Context: This article is based on the news “It is time for a full-scale overhaul of the Insolvency and Bankruptcy Code” which was published in the Hindu. The Financial Stability Report (FSR) released by the Reserve Bank of India reveals the challenges faced and the need for the full-scale overhaul of the Insolvency and Bankruptcy Code (IBC), 2016.

Financial Stability Report By RBI: Shows Inadequate Debt Recovery

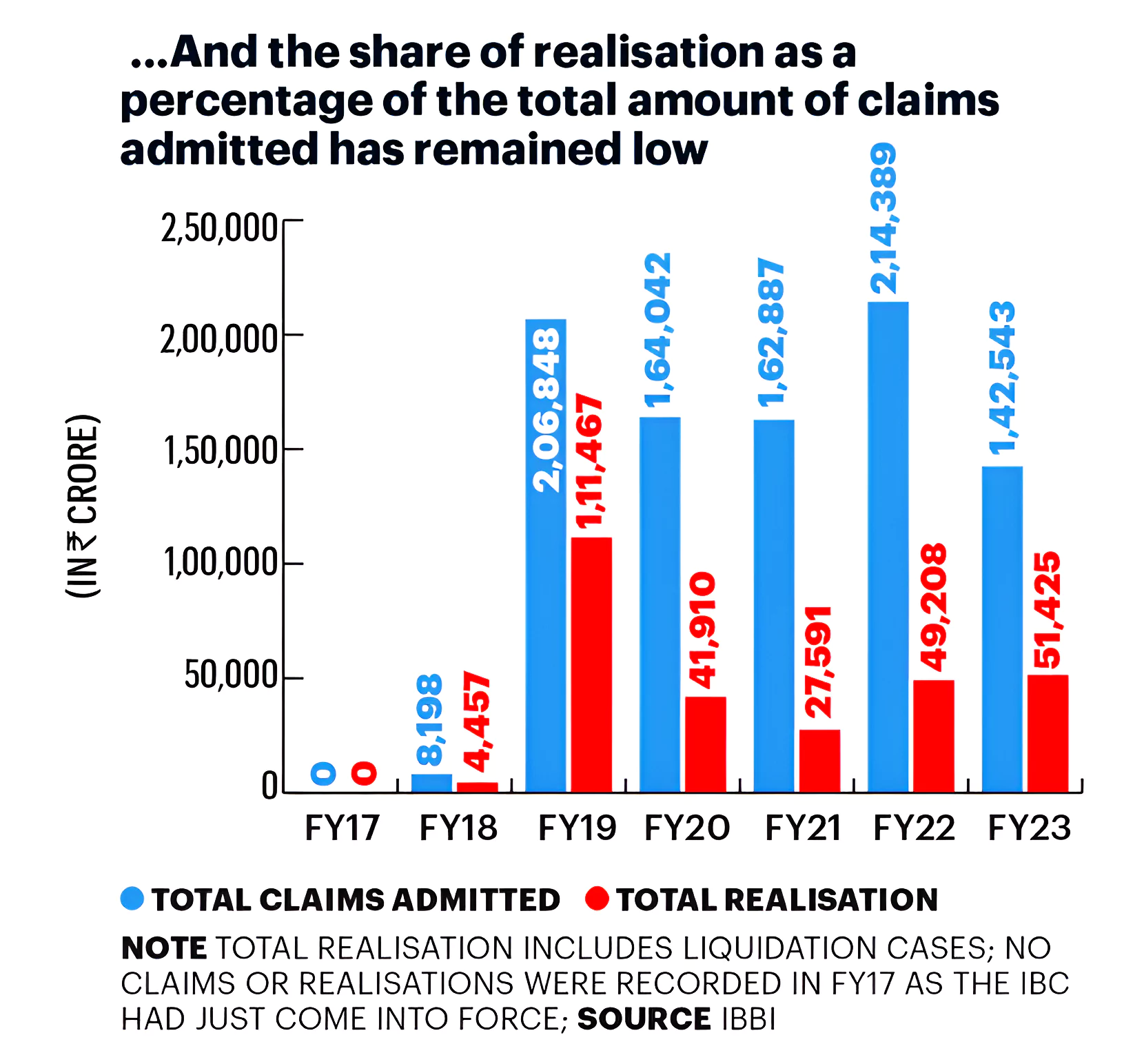

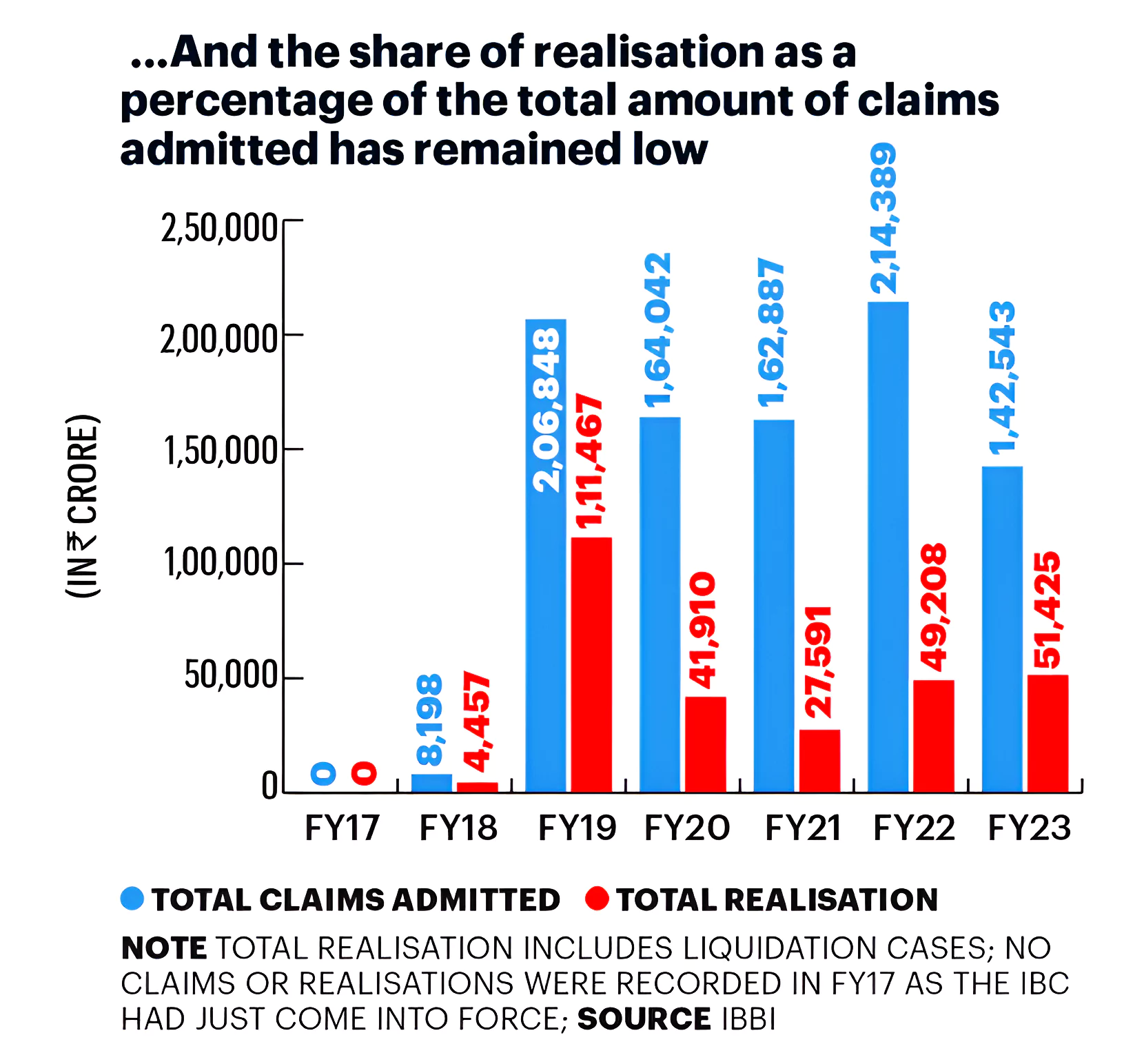

- Inadequate Debt Recovery: This constitutes only 0.92% of the total debt.

- For Example: In a recent case involving settlement by the NCLT of Reliance Communications Infrastructure Ltd. (RCIL), the settlement amounting to ₹455.92 crore, was approved against total debtor claims of ₹49,668 crore.

- Prolonged Resolution Process: The resolution process took four years, against the maximum of 330 days for completing the Resolution Plan (RP).

- Need for Insolvency and Bankruptcy Code and NCLT Review: Since the initial objectives of maximizing debtor’s assets and timely resolution have not been fulfilled, a thorough review of the Insolvency and Bankruptcy Code (IBC) and the National Company Law Tribunals (NCLTs) is needed.

Must Read: Asset quality of Indian banks improves to decadal high: RBI

About Financial Stability Report (FSR)

- It is published by the RBI once every six months.

- It evaluates the banks, NBFCs and other financial intermediaries based on the progress in terms of operating margins, net interest income (NII), net interest margins (NIMs), gross NPAs, net NPAs and the outcome of the various stress tests conducted by the RBI.

|

About the Insolvency and Bankruptcy Code (IBC), 2016

- Insolvency and Bankruptcy Code was enacted in 2016 to provide a robust framework for debt resolution through corporate insolvency resolution processes (CIRP) and liquidation.

- It seeks to maximize asset value and distribute fair proceeds among creditors.

- The Insolvency and Bankruptcy Code provides for a time-bound resolution of firms, addressing the issue of firm exit in India.

