In the first RBI Monetary Policy Committee (MPC) announcement of the Financial Year 2024-25 (FY25), RBI Governor Shaktikanta Das has decided to keep the repo rate at 6.5%.

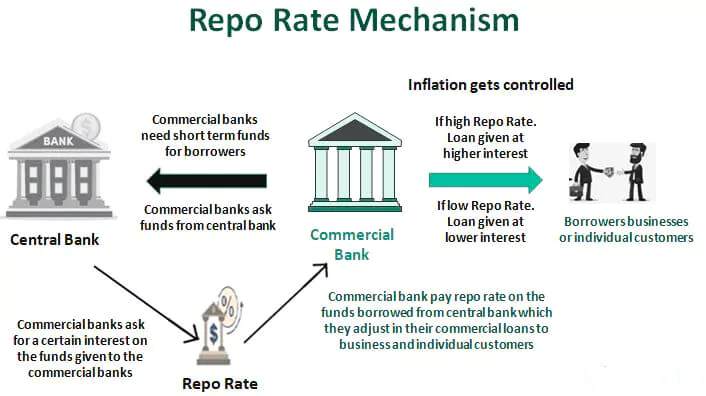

Borrowing from the Central Bank: During fund shortages, commercial banks borrow from the central bank at the repo rate.

Borrowing from the Central Bank: During fund shortages, commercial banks borrow from the central bank at the repo rate.

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

To get PDF version, Please click on "Print PDF" button.

Maharashtra Withdraws GRs on Hindi as Third Langua...

Statistical Report on Value of Output from Agricul...

Skills for the Future: Transforming India’s Work...

National Turmeric Board HQ Inaugurated in Nizamaba...

ECI Moves to De-List 345 Inactive Registered Unrec...

MNRE Issues Revised Biomass Guidelines Under Natio...

<div class="new-fform">

</div>