Pinaka Multi-Barrel Rocket Launch (MRLS) System

|

Context: The Indian Army is modernising its artillery by enhancing range and precision through indigenous systems like the Pinaka Rocket.

Pinaka Rocket:

|

|

Global Innovation Index 2024

|

Context: India has ranked 39th in the Global Innovation Index (GII) 2024, rising from 81st in 2015.

More on the news

Global Innovation Index (GII)

|

Finland announced that it will place a key NATO base less than 200 kilometres (125 miles) from its eastern border with Russia

Recently, The Central Drugs Standard Control Organisation (CDSCO) released its monthly list of drugs that fail quality tests.

|

|---|

Recently, the Supreme Court expressed concern over inappropriate remarks by Karnataka High Court Justice V Srishananda but dropped intervention following his apology.

Safeguards to Supreme Court and High Court Judges:

|

|---|

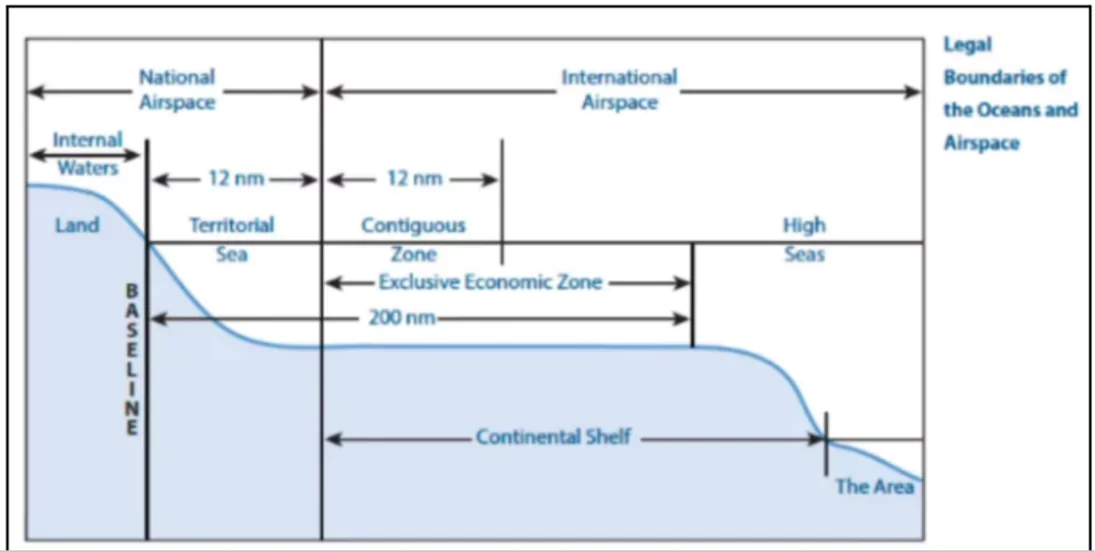

India officially signed the Biodiversity Beyond National Jurisdiction (BBNJ) Agreement at the United Nations General Assembly.

The BBNJ Agreement aims to address growing concerns over the long-term protection of marine biodiversity on the high seas, areas beyond the exclusive economic zones (EEZs) of coastal nations.

Deep Ocean Mission

Focus Areas

|

|---|

India’s participation in the BBNJ Agreement represents a significant step towards marine conservation and sustainable utilisation of resources in areas beyond its Exclusive Economic Zone (EEZ). The benefits for India include:

Recently, the Supreme Court questioned the effectiveness of the Commission for Air Quality Management’s (CAQM) interventions to curb pollution.

It is a Statutory Body established under the Commission for Air Quality Management in National Capital Region and Adjoining Areas Act, 2021.

The Goods and Services Tax (GST) Council has set up a 10-member GoM, chaired by Minister of State for Finance Pankaj Chaudhary.

GST (Goods and Services Tax)

GST is levied at various tax slabs:

Other Categories:

|

|---|

The Goods and Services Tax Council shall make recommendations to the Union and the States on

The Union government recently reduced the export duty on three categories of rice from 20% to 10%.

Different Varieties of RiceHusk:

Husked (Brown) Rice:

Parboiled Rice:

White rice:

Basmati rice:

|

|---|

Irrigation: In regions with less rainfall, rice is cultivated using irrigation.

Irrigation: In regions with less rainfall, rice is cultivated using irrigation.

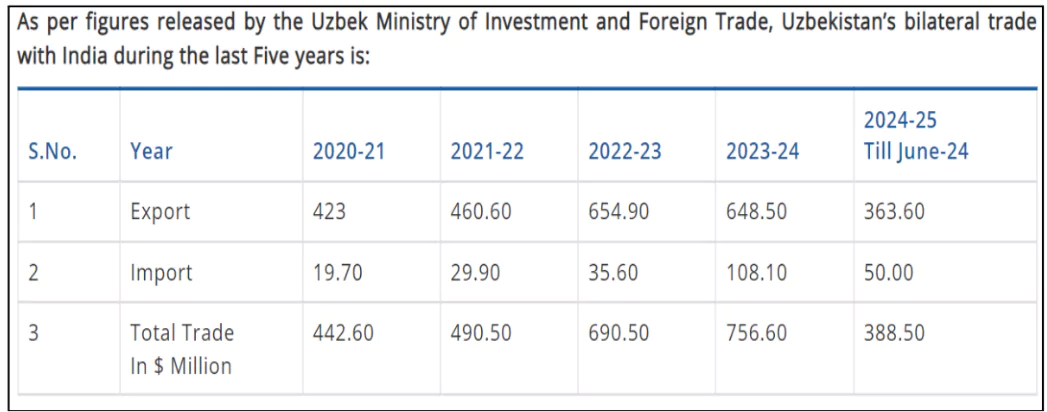

India and Uzbekistan recently signed a Bilateral Investment Treaty (BIT) in Tashkent, Uzbekistan.

About Bilateral Investment Treaties (BITs)

|

|---|

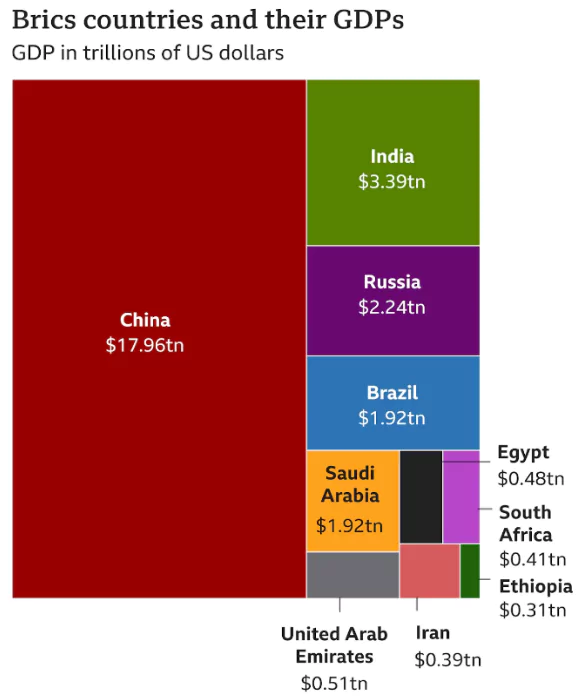

India’s External Affairs Minister S. Jaishankar highlighted the importance of BRICS for multipolarity and global diversity in the BRICS Foreign Ministers Meeting on the sidelines of UNGA79.

About Multipolarity

BRICS and Emerging Multipolarity

|

|---|

<div class="new-fform">

</div>