Objectives of Insolvency and Bankruptcy Code:

- Maximise the value of the debtor’s assets

- Ensure timely and effective resolution of Insolvency and Bankruptcy Code cases

- Balance the interests of all stakeholders, including creditors, debtors, and staff

- Provide for a framework to deal with cross-border insolvency cases.

Need for Insolvency and Bankruptcy Code, 2016:

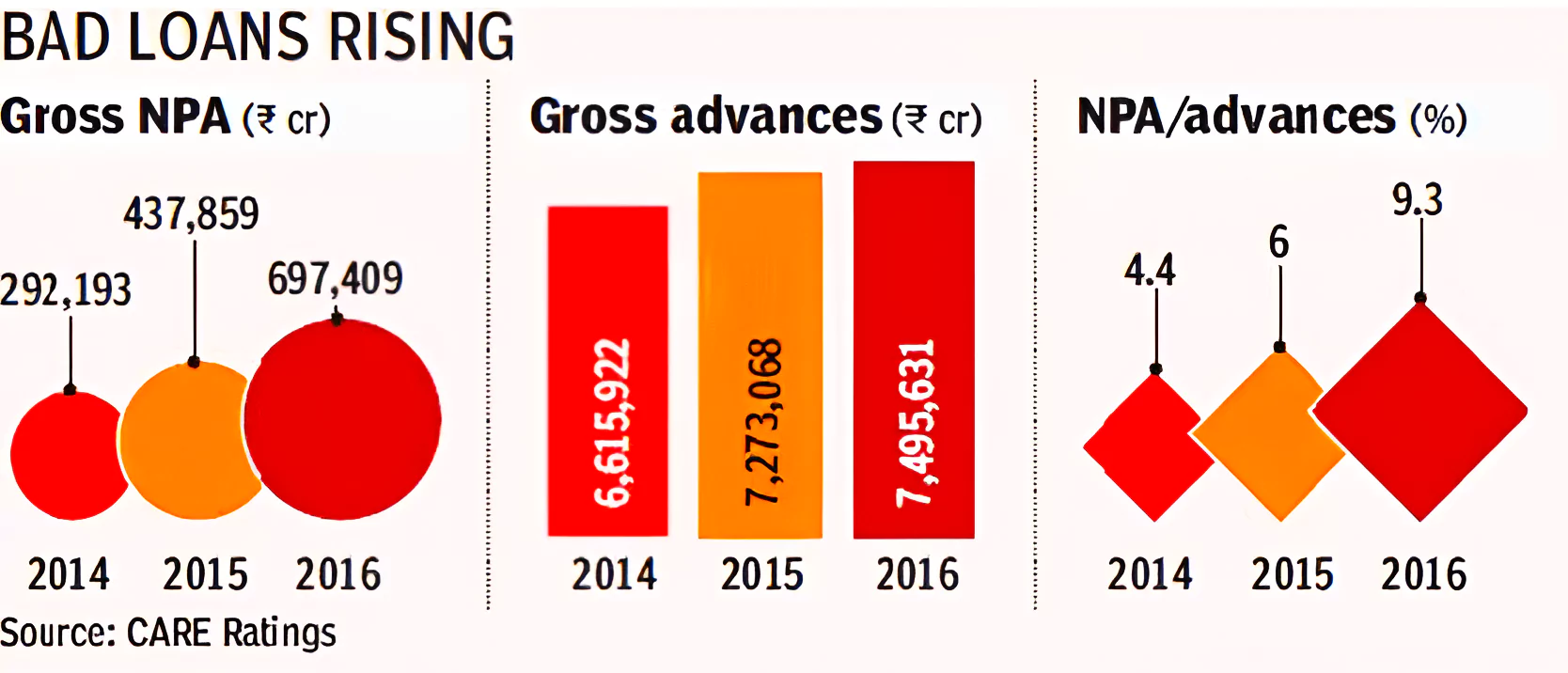

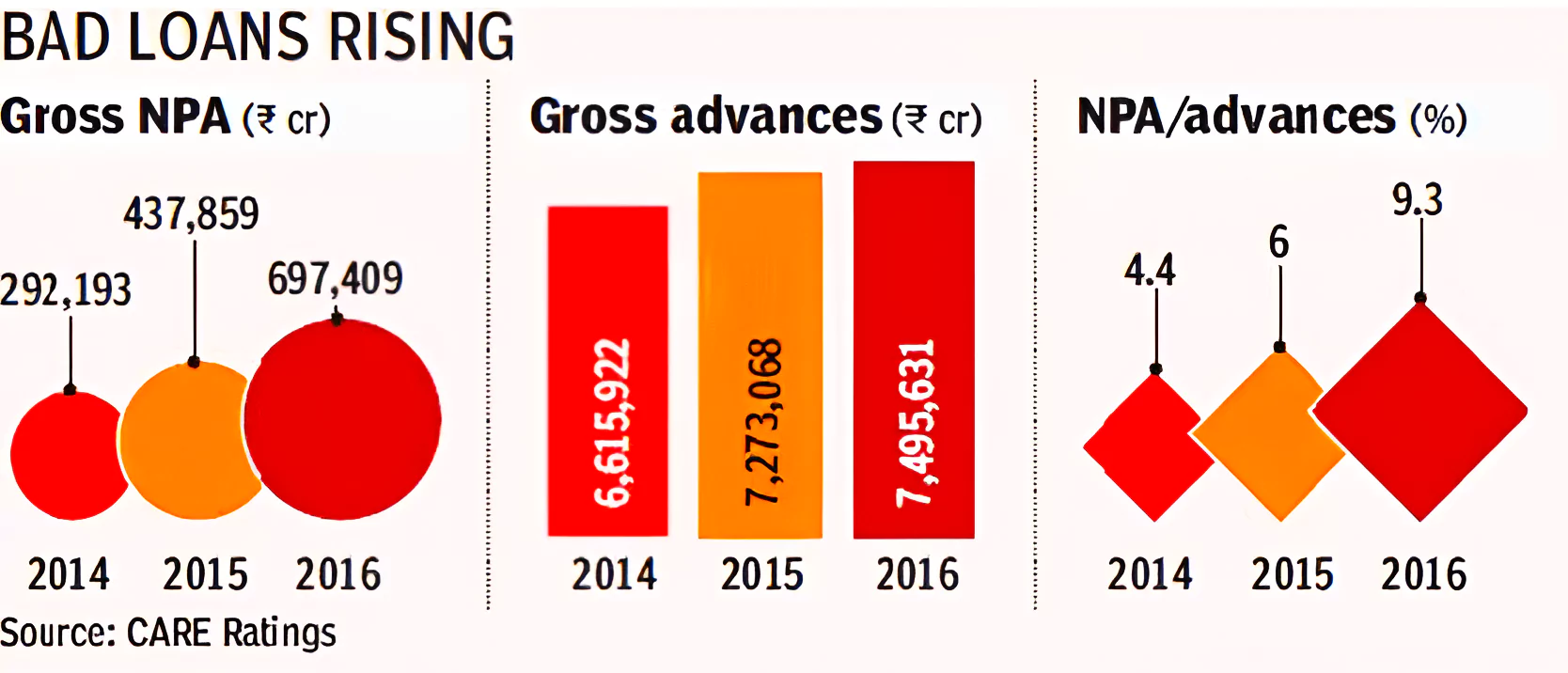

- Rising NPAs: Growing burden of Non-Performing Assets and debt defaults in India.

- As of June 2016, the total Gross Non-Performing Assets (NPAs) for public and private sector banks was around Rs. 6 lakh crore(See Image).

- Failure of Traditional Loan Recovery Mechanisms: Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI), and Debt Recovery Tribunals faced criticism for their inefficiency.

Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI), 2002:

- It was enacted to govern the Securitisation and reconstruction of financial assets, as well as the enforcement of security interests, and to provide for a centralised database of security interests formed on property rights.

|

Institutional Framework for the Insolvency and Bankruptcy Resolution:

- Insolvency and Bankruptcy Board of India (IBBI): Under the Insolvency and Bankruptcy Code 2016, IBBI has the power to make regulations for a mechanism for the disposal of assets under the code.

-

Adjudicating Authority:

- Debt Recovery Tribunal (DRT): It shall be the Adjudicating Authority with jurisdiction over individuals and unlimited liability partnership firms.

- Appeals from the order of DRT shall lie to the Debt Recovery Appellate Tribunal (“DRAT”).

- National Company Law Tribunal (NCLT): It shall be the Adjudicating Authority with jurisdiction over companies and limited liability entities.

- Appeals from the order of NCLT shall lie to the National Company Law Appellate Tribunal (NCLAT).

- NCLAT shall be the appellate authority to hear appeals from the Regulator’s orders regarding insolvency professionals or information utilities.

Achievements of Insolvency and Bankruptcy Code (IBC)

