The Government of India has announced that the four Labour Codes are being made effective from 21st November 2025, rationalising 29 existing labour laws.

- The second National Commission on Labour had recommended that the existing Labour Laws should be broadly grouped into four/ five Labour Codes on functional basis

- The four Labour Codes were enacted after the deliberations held in the tripartite meeting of the Government, employers’, industry representatives and various trade unions during 2015 to 2019.

- The Code on Wages, 2019 was notified on 8th August, 2019 and the remaining three Codes were notified on 29th September, 2020.

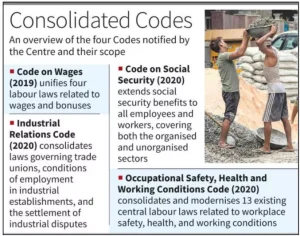

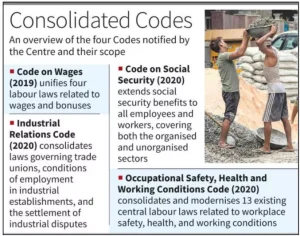

- The four Labour Codes includes

-

- The Code on Wages, 2019

- The Industrial Relations Code, 2020

- The Code on Social Security, 2020

- The Occupational Safety, Health and Working Conditions Code, 2020

Concurrent Jurisdiction & Implementation by States

- Labour is on the Concurrent List: both the Centre and the States have roles.

- The Centre frames the codes and sets broad policy; states notify rules, enforce them, adapt to local contexts.

- Enforcement is often through state labour departments, inspectorates, etc.

|

Rationale Behind Codification of Existing 29 Labour Laws

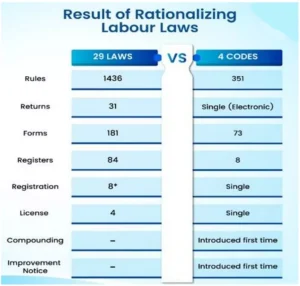

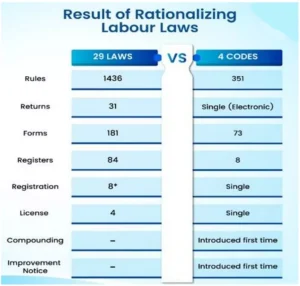

The codification of 29 existing labour laws into four Labour Codes was undertaken to address long-standing challenges and make the system more efficient and contemporary.

- Aim: The codification aims to enhance ease of doing business, promote employment generation, ensure safety, health, social & wage security for every worker.

- Simplifying Compliance: Multiplicity of laws leads to difficulty in compliance.

- Rationalizing labour laws via codification simplify the registration, licensing framework by introducing the concept of a Single Registration, Single License, and Single Return, thereby reducing the overall compliance burden to spur employment.

- Streamlining Enforcement: Multiplicity of authorities in different labour laws led to complexity and difficulty in enforcement.

- Modernizing Outdated Laws: Most labour legislations were framed during the pre-Independence era, necessitating alignment with today’s economic realities and technological advancements.

Comparison Of The Labour Ecosystem

A comparison of the labour ecosystem, before and after the implementation of the Labour Codes, is as follows:

|

Pre Labour Reforms |

Post Labour Reforms |

| Formalisation of Employment |

- No mandatory appointment letters

|

- Mandatory appointment letters to all workers.

|

| Social Security Coverage |

- Limited Social Security Coverage

|

- Under Code on Social Security, 2020 all workers including gig & platform workers to get social security coverage.

- All workers will get PF, ESIC, insurance, and other social security benefits.

|

| Minimum Wages |

- Minimum wages applied only to scheduled industries/employments

- Large sections of workers remained uncovered

|

- Under the Code on Wages, 2019, all workers to receive a statutory right minimum wage payment.

|

| Preventive Healthcare |

- No legal requirement for employers to provide free annual health check-ups to workers

|

- Employers must provide all workers above the age of 40 years with a free annual health check-up.

|

| Timely Wages |

- No mandatory compliance for employers payment of wages

|

- Mandatory for employers to provide timely wages

- Impact: This ensures financial stability, reducing work stress and boosting overall morale of the workers.

|

| Women workforce participation |

- Women’s employment in night shifts and certain occupations was restricted

|

- Women are permitted to work at night and in all types of work across all establishments, subject to their consent and required safety measures.

