![]() 5 Apr 2024

5 Apr 2024

There is a hearing on whether states have the authority to levy excise duty on industrial alcohol by a 9-judge Bench of the Supreme Court.

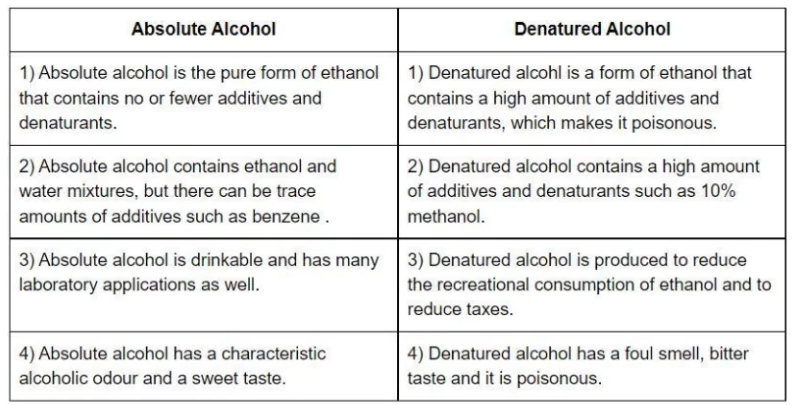

Denaturation is the process of making industrial alcohol unsuitable for misuse or consumption.

Denaturation is the process of making industrial alcohol unsuitable for misuse or consumption.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

<div class="new-fform">

</div>