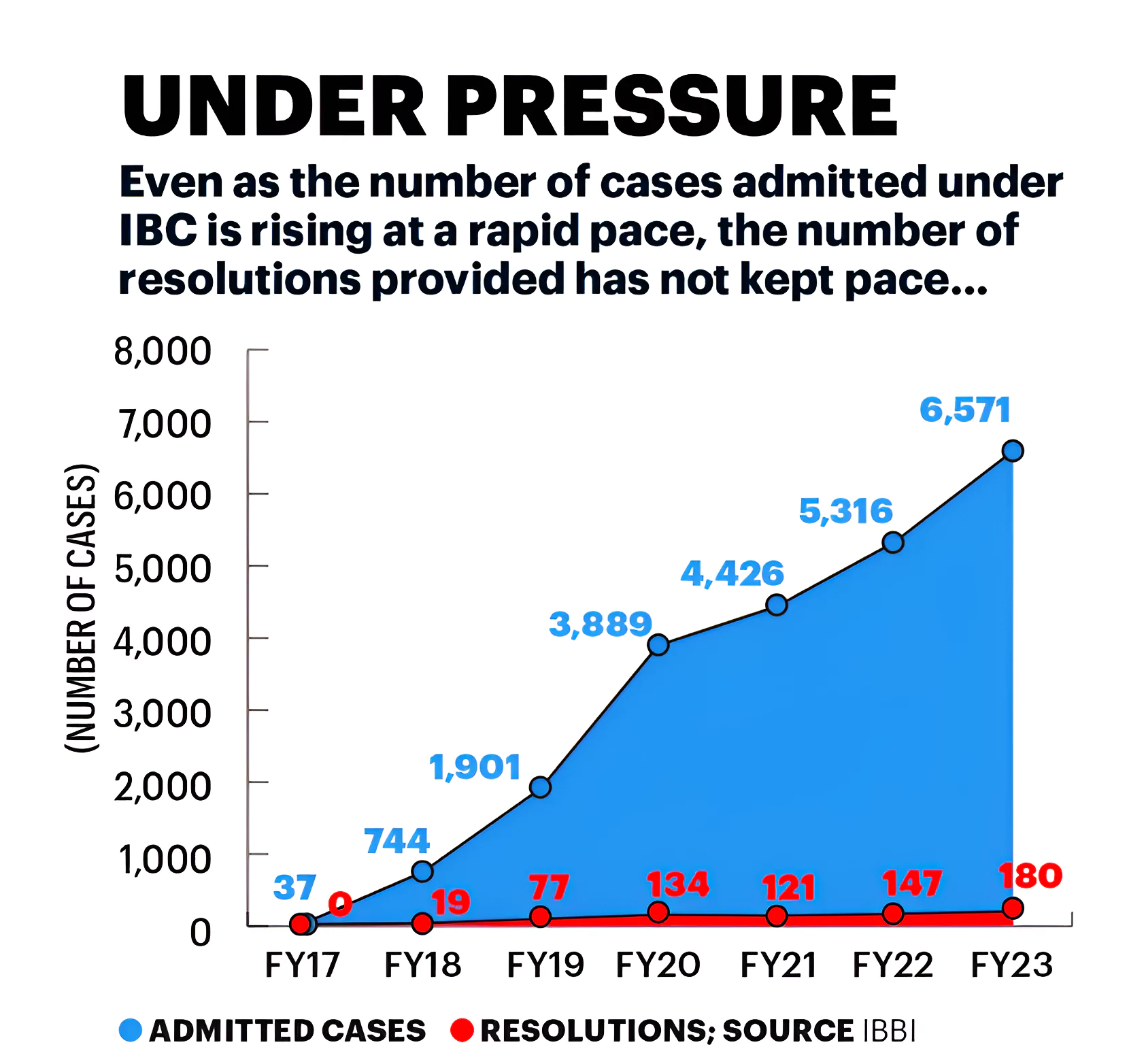

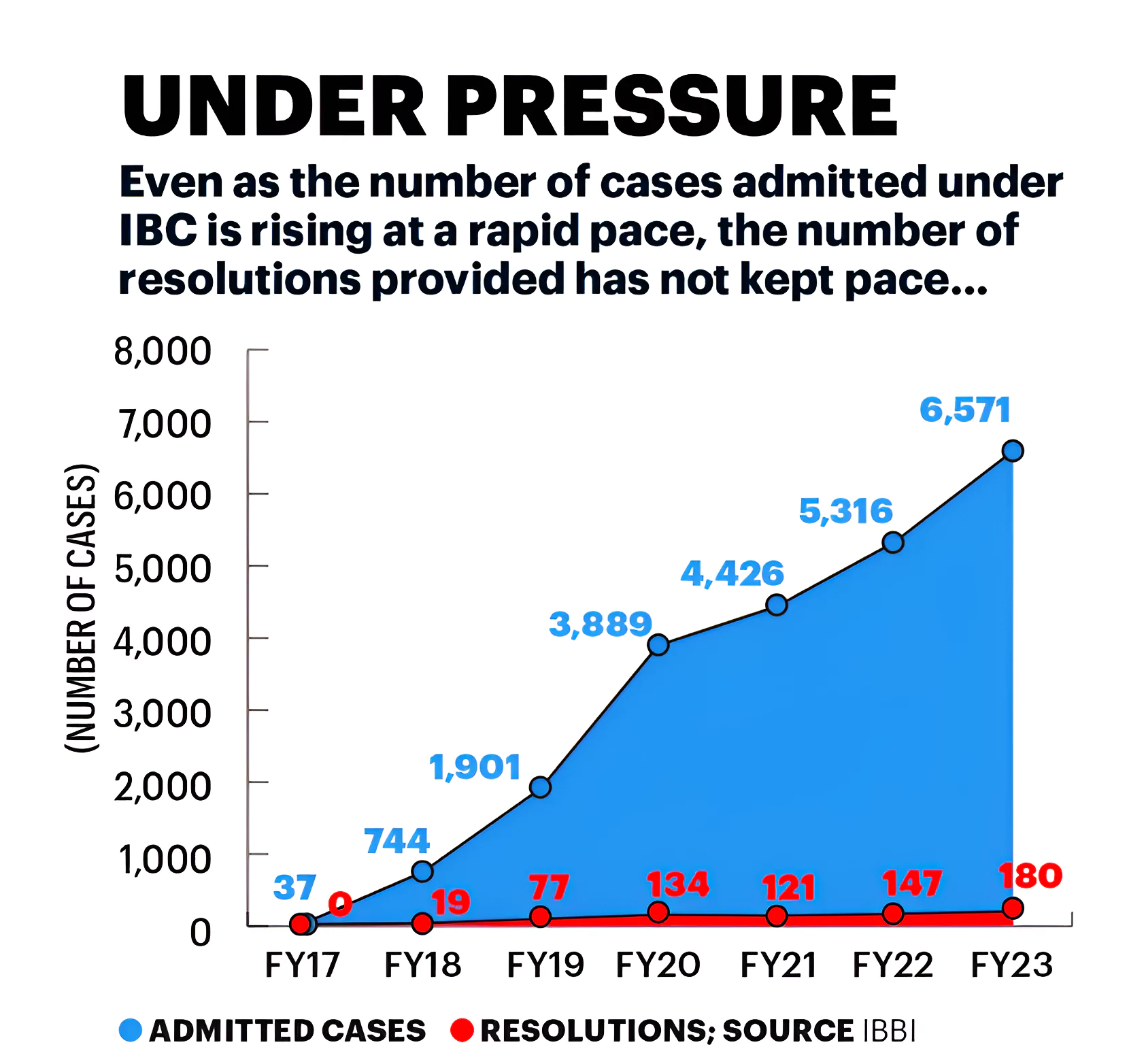

- Company Resolutions: According to the data from IBBI, the code had helped 2,622 companies (720 through resolution plans, 1,005 through appeals, reviews, or settlements, and 897 through withdrawal of insolvency proceedings till June 2023).

- Admitted Cases: By the end of September, 7,058 cases had been admitted under the Insolvency and Bankruptcy Code (IBC) framework.

- Credit Recovery: As of September 2023, the creditors have realised Rs 3.16 lakh crore under the resolution plans approved under the Code.

- Outperforming Board of Industrial and Financial Reconstruction (BIFR) Regime: The Insolvency and Bankruptcy Code has significantly outperformed the earlier BIFR regime in terms of the speed of resolution.

- BIFR was established under the Sick Industrial Companies (Special Provisions) Act, 1985 (SICA) for the rehabilitation and reconstruction of sick companies and the release of public funds sunk in those companies into the open market.

- Rise in Employment Intensity: According to a report by the IIM, Ahmedabad, there has been a 50 percent rise in average employee expenses in the three years post-resolution cases, indicating a higher employment intensity in the resolved firms (listed) during the post-resolution period.

Concerns Associated with Insolvency and Bankruptcy Code

- Poor Recovery Rates: According to the report, banks or FCs are recovering an average of just 10-15% in NCLT-settled cases of large corporates.

- In contrast, banks collect complete interest on loans extended to farmers, students, MSMEs, and housing, including penalty interest for delays, displaying complete disparity with the treatment of corporations.

- Prevalence of Haircuts: The 32nd report of the Parliamentary Standing Committee on Finance highlighted low recovery rates with haircuts as much as 95%.

- Videocon Case: Taken over by the Vedanta Group, the banks recovered only 5% of the loan outstanding on the declaration date.

- A ‘haircut’ refers to the amount of money lenders need to sacrifice as part of a loan resolution process.