- Impact: Women will get equal opportunities to earn higher incomes – in high paying job roles.

|

| ESIC coverage |

- ESIC coverage was limited to notified areas and specific industries

- Establishments with fewer than 10 employees were generally excluded, and hazardous-process units did not have uniform mandatory ESIC coverage across India

|

- ESIC coverage and benefits are extended Pan-India

- Voluntary for establishments with fewer than 10 employees

- Mandatory for establishments with even one employee engaged in hazardous processes.

|

| Compliance Burden |

- Multiple registrations, licenses and returns across various labour laws.

|

- Single registration, PAN-India single license and single return.

- Impact: Simplified processes and reduction in Compliance Burden.

|

Labour Codes Introduce Several Further Reforms

These reforms are to strengthen worker protection and simplify compliance for employers:

- National Floor Wage to ensure no worker receives a wage below the minimum living standard.

- Gender-neutral pay and job opportunities, explicitly prohibiting discrimination—including against transgender persons.

- Faster and predictable dispute resolution, with two-member Industrial Tribunals and the option to approach tribunals directly after conciliation.

- Single registration, single licence and single return across safety and working-conditions requirements, replacing multiple overlapping filings.

- National OSH Board to set harmonised safety and health standards across sectors.

- Mandatory safety committees in establishments with 500+ workers, improving workplace accountability.

- Higher factory applicability limits, easing regulatory burden for small units while retaining full safeguards for workers.

|

Code 1: The Code of Wages, 2019

- It seeks to simplify, consolidate, and rationalize the provisions of four existing laws

- The Payment of Wages Act, 1936

- The Minimum Wages Act, 1948

- The Payment of Bonus Act, 1965

- The Equal Remuneration Act, 1976.

- Aim: It aims to strengthen workers’ rights while promoting simplicity and uniformity in wage-related compliance for employers.

- Major Highlights

-

- Universal Minimum Wages: The Code establishes a statutory right to minimum wages for all employees across both organized and unorganized sectors.

- Earlier, the Minimum Wages Act applied only to scheduled employments covering ~30% of workers.

- Introduction of Floor Wage: A statutory floor wage shall be set by the Government based on minimum living standards, with scope for regional variation.

- No state can fix minimum wages below this level, ensuring uniformity and adequacy nationwide.

- Overtime Compensation: Employers must pay all employees overtime wages at least twice the normal rate for any work done beyond the regular working hours.

- Decriminalization of Offences: The Code replaces imprisonment for certain first-time offences with monetary fines (up to 50% of the maximum fine), making the framework less punitive and more compliance-oriented.

Code 2: The Industrial Relations Code, 2020 (IR Code)

- It simplifies laws related to trade unions, conditions of employment in industrial establishment or undertaking, investigation and settlement of industrial disputes.

- IR Code has been prepared after rationalizing the relevant provisions of

- Trade Unions Act, 1926

- Industrial Employment (Standing Orders) Act, 1946

- Industrial Disputes Act, 1947.

- Major Highlights

- Fixed Term Employment (FTE): Allows direct, time-bound contracts with full parity in wages and benefits; gratuity eligibility after one year.

- The provision reduces excessive contractualization and offers cost efficiency to employers.

- Re-skilling Fund: To train retrenched employees, this fund has been set up from the contribution to be made by an industrial establishment for an amount equal to 15 days’ wages for every worker retrenched.

- Trade Union Recognition: Unions with 51% membership get recognition as the Negotiating Union;

- Otherwise, a Negotiating Council is formed from unions, not less than 20% membership of trade union.

- Such an arrangement strengthens collective bargaining.

- Women’s Representation: Ensures proportional representation of women in grievance committees for gender-sensitive redressal.

- Industrial Tribunals: Two-member tribunals consisting of judicial and administrative member for quicker dispute resolution.

- Direct Tribunal Access: Parties may approach tribunals directly after failed conciliation within 90 days.

- Notice for Strikes/Lockouts: Mandatory 14-day notice for all establishments to promote dialogue and minimize disruptions.

- Expanded Definition of Strike: Includes “mass casual leave also within its ambit” to prevent flash strikes and ensure lawful action.

Code 3: The Code on Social Security, 2020

- It incorporates existing nine Social Security Acts

- The Employee’s Compensation Act, 1923

- The Employees’ State Insurance Act, 1948

- The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952

- The Employment Exchanges (Compulsory Notification of Vacancies) Act, 1959

- The Maternity Benefit Act, 1961; The Payment of Gratuity Act, 1972

- The Cine-Workers Welfare Fund Act, 1981

- The Building and Other Construction Workers’ Welfare Cess Act, 1996

- The Unorganised Workers’ Social Security Act, 2008.

