The devolution of Union tax revenue to States is significant in India’s fiscal federalism.

- The Finance Commission (FC) formulates this distribution every five years, and often prioritizes intragenerational equity, that is, to redistribute tax revenue among States over efficiency. However, it can exacerbate intergenerational inequity, necessitating the inclusion of intergenerational equity as a criterion in tax devolution.

About Fiscal Federalism

It entails the division of responsibilities and resources between the central and state governments, with the Finance Commission playing a key role in recommending tax proceeds distribution.

- Equitable Intergovernmental Transfers: It involves fund transfers from the central to state governments, are vital for balanced regional development, reducing fiscal imbalances, and promoting cooperative federalism.

- Federalism: It is a mode of government that combines a general government with regional governments in a single political system, dividing the powers between the two.

- Centralised Federal Structure: Constitution provides for a significantly centralized federal structure, with the bulk of revenue-raising powers residing with the Union government. As a result, Union government transfers to the States are vital for the latter’s fiscal space.

- The Union government’s fiscal transfers to States are made through two mechanisms viz. the Finance Commission and a variety of Central government schemes.

Enroll now for UPSC Online Course

Broad Principles Associated with Fiscal Federalism

Following are the three main broad principles associated with Fiscal Federalism:

- Fiscal Equivalency: The jurisdiction determining the order of provision of each public good should include the set of individuals that consume it. This generally requires a large number of overlapping jurisdictions.

- Decentralisation Theorem: Each public service should be provided by the jurisdiction having control over the minimum geographic area that would internalise the benefits and costs of such provision.

- Principle of Subsidiarity: Functions should be performed at the lowest level of government. The principle implicitly implies hierarchy.

About the Finance Commission

The Sixteenth Finance Commission has begun its work, which was constituted in December last year and is expected to submit its recommendations by October, 2025 that will be valid for five years starting from April 1, 2026.

- Constitutional Body: The Finance Commission is a constitutional body and provided by Article 280 of the Indian Constitution as a quasi-judicial body.

- Appointing Authority: The President of India constitutes a Finance Commission every fifth year or at such a time that is considered necessary.

- Composition: The Finance commission composition consists of a chairman and four other members.

- Tenure: For the duration specified in Presidential order. The Commission is reconstituted typically every five years and usually takes a couple of years to make its recommendations.

- Members are eligible for reappointment.

- Qualifications: The Parliament has been authorised by the constitution to determine the qualifications of the members and the manner in which they are to be appointed.

- Specifications: Based on these powers, the Parliament has given the following specifications for appointing the members.

- The chairman must have experience in public affairs while the other four members should be selected from amongst the following criteria:

- A High Court judge or one qualified to become one

- An individual having specialised knowledge of finance and accounts of the government

- A person who possesses experience in financial matters and administration

- A person who has special knowledge of economics

- Powers: Based on the Code of Civil Procedure 1908, the Finance Commission of India has all the powers of a Civil Court.

- Evidence Demand: The commission has powers to call witnesses, and ask for the production of a public document or record from any office or court.

- Mandates:

- Tax Distribution: Distributing shares of net proceeds of tax between the Union and the States and the allocation between the States of the respective shares of such proceeds.

- The Centre, however, is not legally bound to implement the suggestions made by the Finance Commission.

- Rules for Grants-in-Aid: The rules that govern grant-in-aid to the states by the Centre from Consolidated Fund of India.

- Tax Devolution at State Level: Augmenting the consolidated fund of the state to supply resources to panchayats and municipalities based on recommendations of the State Finance Commission.

- Miscellaneous Matter: Any other matter referred by the President to the Commission in the interests of sound finance.

- Submit Report: A report is submitted to the President, who lays it before both houses of the Parliament. The report is followed by an explanatory memorandum on the actions taken on its recommendations.

About the Distribution of Funds by the Finance Commission

Financial devolution refers to the transfer of financial resources and decision-making powers from the central government to the states.

