The RBI’s Framework for Responsible and Ethical Enablement of Artificial Intelligence (FREE-AI) committee, set up in December 2024, has proposed 26 recommendations under six pillars to promote ethical AI use in finance.

About the FREE-AI Committee

- Constituted by: Reserve Bank of India (RBI).

- Chairperson: Dr. Pushpak Bhattacharyya.

- Mandate: Study the present level of AI adoption in financial services and review regulatory and supervisory approaches on AI with a focus on the financial sector globally.

- Purpose: Develop a framework for responsible and ethical AI use in the financial sector.

- Focus: Ensure consumer protection while enabling AI adoption.

- Terms of Reference:

- Assess AI adoption in financial services in India and globally.

- Review global regulatory and supervisory approaches to AI in finance.

- Identify AI-related risks and recommend frameworks for evaluation, mitigation, and monitoring, including compliance for banks, NBFCs, FinTechs, and PSOs.

- Recommend a governance framework for ethical AI adoption in India’s financial sector.

- Address any other AI-related matters in the financial sector.

Benefits and Opportunities of AI in Financial Services

- Operational & Business Advantages:

- Enhances efficiency, accuracy, and personalisation at scale.

- For Example AI analytics for customer behaviour and risk management.

- Financial Inclusion:

- Assess creditworthiness using non-traditional data (utility bills, mobile usage, GST filings).

- Voice-enabled banking in regional languages for illiterate/semi-literate users.

- Chatbots for financial literacy, grievance redressal, and behavioural nudges.

The Seven Sutras – Guiding Principles

The Committee has formulated 7 Sutras – a set of foundational principles that will guide the development, deployment, and governance of AI in the financial sector.

- Trust is the Foundation: Trust is non-negotiable and should remain uncompromised

- People First: AI should augment human decision-making but defer to human judgment and citizen interest

- Innovation over Restraint: Foster responsible innovation with purpose

- Fairness and Equity: AI outcomes should be fair and non-discriminatory

- Accountability: Accountability rests with the entities deploying AI

- Understandable by Design: Ensure explainability for trust

- Safety, Resilience, and Sustainability: AI systems should be secure, resilient and energy efficient

FREE-AI Framework

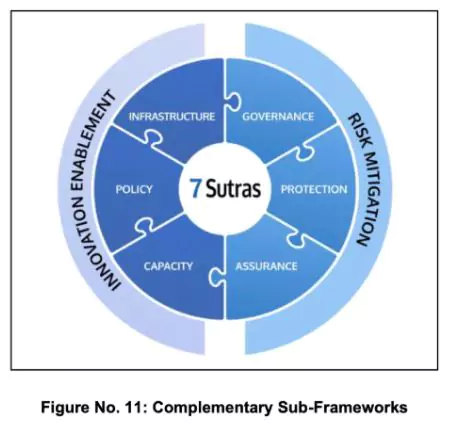

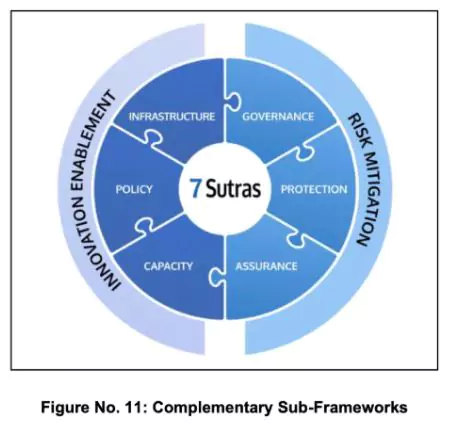

The FREE-AI Framework translates the 7 sutras into actionable recommendations through two complementary sub-frameworks

1. Innovation Enablement Framework

- Focus: Unlock AI’s transformative potential while ensuring responsible adoption.

- Pillars:

-

- Infrastructure – Build data ecosystems, compute capacity, and public goods to support AI development.

- Policy – Create adaptive, agile regulatory frameworks to encourage innovation.

- Capacity – Strengthen human skills and institutional ability to manage AI responsibly.

2. Risk Mitigation Framework

- Focus: Address risks from AI integration in finance.

- Pillars:

-

- Governance – Establish clear structures for oversight of AI decisions and actions.

- Protection – Safeguard consumers and systems from harm.

- Assurance – Ensure ongoing validation, monitoring, and control of AI systems.

Key Recommendations

- Data Infrastructure: Establish a high-quality financial sector data infrastructure as digital public infrastructure, integrated with AI Kosh – India Datasets Platform under the IndiaAI Mission.

About Sandbox

In cybersecurity, a sandbox is an isolated environment that allows suspicious files, programs, or applications to be run and analyzed without endangering the main system or network. |

- Sandbox: Set up an AI Innovation Sandbox to test AI solutions in a controlled environment.

- Indigenous AI Models: Develop financial sector-specific AI models to reduce dependence on foreign technologies.

- Adaptive AI Policy: Formulate enabling AI policies that evolve with technological advancements.

- AI Liability Framework: Introduce clear accountability rules for AI-related outcomes.

- Executive and Regulatory Training: Build AI-related capacity for boards, C-suite executives, regulators, and supervisors.

- Institutional Capacity Building: Conduct training and strengthen regulatory oversight and technical competence.

- Risk-Based AI Audits: Implement a board-approved AI audit framework based on AI risk categorisation.

- Lifecycle Audit Coverage: Ensure audits assess data inputs, algorithms, and decision outputs.

- Cybersecurity and Consumer Protection: Enhance safeguards for AI-powered financial services.

![]() 14 Aug 2025

14 Aug 2025