Context:

This article is based on the news “Farmers back on road to Delhi: How the current protest differs from the 2020-21 edition” which was published in the Indian Express. More than 250 farmers’ unions under the Kisan Mazdoor Morcha (KMM) and the Samyukta Kisan Morcha have resumed their protest, after two years.

Farmers Protest 2024 and Delhi Chalo Champignon| Why Farmers Are Marching to Delhi?

- Delhi Chalo: These forums gave a call of “Delhi Chalo” to remind the government of the promises to farmers.

- Demand “MSP Guarantee”: The Minimum Support Price (MSP) assurance is one of the main issues and farm unions are demanding a statutory status to MSP.

- Negotiations: A government delegation has held negotiations with the protesting farmers, but the talks have not yielded results yet.

Enroll now for UPSC Online Course

Background of Farmers Protest 2024

-

The Government Had Brought Three Farm Laws in 2020

-

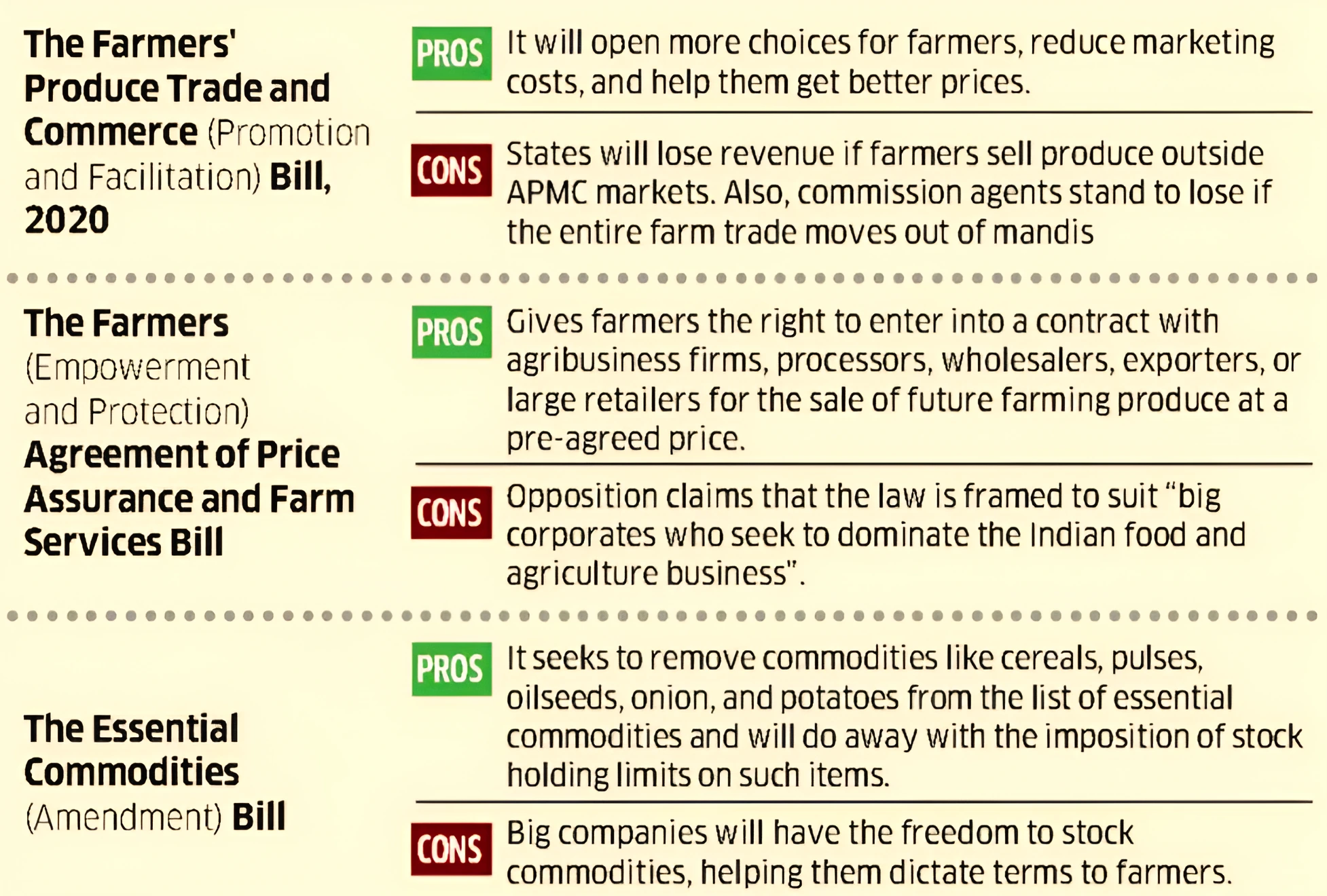

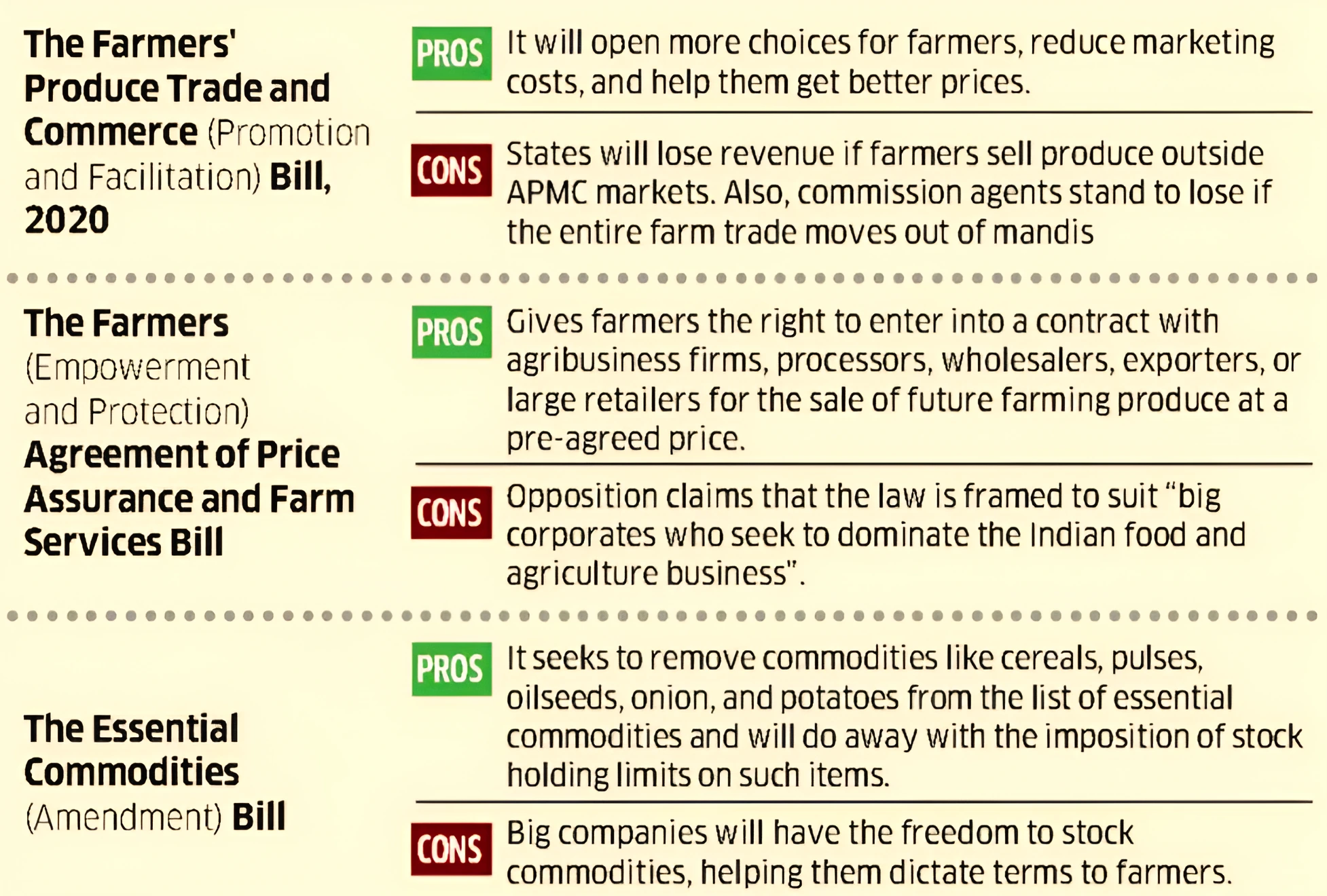

- The Farmers’ Produce Trade and Commerce (Promotion and Facilitation) Act: Provides for setting up a mechanism allowing the farmers to sell their farm produce outside the Agriculture Produce Market Committees (APMCs).