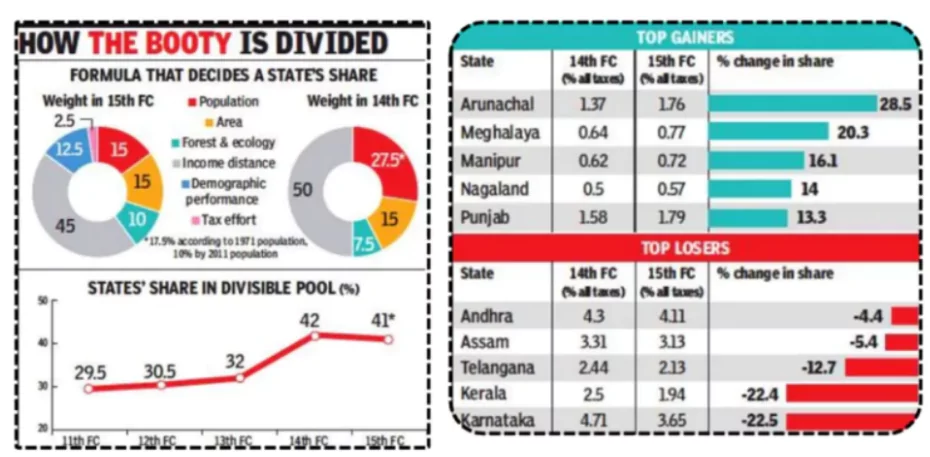

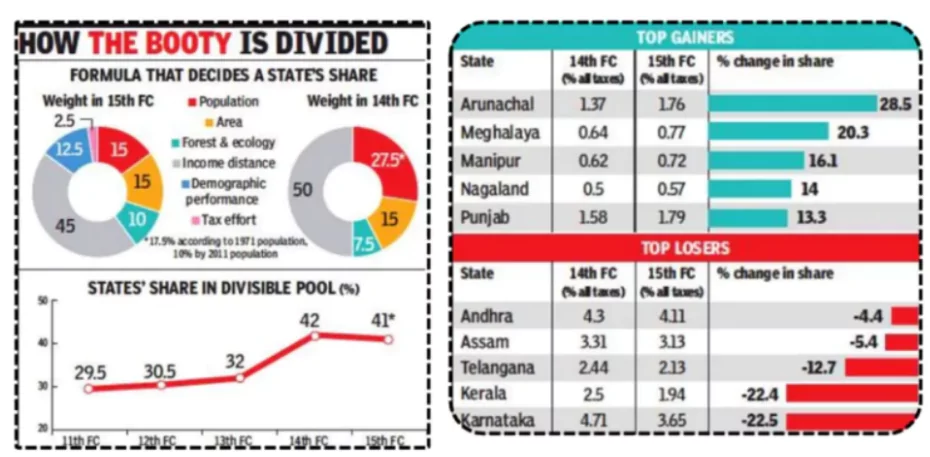

- Decided by: The Finance Commission decides what proportion of the Centre’s net tax revenue goes to the States overall (vertical devolution) and how this share for the States is distributed among various States (horizontal devolution).

- Constitutional Provisions: Article 280(3)(a) of the Constitution of India mandates that the FC has the responsibility to make recommendations regarding the division of the net proceeds of taxes between the Union and the states.

- Article 270 outlines the distribution of net tax proceeds between the Union government and the States.

- Vertical Devolution: This devolution of funds however, is not based on any such objective formula.