- Major Highlights

-

- The Code extends social security to all workers including unorganized, gig, and platform workers-covering life, health, maternity, and provident fund benefits, while introducing digital systems and facilitator-based compliance for greater efficiency.

- Inclusion of Gig and Platform Workers: New definitions are included- “Aggregator” “gig worker,” and “platform worker” to enable social security coverage.

- Aggregators to contribute 1- 2% of annual turnover (capped at 5% of payments to such workers).

About Labour Force

- The labour force, or currently active population, comprises all persons who fulfil the requirements for inclusion among the employed (civilian employment plus the armed forces) or the unemployed.

|

-

- Expanded ESIC (Employees’ State Insurance) Coverage: ESIC now applies pan-India, eliminating the criteria of “notified areas.”

- Establishments with fewer than 10 employees may voluntarily opt in with mutual consent of employers and employees.

- Uniform Definition of Wages: “Wages” now include basic pay, dearness allowance, and retaining allowance

- 50% of the total remuneration (or such percentage as may be notified) shall be added back to compute wages, ensuring consistency in calculating gratuity, pension, and social security benefits.

- Gratuity for Fixed-Term Employees: Fixed-term employees become eligible for gratuity after one year of continuous service (Earlier Five years).

- Time-bound EPF (Employees’ Provident Fund) Inquiries: A five-year limit has been set for initiating EPF inquiries and recovery proceedings, to be completed within two years (extendable by one).

- Suo-moto reopening of cases has been abolished, ensuring timely resolution.

- Social Security Fund: A dedicated fund to finance schemes for unorganised, gig, and platform workers, covering life, disability, health, and old-age benefits has been proposed.

- The amount collected through the compounding of offences will be credited to this Fund and used by the Government.

Code 4: The Occupational Safety, Health and Working Conditions Code 2020

- The Code has been drafted after amalgamation, simplification and rationalization of the relevant provisions of the 13 Central Labour Acts.

- The Code balances the twin objectives of safeguarding worker rights and safe working conditions, and creating a business-friendly regulatory environment.

- Major Highlights

- Unified Registration: A uniform threshold of 10 employees is set for electronic registration.

- One registration for an establishment has been envisaged in place of 6 registrations in the Acts.

- This will create a centralised database and promote ease of doing business.

- Extension to Hazardous Work: The Government can extend the Code’s provisions to any establishment, even with one employee, engaged in hazardous or life-threatening occupations.

- Wider Definition of Migrant Workers: The definition of inter-state migrant workers (ISMW) now covers workers employed directly, through contractors, or migrate on their own.

- Establishments must declare the number of ISMW.

- Formalization via appointment letters: Appointment letters specifying job details, wages, and social security will be given to enhance transparency and accountability.

- Women’s Employment: Women can work in all types of establishments and during night hours (before 6AM, beyond 7PM) with consent and safety measures, fostering equality and inclusion.

- National Database for Unorganised Workers: A national database to be developed for unorganized workers including migrants to help migrant workers get jobs, map their skills and provide other social security benefits.

- Contract Labour Reform: Applicability threshold has been raised from 20 to 50 contract workers.

- All India license valid for 5 years against work-order based license to be provided to the contractor.

- For contract labour, beedi and cigar manufacturing and factory: a common license is envisaged and provision of deemed license after expiry of prescribe period is introduced.

- Moreover, the license shall be auto-generated.

- Provision of contract labour board has been done away with and provision for appointment of designated authority to advise matters on core and non-core activities is introduced.

- Safety Committees: Establishments with 500 or more workers will form safety committees with employer-worker representation, enhancing workplace safety and shared accountability.

- National Occupational Safety & Health Advisory Board: A single tripartite advisory board replaces six earlier boards to set national safety and health standards across sectors, ensuring uniformity and quality.

- Social Security Fund: Establishes a fund for unorganised workers, financed through penalties and compounding fees, for their welfare and benefit delivery.

- Contract Labour- Welfare & Wages: Principal employers to provide welfare facilities like health and safety measures to contract workers.

- If the contractor fails to pay wages, the principal employer has to pay unpaid wages to the contract labour.

- Working Hours & Overtime: Normal working hours capped at 8 hours/day and 48 hours/week.

- Overtime allowed only with worker consent and paid at twice the regular rate.

Challenges and Concerns

- Trade Union Opposition & Rights Undermined: Major trade unions oppose the new labour codes, arguing that they reduce strike rights, weaken collective bargaining, and allow easier layoffs/closures.

