Wainganga-Nalganga River Linking Project

|

The Maharashtra cabinet has approved the ambitious Wainganga-Nalganga river linking project

About Wainganga-Nalganga river linking project:

About Wainganga and Nalganga River:

|

BIMSTEC- Free Trade Agreement |

BIMSTEC members should re-examine the priorities of member nations with regards to trade negotiations so that the delayed Free Trade Agreement can be finalized

About BIMSTEC:

BIMSTEC Free Trade Area Framework Agreement:

|

Kasturi Cotton Bharat Program

|

The Ministry of Textiles in India has launched the Kasturi Cotton Bharat programme to enhance the traceability, certification, and branding of Indian cotton.

About Kasturi Cotton Bharat Programme:

|

Cheque Truncation System (CTS) |

The Reserve Bank of India (RBI) governor has proposed to change the Cheque Truncation System method from batch processing to continuous clearing.

Batch Processing and Continuous Clearing:

About Cheque Truncation System:

Benefits:

|

Chandipura Virus & Viral Encephalitis |

Gujarat is going through its worst outbreak of Chandipura virus and viral encephalitis, in which 73 people have died so far

About Chandipura Virus:

About Viral encephalitis:

|

Mitra Shakti

|

Indian Army and the Sri Lankan Army will kick off the 10th edition of their joint exercise, “Mitra Shakti,” at Maduruoya in Sri Lanka’s Southern Province.

About Mitra Shakti:

|

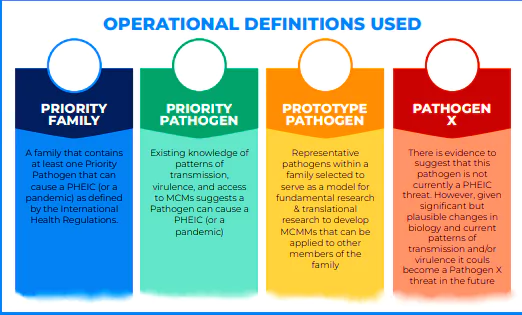

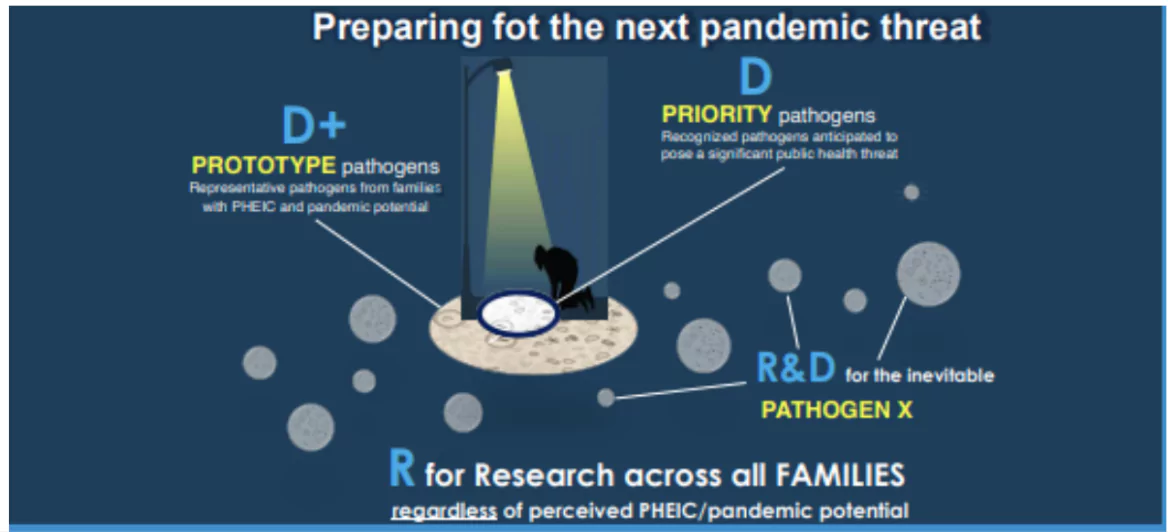

The World Health Organisation (WHO) has recently released its ‘Pathogens Prioritization’ Report.