- The Farmers (Empowerment and Protection) Agreement of Price Assurance and Farm Services Act: Allows farmers to do contract farming and market their produce freely.

- The Essential Commodities (Amendment) Act: Fees items such as foodgrains, pulses, edible oils and onion for trade except in extraordinary (read crisis) situations.

-

Fears of Farmers

- Lesser buying by the government agencies in the approved mandi’s due to outside APMC trade of farm produce.

- The MSP system would become irrelevant.

- Farmers would not have any assured income and would be at the mercy of big corporations.

- Farmers Protests: These laws were met with unprecedented protests by farmers at Delhi borders for over a year and were eventually withdrawn in 2021. The farmers have now resumed the protest.

Farmer’s Demands in Recent Farmers Protest 2024

Legal Status to MSP: Enactment of legislation conferring mandatory legal status to MSP based on the MS Swaminathan Commission’s recommendation. Some of the other demands include:

- Debt Waiver: Full debt waiver for farmers and labourers;

- Implementation of the Land Acquisition Act of 2013: with provisions for written consent from farmers before acquisition, and compensation at four times the collector rate;

- Withdrawal from WTO: India should withdraw from the World Trade Organization (WTO) and freeze all free trade agreements;

- Pension support: Pensions for farmers and farm labourers;

- Employment under MGNREGA: 200 (instead of 100) days’ employment under MGNREGA per year, daily wage of Rs 700, and scheme should be linked with farming;

MS Swaminathan Committee

- The late MS Swaminathan was hailed as the ‘Father of India’s Green Revolution. He was recently conferred the Bharat Ratna.

- He chaired the National Commission on Farmers (NCF).

- The NCF had recommended: C2+50 percent formula for MSP i.e MSP should be at least 50 per cent more than the weighted average cost of production.

- It recommended adding ‘Agriculture‘ in the Concurrent List of the country’s Constitution.

- Diversion of ‘prime’ agricultural land and forest to the corporate sector for non-agricultural purposes should not be allowed.

- Increasing investment in agriculture-related infrastructure and credit availability to farmers

- It also suggested promoting conservation farming.

|

About Minimum Support Price (MSP)

- Introduction: It was introduced in the mid-sixties when India was food-deficit.

- Definition: MSP for a crop is the price at which the government is supposed to procure/buy that crop from farmers if the market price falls below it.

- Objective:

- To ensure that farmers receive a certain “minimum” remuneration so that their costs of cultivation can be recovered.

- To incentivise the production of certain crops for the food security of India.

- Announced by: They are announced by the Union government based on the recommendations of the Commission for Agricultural Costs and Prices (CACP).

- Factors Taken into Consideration: The CACP considers the following factors such as:

- The demand and supply of a commodity;

- Its cost of production;

- The market price trends (both domestic and international);

- Inter-crop price parity;

- Ratio of prices of farm inputs and farm outputs); a minimum of 50 per cent as the margin over the cost of production; and

- The likely implications of an MSP on consumers of that product.

- Coverage of crops under MSP: The Government announces MSP for 23 crops however,

- It is not legally bound to pay MSP.

- It effectively procures only a third of these crops.

- Status of MSP: It does not have any statutory/legal backing. Access to it, unlike subsidised grains through the PDS, isn’t an entitlement for farmers. The farmers cannot demand MSP as a matter of right.

- MSP for Sugarcane: The only crop where MSP payment has some statutory element is Sugarcane. This is due to its pricing being governed by the Sugarcane (Control) Order, 1966 issued under the Essential Commodities Act.