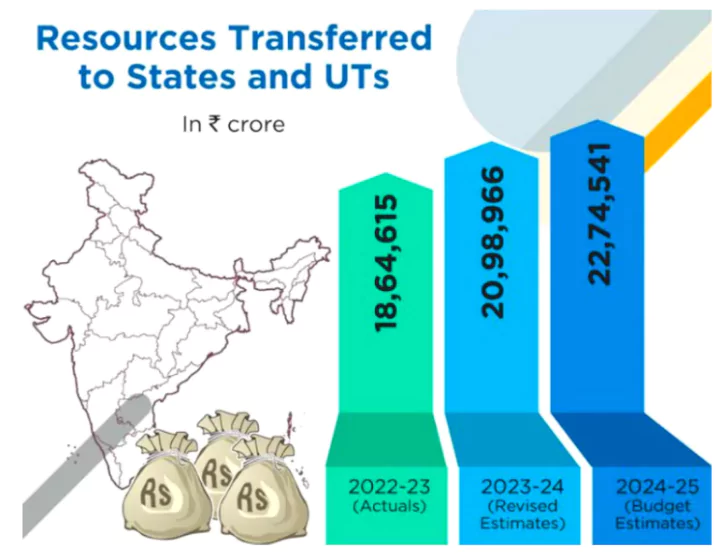

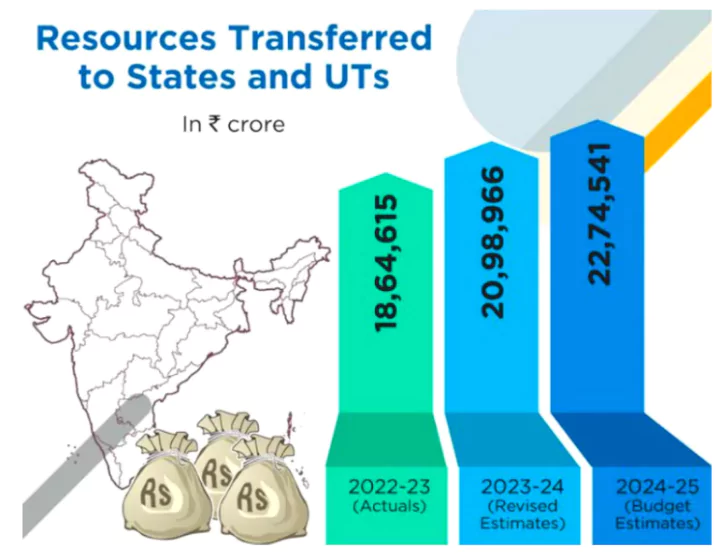

- Nevertheless, the last few Finance Commissions have recommended greater vertical devolution of tax revenues to States.

- The 13th, 14th and 15th Finance Commissions recommended that the Centre share 32%, 42% and 41% of funds, respectively, with States.

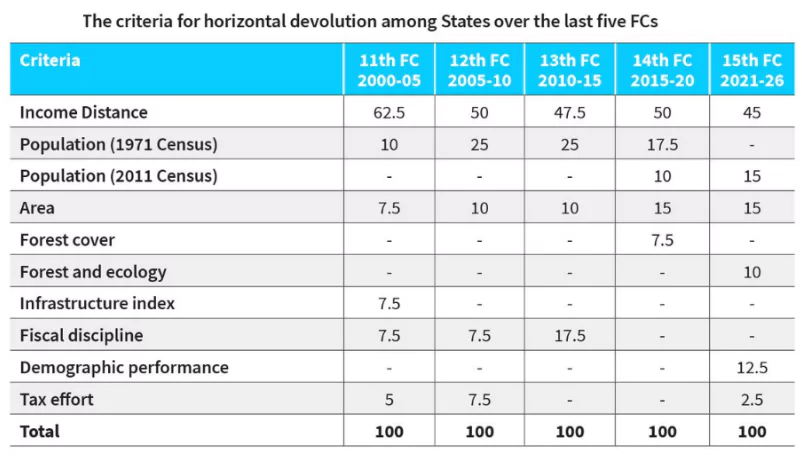

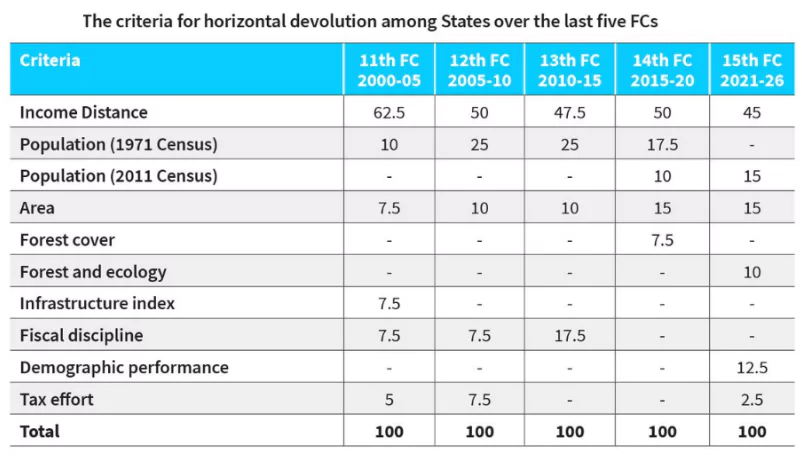

Horizontal Devolution: This devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc.