- If unions feel excluded or rights curtailed, implementation will face resistance and legitimacy issues.

- Fragmentation in State Capacities: States differ greatly in digital infrastructure, administrative readiness, inspector strength, training and resource allocation, creating disparities in coverage and enforcement.

- Labour being a concurrent subject means implementation bottlenecks now rest mainly with states; many haven’t aligned their rules despite nudging from Centre.

- Some states lag in drafting rules or modifying their local systems to adapt to codes.

- Risk of Fixed-Term/Contract Employment Supplanting Permanent Jobs: The codes and supporting commentary raise the concern that employers may increasingly use fixed-term contracts or casualisation, eroding job security.

- Job insecurity undermines worker welfare, long-term planning, skills investment and may increase informalisation.

- Unclear National Wage Floor & Methodology Challenges: The Code on Wages, 2019 introduces a national minimum wage concept, but the methodology, state-alignment and effective enforcement mechanisms are still uncertain.

- Inconsistent wage floors undermine equality and can deepen state-level wage disparities.

- Lack of Legal Enforceability in Social Security: Many benefits remain welfare schemes, not legal entitlements, leaving vulnerable workers without guaranteed access.

- The informal sector especially remains outside the fold of formal social security coverage.

- Lack of Legal Enforceability in Social Security

- Even though the Social Security Code now offers gratuity after 1 year (instead of 5), operationalising this will require state-level rulemaking that remains incomplete.

- Coverage Gaps for Gig, Platform, and Informal Workers: Although the Codes define many categories (Gig, Contract, Platform work), practical inclusion is patchy.

- The International Labour Organization (ILO) notes that around 90% of Indian workers lack full social security benefits like pension, insurance, paid leaves.

- Overlapping & Disjoint Scheme Architecture: Many schemes (central + state) operate in silos, leading to duplication, gaps, and unclear jurisdiction.

- Karnataka and Rajasthan advanced standalone gig welfare laws even while the Social Security Code’s provisions (like aggregator contribution of 1–2% turnover) remain in limbo.

- Data, Portability & Integration Issues: Databases are often disparate and fragmented, lacking unified identity, cross-linking, or real-time synchronization.

- This complicates benefit portability (across states/districts) and undermines seamless worker mobility.

- Manufacturing push (PLI, MSME expansion) requires integrated labour systems; without unified data architecture, labour mobility remains constrained.

Way Forward

- Build a Clear, Time-Bound State Implementation Roadmap: Create a mandatory, centrally monitored timeline for states to notify rules.

- Provide technical templates, model rules, and funding incentives for lagging states.

- Set up a single national dashboard with real-time status of rule-making, inspections, registrations, and tribunal cases.

- Strengthen Social Security Enforcement, Not Just Recognition: Convert key benefits (PF, ESIC, health, maternity) into enforceable entitlements, not optional schemes.

- Prioritize gig & informal workers for legal coverage, not just as optional beneficiaries.

- Establish a uniform worker-ID system linking EPFO, ESIC, e-Shram, BOCW data for portability.

- Create a dedicated social security delivery authority for gig/platform workers with automated contribution tracking.

- Prevent Misuse of Fixed-Term Employment (FTE): Introduce sector-wise caps on FTE usage where risk of substitution is high (textile, logistics, electronics).

- Require annual disclosure of permanent vs FTE vs contract workforce ratios.

- Enable unions to audit misuse through grievance escalation pathways.

- Build State Capacity & Digital Governance: Invest in upskilling inspectorates, local labour departments, ICT infrastructure, analytics.

- Introduce real-time dashboards, public accountability, social audits to ensure transparency.

- Transitional Safeguards & Legacy Protection: Protect existing welfare entitlements during transition (avoid benefit cuts).

- Improve Gig & Platform Worker Inclusion: Operationalise the Social Security Fund with automatic deduction systems for aggregators.

- Enable gig workers to view contributions and benefits via a mobile app.

- Partner with states to align gig-worker laws (Rajasthan, Karnataka) with central frameworks.

- Strengthen Manufacturing Competitiveness Without Diluting Protections: Link compliance ease for MSMEs with verified safety, wage, and PF adherence.

- Provide compliance-support cells for small factories transitioning to new thresholds.

- Incentivise formalisation by integrating labour compliance with PLI ratings.

Conclusion

The Labour Codes offer a modernised, simplified labour framework, but their success now hinges entirely on political coordination, state-level capacity, and rigorous, worker-centred implementation.

![]() 22 Nov 2025

22 Nov 2025