Enroll now for UPSC Online Classes

Commission for Agricultural Costs & Prices (CACP)

- The Commission for Agricultural Costs & Prices (CACP) is an attached office of the Ministry of Agriculture and Farmers Welfare, Government of India.

- It considers the following costs for MSP calculation:

- A2: All paid-out costs directly incurred by the farmer in cash and kind on seeds, fertilisers, pesticides, hired labour, leased-in land, fuel, irrigation, etc.

- A2+FL: A2 plus an imputed value of unpaid family labour.

- C2: It is a more comprehensive cost that factors in rentals and interest forgone on owned land and fixed capital assets, on top of A2+FL.

|

Issues Related to Farmers

- Price Volatility: Farmers often face price volatility, especially during peak harvest season. The sudden increase in supply can lead to a drop in prices, impacting the income of farmers who may not receive adequate returns for their produce.

- Stock Limits: The stock limits under the Essential Commodities Act and restrictions under Foreign Trade (Development and Regulation) Act keep the farm gate prices low.

- Priority on Low Food Inflation: The emphasis on keeping food inflation low might sometimes conflict with the objective of ensuring fair remuneration for farmers. The Government’s anti-inflationary policies of low import duties also depress the prices.

|

Reasons For Not Giving MSP a Legal Backing

There are various issues due to which the Governments have been reluctant to give MSP a legal guarantee:

- Heavy Subsidy Burden on the Government: The rising food bill under the existing MSP system of the government translates into an increase in fiscal deficit in the annual budget.

- Foodgrain Management: The Government does not have the physical resources to purchase, store and market large quantities of produce, if it must procure the same due to absence of buyers willing to pay the MSP.

- Consistent Increase in MSPs: Rising procurement means the Food Corporation of India (FCI) godowns are overflowing, and rising MSP means that the FCI cannot sell its stocks in the international market at a profit.

- Sale Outside APMC: Most of the sales of crops covered under MSP are not sold in the APMCs. So, there is no record of purchaser or seller farmers.

- For these transactions, it is not possible to guarantee the MSP. Many small and marginal farmers sell their produce to village traders who are outside the ambit of Agricultural Produce Marketing Committee (APMCs).

|

It refers to a statutory body established by state governments in India to regulate and oversee the marketing and trade of agricultural produce within designated market areas.

This regulatory mechanism offers several benefits:

- Fair Pricing: It establishes fair pricing mechanisms to ensure that farmers receive reasonable compensation for their efforts and investments.

- Elimination of Middlemen: who might exploit farmers, ensuring that farmers receive better returns for their products.

- Reduced Market Charges: By regulating market charges and fees, it contributes to improved market efficiency and reduces unnecessary financial burdens on farmers.

- Protection of Producers’ Interests: The APMC ensures that the interests of producer-sellers (farmers) are safeguarded, preventing them from being coerced into distress sales.

|

Way Forward

- Build Consensus: Continuous talks between the Government and the farmers should be held so that a consensus can be built to ensure that the income of farmers is safeguarded.

- Income Support: Many economists believe it is better to give farmers “income”, instead of “price”, support. This means transferring a fixed sum of money annually into their bank accounts, whether on a per-farmer (as in the Centre’s PM-Kisan Samman Nidhi) or per-acre (the Telangana government’s Rythu Bandhu) basis.

- Representation in Expert Committee: One of the issues of farmers was that the state of Punjab, Haryana and Uttar Pradesh were not represented in the committee. The Government should ensure that adequate representation should be given to all the stakeholders in the committee .

- Strengthen the Agricultural Marketing System: APMC should be strengthened as per the changing requirements of the country to ensure higher value to the farmers through remunerative prices of their produce by taking advantage of the domestic and export opportunities.

- Setting up of State Farmers Commissions: This was recommended by the National Commission for Farmers. The State level Farmers’ Commission should be set up in all the states with representation of farmers for ensuring dynamic government response to farmers’ problems.

- Strengthening of Agricultural Infrastructure: Overall improvement in the agricultural infrastructure is the need of the hour. The farmers should be provided with better logistical and storage facilities along with real time information on weather and market conditions. These will enable them to make an informed decision.

Enroll now for UPSC Online Course

Also Read: Recent Food Inflation In India

![]() 14 Feb 2024

14 Feb 2024