India faces increasing climate-induced disasters with over 80% of its population residing in high-risk districts, but adaptation strategies remain reactive due to fragmented risk assessments.

What Are Climate Physical Risks (CPRs)?

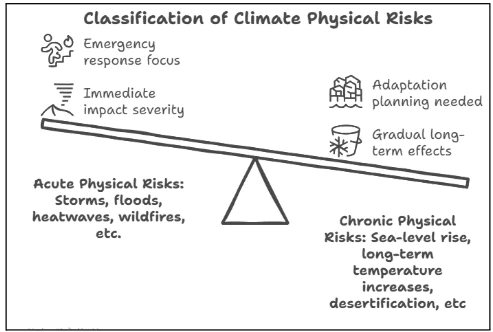

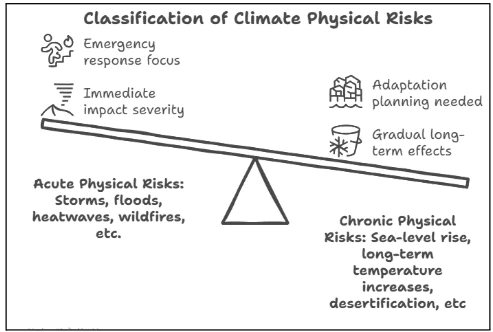

- CPRs refer to long-term risks arising from climate change, including acute shocks (floods, cyclones, heatwaves) and chronic stresses (droughts, changing monsoons).

These are not limited to weather events but include their cascading impacts on infrastructure, livelihoods, health, and national security.

These are not limited to weather events but include their cascading impacts on infrastructure, livelihoods, health, and national security.- Determinants of CPR: As per the IPCC, CPR is determined by three factors:

- Hazard such as extreme weather events)

- Exposure : people, assets, ecosystems at risk)

- Vulnerability : system’s ability to withstand and recovery

- Beyond Weather Forecasting: Unlike weather forecasts, CPRs require long-term modelling to track trends and predict evolving hazards.

- Existing forecasting systems are insufficient to address deep-seated vulnerabilities driven by climate change.

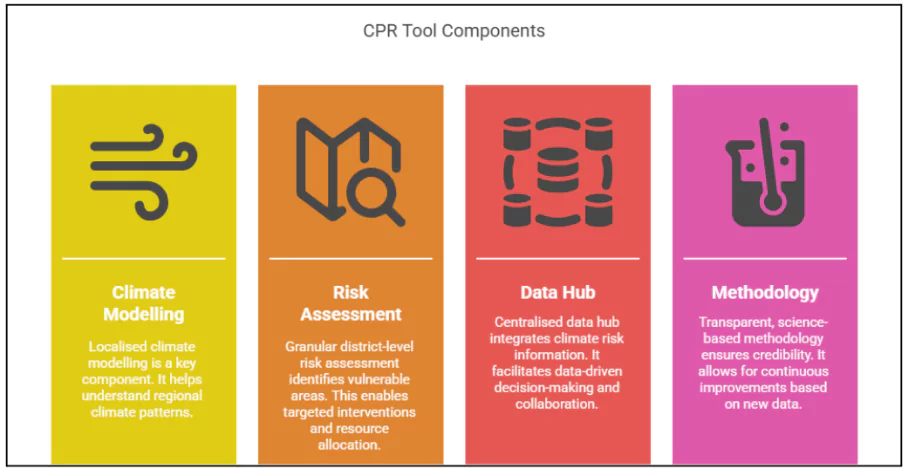

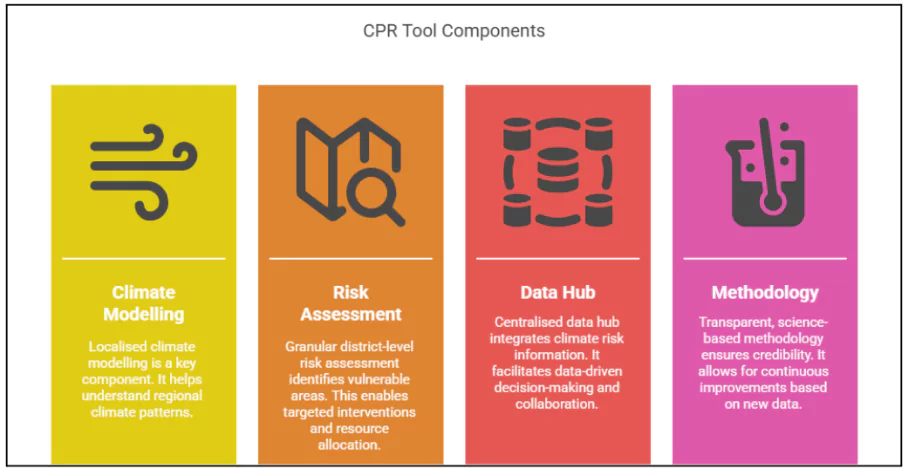

- Need for a New Framework on Climate-Related Risk: A structured climate risk assessment framework is essential to shift from reactive responses to proactive planning based on long-term, localised climate projections and vulnerability mapping.