Horizontal Devolution: This devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc. - Additional Aid: The Centre may also aid States through additional grants for certain schemes that are jointly funded by the Centre and the States.

- For Local Bodies: The 16th Financial Commission is also expected to recommend ways to augment the revenues of local bodies such as panchayats and municipalities.

- As of 2015, only about 3% of public spending in India happened at the local body level, as compared to other countries such as China where over half of public spending happened at the level of the local bodies.

- Ways to Raise Revenue: For any government, there are only two ways to raise its revenue: tax or borrowing.

- If, in a period, the tax revenue equals the current expenditure of the government, then the current taxpayers pay for the public services they receive.

- If the government finances the current expenditure through borrowings, it means the future generation is going to pay higher taxes to repay this borrowing and interest.

Check Out UPSC CSE Books From PW Store

About Intergenerational Fiscal Equity

In general, intergenerational equity is the principle of providing equal opportunities and outcomes to every generation.

- Refers: From a public finance point of view, it refers to a situation where every generation pays for the public services it receives and ensures that the decisions or actions of current generations should not burden the future generation.

- Factors of Creation: Borrowing to meet the current expenditure of the government amounts to intergenerational inequity.

- As per Ricardian Equivalence Theory, whenever the government resorts to borrowing to finance current expenditure, households react through higher savings and thus enable the future generation to pay higher taxes as well as keep aggregate demand in the economy constant over different periods.

- This theory assumes that the current generation pays tax less than the value of the current public services it receives, and thus saves. Whereas in the present federal situation this is not the case.

- States on Paying Taxes: Households in developed States pay taxes that are not entirely used within the specific States, thus compelling such States to borrow more or curtail current expenditure.

- Households in developing States pay taxes much less than the value of current expenditure and fill the gap by receiving higher financial transfers from the Union government.

About Intragenerational Equity

It focuses on fair distribution of resources among different states within the same generation.