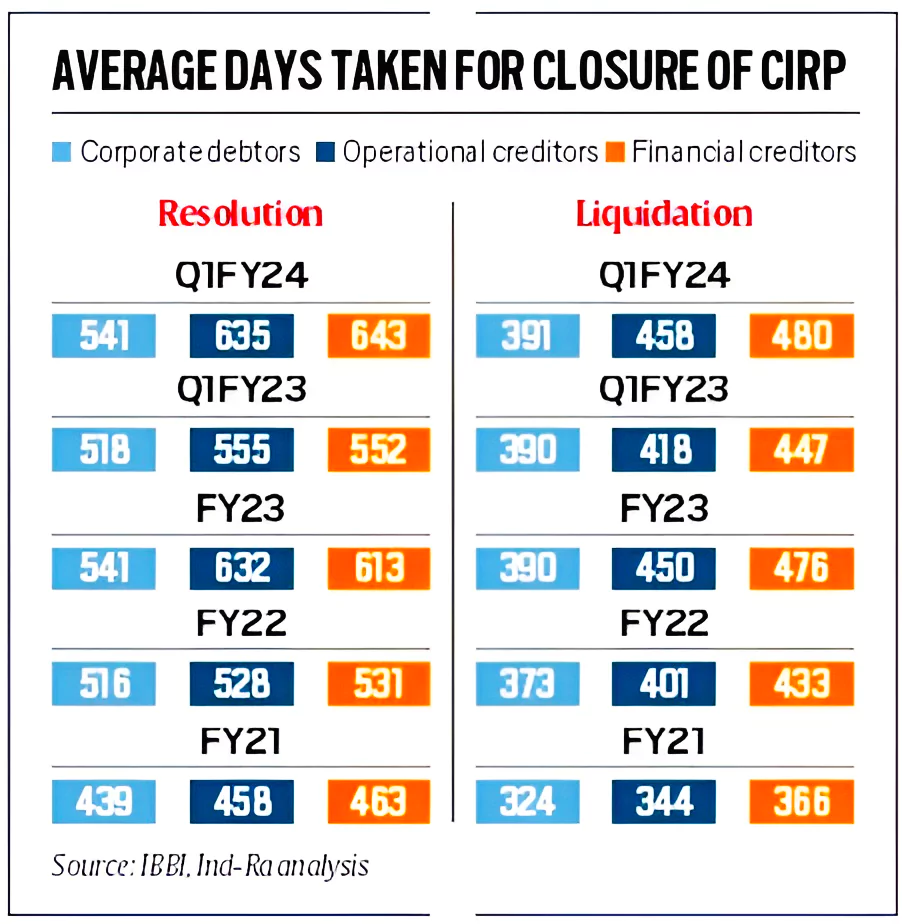

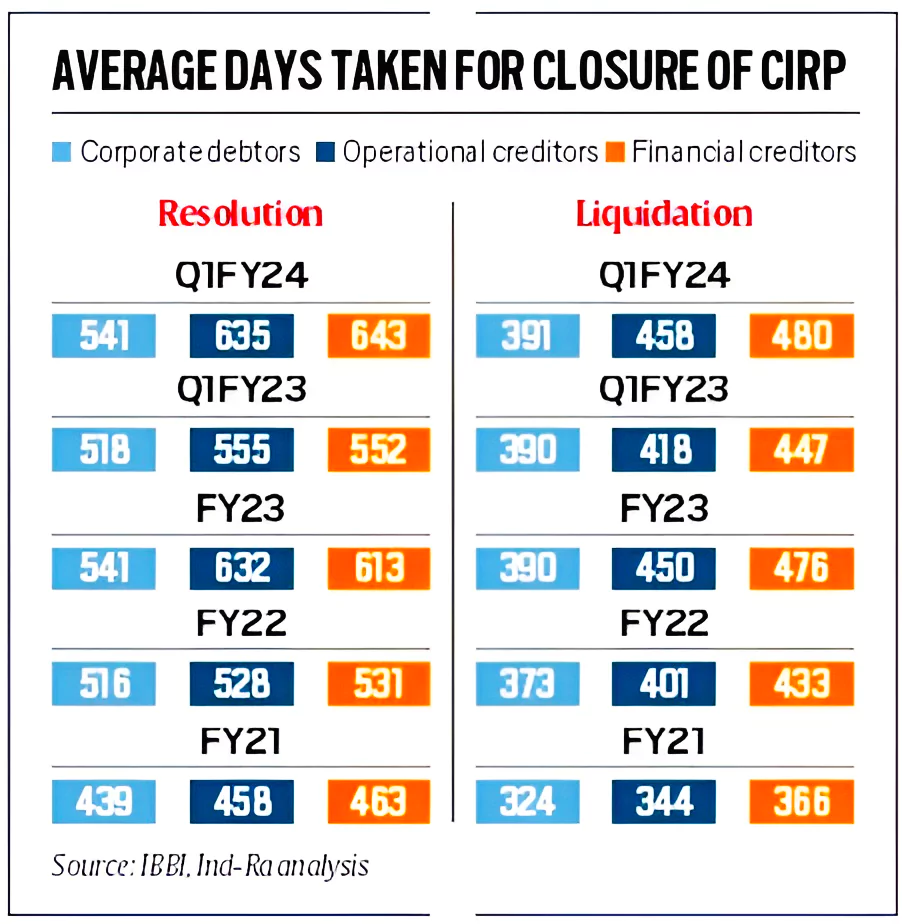

Delay in Resolution Process: While the time taken under Insolvency and Bankruptcy Code is lower than what it used to take before Insolvency and Bankruptcy Code, it continues to exceed the expected timelines.