Sample Size: The Research involved over 200 scientists from 54 countries, evaluating the evidence related to 28 viral families and one core group of bacteria, encompassing 1,652 pathogens.

Sample Size: The Research involved over 200 scientists from 54 countries, evaluating the evidence related to 28 viral families and one core group of bacteria, encompassing 1,652 pathogens.

Antarctica is experiencing its second intense winter heatwave in two years, with ground temperatures averaging 10°C above normal since mid-July and reaching up to 28°C higher on some days.

| Historical Ice Loss and Heat Wave Impact in Antarctica | |

| Period | Ice Loss/Impact |

| 2000s-2010s | 280% more ice mass loss than 1980s-1990s |

| March 2022 | East Antarctic temperatures rose above 39°C, leading to ice sheet collapse (area of Rome) |

| Section | Details |

| Initiation and Early Years |

|

| Research Stations |

|

| Scientific Expeditions |

|

| International Collaboration |

|

Criteria for Heat WavesGeneral Criteria:

Conditions Based on Normal Maximum Temperature:

Additional Criterion:

|

|---|

Recently, the Finance Bill 2024 was passed in the Lok Sabha with an amendment relaxing a proposal for the long-term capital gains (LTCG) tax on real estate.

Long-Term Capital Gains (LTCG):

|

|---|

Finance Bill Overview

|

|---|

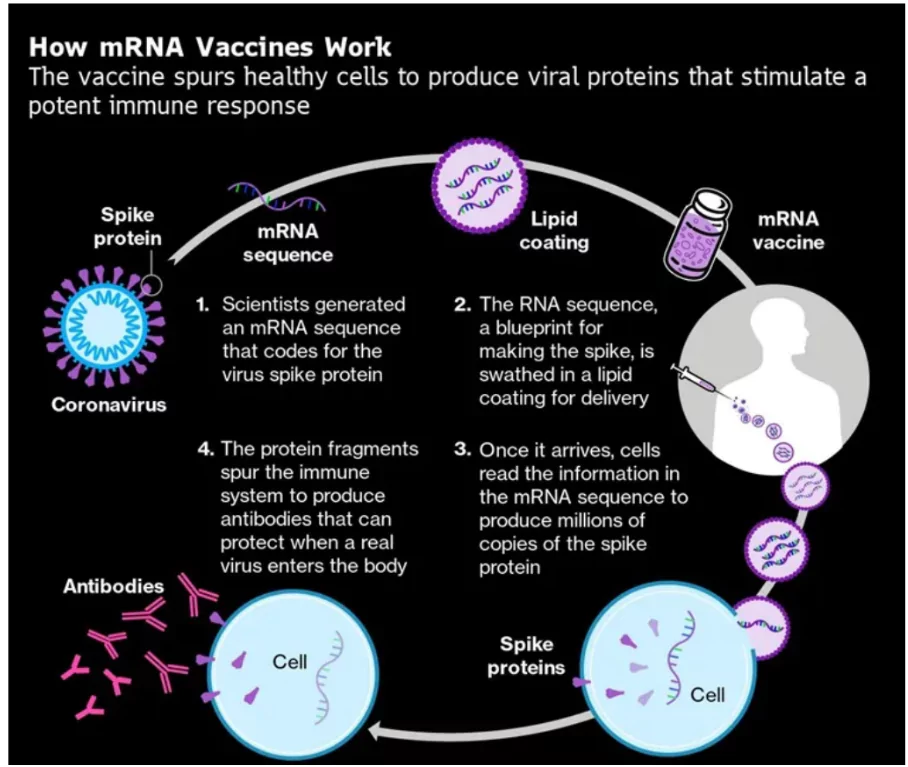

Recently, A new project aiming to accelerate the development and accessibility of human avian influenza (H5N1) messenger RNA (mRNA) vaccine candidates for manufacturers in low- and middle-income countries has been launched.

mRNA Technology Transfer Programme of WHO

About Pandemic Influenza Preparedness (PIP) Framework

|

|---|

Recently, the Supreme Court has upheld its power to review Delimitation Commission orders if they are deemed clearly arbitrary or in violation of constitutional principles.

