. | Right to consult & to be defended by a legal practitioner. |

| Safeguards are available to both citizens as well as aliens. | Safeguards are not available to an enemy alien. |

Judgment related to Preventive Detention:

|

|---|

Telangana Act of 1986: Establishment of Advisory Boards under Section 9:

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Border Roads Organisation (BRO) connected the strategic Nimmu-Padam-Darcha road in Ladakh.

Shinkun La Tunnel:

|

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

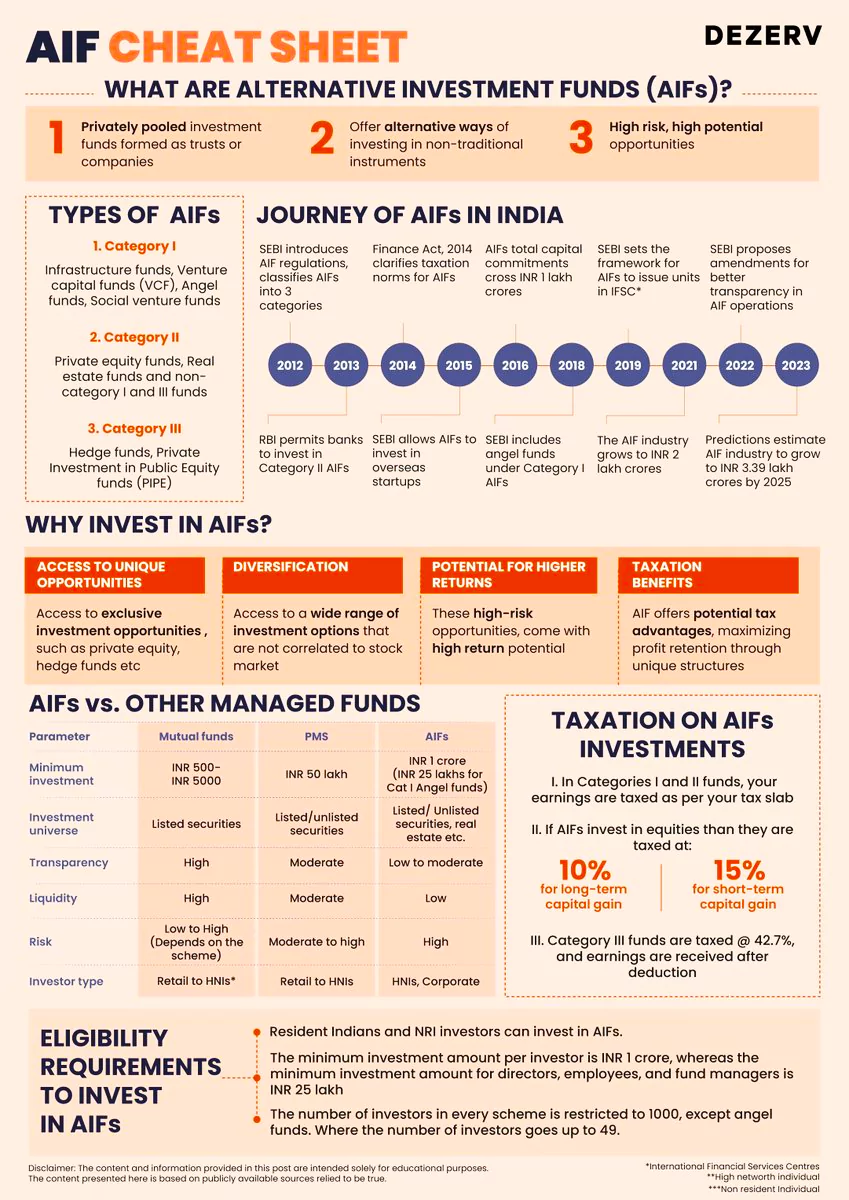

The Reserve Bank of India (RBI) has made revisions to regulations entities (REs) regarding their investments in Alternative Investment Funds (AIFs).

| Regulated Entity (RE)

This entity is the financial institution or organizations that follow specific rules and regulations set by regulatory authorities. |

|---|

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

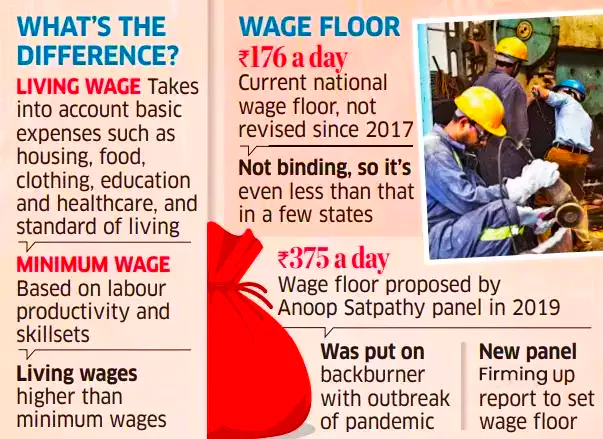

India is set to replace its minimum wage system with a living wage system by 2025.

| Relevancy for Prelims: India Employment Report 2024, Labour Migration, and Periodic Labour Force Survey (PLFS) Annual Report 2022.

Relevancy for Mains: Living Wage Standard: Need, Significance, Challenges, and Way Forward. |

|---|

International Labour Organization (ILO)

|

|---|

| Fair Wage: It comes after minimum wage which surpasses the minimum threshold yet falls below what’s required for a living standard.

While the minimum wage sets the baseline, the upper boundary of a fair wage is determined by the industry’s financial capability to compensate. |

|---|

Provision for Living Wage under the Indian Constitution:

|

|---|

National Multidimensional Poverty Index in India:

|

|---|

Case Studies:

|

|---|

India’s aim to replace the minimum wage with a living wage by 2025 represents a significant step towards improving the lives of Indian workers. The government’s commitment to developing a well-defined and operational system, with technical assistance from the ILO, is crucial for the successful implementation of this policy. Balancing affordability for businesses with ensuring worker well-being will be key to achieving this goal.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>