Delay in Resolution Process: While the time taken under Insolvency and Bankruptcy Code is lower than what it used to take before Insolvency and Bankruptcy Code, it continues to exceed the expected timelines. -

- The average time to close the resolution process is around 653 days.

- More than 71% of cases have been pending (for) more than 180 days.

- Inadequate Contingency Planning for Mitigating Project Risks: According to a former RBI official, banks are inadequately conducting contingency planning, particularly for mitigating project risks.

- Stress tests and simulation models used by banks do not incorporate extreme stress scenarios, including assessing the borrower’s ability to withstand them and determining the potential haircut imposed by banks in such cases.

- Corporations that underwent liquidation under the Insolvency and Bankruptcy Code reported only 5 percent of assets under their ownership, highlighting lenders’ inadequate risk management practices.

- Issues with Resolution Professionals (RPs): The RP has been accused of violating the code of conduct and not acting in the best interest of creditors.

- Some RPs allegedly advocated for the company’s liquidation rather than resolution, as the resolution process would provide them with a greater fee.

Resolution Professionals (RPs)

- RPs are appointed by the NCLT to oversee the affairs of debt-laden firms during their insolvency proceedings.

- They take control of such companies, operate them, complete all the statutory processes, and get resolution proposals.

|

-

- The Parliamentary Standing Committee revealed that disciplinary actions have been taken against 123 Insolvency Professionals (RPs).

- For Example, 60% of the RPs inspected were found to be indulging in malpractices.

- Shortage of Staff at the National Company Law Tribunal (NCLT): Currently, NCLT has 55 members as opposed to the sanctioned strength of 63 members.

Also Refer: India’s Forex Reserves Up by $2.54 bn

Way Forward to the Insolvency and Bankruptcy

- Redesigning the Fast-Track Corporate Insolvency Resolution Process (FIRP): It will allow financial creditors to drive the insolvency resolution process for a Corporate Debtor outside of the judicial process while retaining some involvement of the Adjudicating Authority (AA) to improve the legal certainty of the outcome.

- Structuring the Resolution Plan: As proposed by the IBBI, the resolution plan needs to be structured in two parts to streamline the CIRP and prevent delays in executing the resolution plan.

- Part A: To deal with inflow, that is, payments under the resolution plan, payment of insolvency resolution process cost, etc.

- Part B: To deal with distribution to the various stakeholders.

- Ceiling on Haircuts: There is a need to fix a ceiling on haircuts, which has not been implemented yet.

- Ceiling on Maximum Credit: The RBI must implement a maximum ceiling of credit to a single corporate house at ₹10,000 crore, reducing banks’ burden during write-offs.

- Establishing Adequate Bench Strength: This will curtail the delays and lead to the time-bound nature of the corporate insolvency resolution process.

- Given the increasing volume of cases, the sanctioned strength of NCLT members needs to be further increased to ensure higher disposal rates.

- Judicial Training to NCLT Members: Experts have suggested that bureaucrats appointed as technical members must undergo judicial training before being appointed to NCLT.

- It needs to be ensured that the tribunal is immune from executive interference by stopping the appointment of bureaucrats to such bodies.

- Contingency Plans for banks: Banks need to factor in the financial risk situations of the firms and implement a backup/contingency plan in their appraisal process.

- Pre-packaged insolvency resolution framework for corporate debtors: The pre-packaged insolvency resolution framework needs to be expanded to certain categories of corporate debtors like micro, small, and medium enterprises (MSMEs).

Conclusion

Improving operational infrastructure, providing clarity in legal interpretation, streamlining procedures, developing a robust insolvency ecosystem, and enhancing mechanisms for cross-border insolvency are crucial steps in ensuring the effective implementation of the Insolvency and Bankruptcy Code.

| Prelims Question (2017)

Which of the following statements best describes the term ‘Scheme for Sustainable Structuring of Stressed Assets (S4A)’, recently seen in the news?

(a) It is a procedure for considering ecological costs developmental schemes formulated by the Government.

(b) It is a scheme of RBI for reworking the financial structure of big corporate entities facing genuine difficulties.

(c) It is a disinvestment plan of the Government regarding Central Public Sector Undertakings.

(d) It is an important provision in ‘The Insolvency and Bankruptcy Code’ recently implemented

Ans: (b) |

![]() 10 Jan 2024

10 Jan 2024

Delay in Resolution Process: While the time taken under Insolvency and Bankruptcy Code is lower than what it used to take before Insolvency and Bankruptcy Code, it continues to exceed the expected timelines.

Delay in Resolution Process: While the time taken under Insolvency and Bankruptcy Code is lower than what it used to take before Insolvency and Bankruptcy Code, it continues to exceed the expected timelines.