Judicial Review

|

|---|

About Article 329

|

|---|

Constitutional Requirement of Delimitation Commission

|

|---|

Delimitation Commission & Its Composition

|

|---|

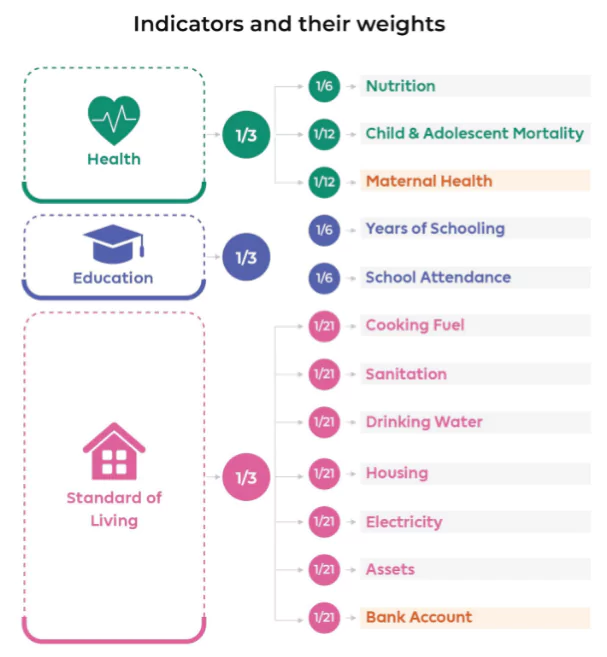

Recently, A discussion paper by NITI Aayog, Multidimensional poverty in india since 2005-06, found that multidimensional poverty declined to 11.28 per cent in 2022-23 from 29.17 per cent in 2013-14

Dual Cutoffs

|

|---|

How Did India Reduce Multidimensional Poverty So Fast?

|

|---|

The Waqf Amendment Bill 2024 has been referred to a Joint Committee of Parliament. The Bill seeks to amend the 1995 Waqf Act, proposing sweeping changes to how Waqfs are governed and regulated.

About Joint Parliamentary Committee

|

|---|

A Waqf is a personal property given by Muslims for a specific purpose — religious, charitable, or for private purposes.