Role of Global Agreements in Tackling Climate Physical Risks

Paris Agreement (2015)

- Focus on Adaptation: The Paris Agreement under Article 7 mandates all countries to undertake adaptation planning and actions to reduce vulnerability to climate-related physical risks.

- National Adaptation Plans (NAPs): The Paris Agreement encourages countries to develop National Adaptation Plans that integrate long-term climate risk assessments into national planning and development strategies.

Sendai Framework for Disaster Risk Reduction (2015–2030)

- Holistic Risk Reduction: The Sendai Framework promotes understanding and managing disaster risk, emphasizing risk-informed investments and early warning systems to reduce the impacts of extreme weather events.

Challenges in Setting Up a New Framework for Climate Physical Risk (CPR) Assessment

- Fragmented Climate Risk Assessments: Despite mounting evidence, India lacks a unified, scientific system to assess CPRs.

- Multiple institutions such as IIT Gandhinagar, IMD, and NIDM conduct CPR-related studies, but operate in silos with inconsistent methodologies.

- This fragmented landscape makes it difficult for policymakers and businesses to make proactive, informed decisions.

- Absence of Standardised Climate Risk Data: Existing tools like flood maps or vulnerability atlases are not integrated into a central repository.

- Without standardised metrics or accessible datasets, climate risk insights remain isolated and ineffective for long-term planning.

- Globally, developing countries face similar issues e.g., Sub-Saharan African nations lack region-specific climate datasets to inform planning

- Reactive to Proactive: India’s current adaptation strategies are largely reactive, focusing on damage control rather than risk prevention.

- A proactive framework must anticipate risks based on long-term climate trends and local vulnerabilities.

- Technical and Modelling Limitations: Climate models such as Representative Concentration Pathways (RCPs) and Shared Socioeconomic Pathways (SSPs) are currently downscaled inadequately to capture the complexities of India’s hyper-local climatic zones.

- Globally, even developed countries like the U.S. struggle to simulate combined sea-level rise and storm surge scenarios for specific urban zones such as Miami.

RBI’s Draft Disclosure Framework on Climate-related Financial Risks, 2024:

- The Reserve Bank of India introduced the draft disclosure norms under the Banking Regulation Act, 1949, to address emerging climate-related financial risks impacting economic and financial stability.

- Rationale: Climate-related financial risks include threats arising from climate change and mitigation efforts, aiming to promote early risk assessment, market discipline, and informed stakeholder engagement.

- Applicability of the Guidelines: The disclosure norms apply to Regulated Entities (REs), including Scheduled Commercial Banks (excluding LABs, Payments Banks, RRBs), Tier-IV Urban Co-operative Banks, All-India Financial Institutions, and large NBFCs.

- Expected Outcomes: The framework is expected to enhance transparency, enable proactive climate risk management, and align India’s financial sector with evolving global sustainability norms.

|

- Private Sector Reluctance: Businesses often view climate risk disclosure as an added compliance burden

- A 2022 global survey by CDP (Carbon Disclosure Project) revealed that only 41% of global companies have quantified climate-related financial risks.

- Funding Skewed Toward Mitigation: International climate finance prioritises emission reduction over adaptation.

- Less than 25% of total climate finance in 2022 supported adaptation, leaving CPR framework initiatives underfunded.

- Political and Policy Discontinuity: Frequent shifts in leadership and policy priorities undermine sustained climate planning.

Way Forward

- Unified National CPR Framework: Create an integrated system combining data from IMD, NIDM, and academic institutions with standardised metrics and methodologies.

- Centralised Climate Risk Data Hub: Set up a national repository for localised, real-time climate risk data to support public and private decision-making.

- Enhance Regulatory Mandate: Make climate risk disclosures mandatory across financial sectors, aligning with global standards like IFRS ISSB S2.

- Investment in Adaptation Infrastructure: Prioritise funding for resilient infrastructure, local capacity-building, and early-warning systems through public-private partnerships.

- Role of Financial Institutions: Integrating Climate Risks into Financial Oversight.

- The Reserve Bank of India (RBI) has begun integrating climate risks into its regulatory and supervisory frameworks such as Disclosure Framework on Climate-related Financial Risks.

- SEBI’s Disclosure: The Securities and Exchange Board of India (SEBI) encourages listed companies to report on Environmental, Social, and Governance (ESG) risks, including climate-related exposures.

- International Models: Countries like the U.S., U.K., and New Zealand use national climate risk frameworks that inform financial regulations and planning.

- India must adopt a similar approach to integrate CPR into governance and economic decision-making.

- Ensure Policy Continuity: Establish permanent climate risk assessment bodies to ensure consistent, science-based policy across political transitions.

Conclusion

To achieve climate-resilient growth and Viksit Bharat by 2047, India must institutionalise CPR assessments through a unified, science-driven framework that safeguards its people, economy, and environment from escalating climate risks.

![]() 22 May 2025

22 May 2025

These are not limited to weather events but include their cascading impacts on infrastructure, livelihoods, health, and national security.

These are not limited to weather events but include their cascading impacts on infrastructure, livelihoods, health, and national security.