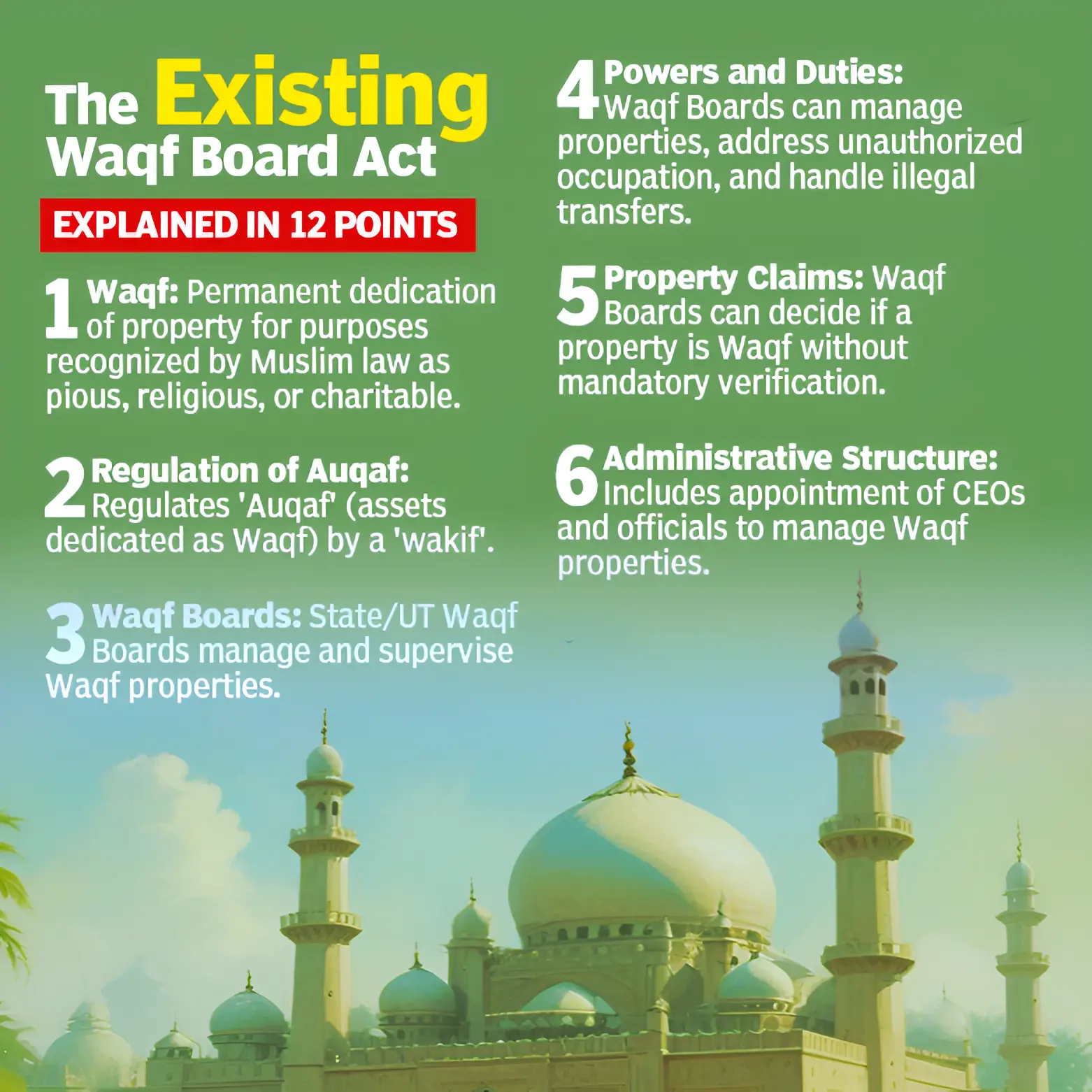

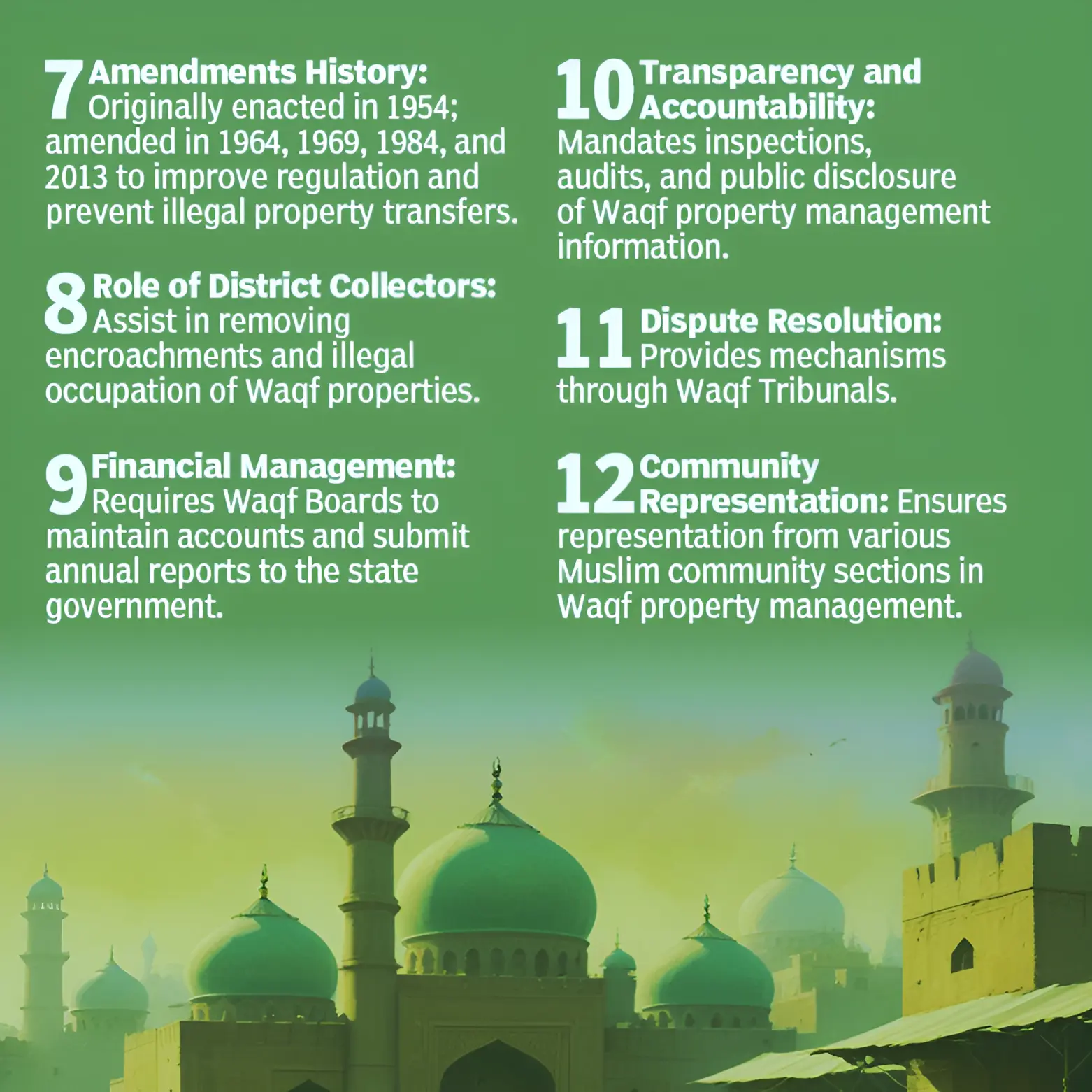

Waqf properties in India are governed by the Waqf Act 1995.

A Waqf Board is a body under the state government, which works as a custodian for Waqf properties across the state.

The Bill seeks to substantially alter the existing framework of Waqf law. The proposed amendment shifts the power of governing Waqfs from the Boards and Tribunals, which are largely run by the Muslim community, to the state governments.

Traditionally, waqf properties were often dedicated orally until formal documentation became standard practice.

Traditionally, waqf properties were often dedicated orally until formal documentation became standard practice. Unrecognition of Waqf Property: To prevent any fraudulent waqf claims, the Bill stipulates, “Any government property identified or declared as waqf property, before or after the commencement of this Act, shall not be recognized as waqf property.”

Unrecognition of Waqf Property: To prevent any fraudulent waqf claims, the Bill stipulates, “Any government property identified or declared as waqf property, before or after the commencement of this Act, shall not be recognized as waqf property.”

The Bill is about bringing transparency in an institution, which is not a place of worship. The Waqf Board is made by law and if it starts malfunctioning, the government has the right to introduce transparency.

The Waqf Board Amendment Bill 2024 will bring a lot of changes that are aiming to improve Governance in India and enhance transparency. By addressing key issues in the existing Waqf Act of 1995, the bill seeks to bring about significant administrative reforms and ensure more inclusive and efficient management of Waqf assets.

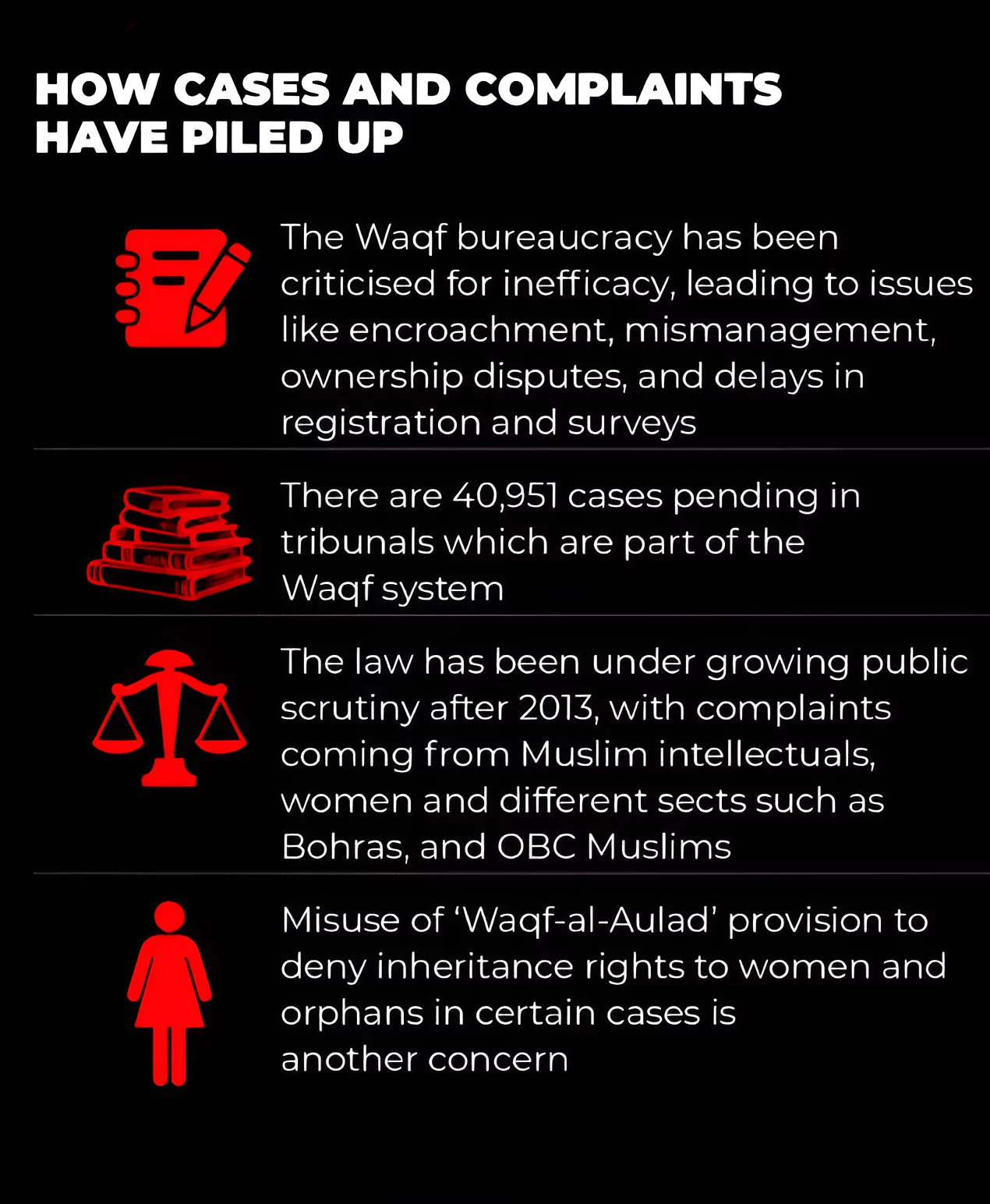

Following challenges has been raised by various experts:

The Waqf is a statutory body, and the amendments aim to enhance its functioning, transparency, and accountability. The passage of the bill is expected to have a profound impact on the management of Waqf properties in India, ensuring that they are used for their intended purposes and benefiting the community at large.

<div class="new-fform">

</div>