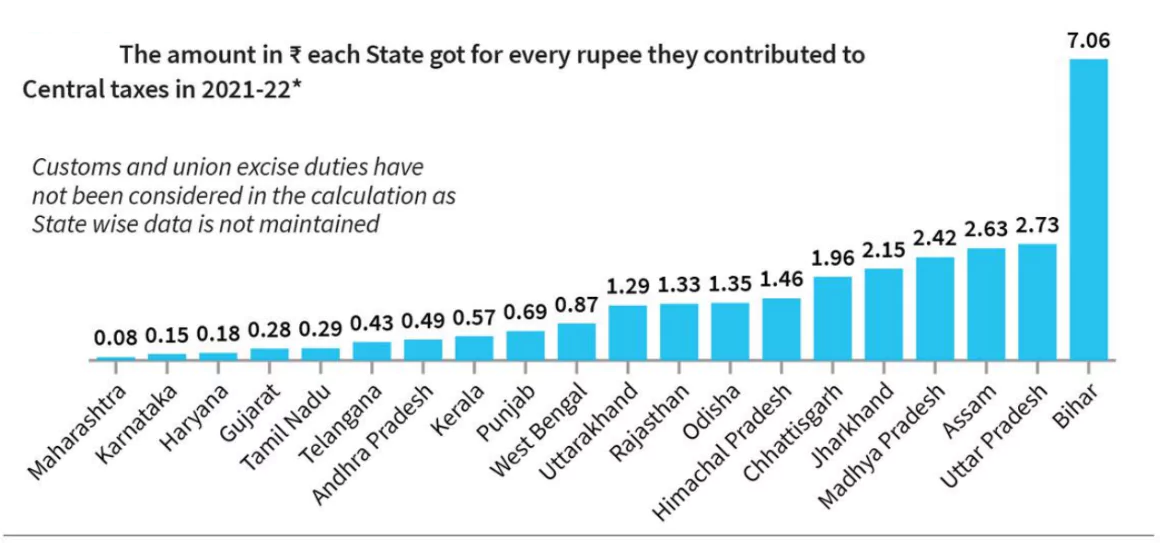

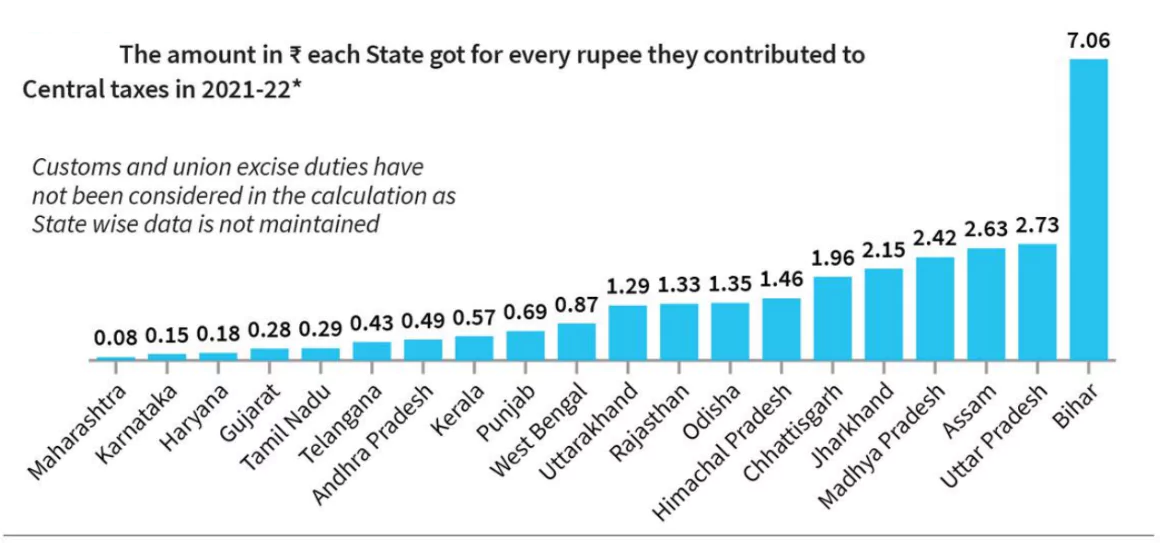

- High-income states, such as Maharashtra and Tamil Nadu, generate substantial tax revenue but receive fewer Union transfers, unlike states like Uttar Pradesh and Bihar, which rely more on Union money.

- Example: During the 14th FC period (2015-20), own tax revenue financed up to 59.3% of revenue expenditure in high-income States, while in low-income States, their own tax revenue was financing only 35.9%.

- The Revenue Expenditure to GSDP ratio for high-income States was 10.9%, which is lower than the similar ratio of 18.3% for low-income States.

- Thus, nearly 57.7% of revenue expenditure in low-income States was financed by Union financial transfers, and only 27.6% of revenue expenditure was financed by Union financial transfers in high-income States.

Arising Concerns with Current Federal Finances

There are following challenges associated with present federal finances in India:

- Borrowing Burden: Current fiscal policies, like funding government expenses through borrowing, potentially burden future generations with higher taxes.

- Disproportionate borrowing by States to meet their expenditures, leading to potential breaches of Fiscal Responsibility Acts.

- Fiscal Imbalance: The high-income States raise higher amounts of their own tax revenue and curtail their own revenue expenditure, yet incur higher deficits because of lower Union financial transfers compared to low-income States.

- Low-income States: They finance a smaller portion of their revenue expenditure with their own tax revenue and also receive larger amounts of Union financial transfers.

- High-income States: They finance a substantial portion of their revenue expenditure with their own tax revenue but receive too little Union financial transfers.

- On Deficit: The high-income States had to incur a deficit of 13.1%, and the low-income States ended up with a deficit of only 6.4% of revenue expenditure.

- Priority of Equity over Efficiency: Current distribution formulas prioritise equity such as population, area, etc., over efficiency such as tax effort, fiscal discipline, etc.

- Inappropriate Devolution: According to the Reserve Bank of India’s (RBI) of State Finances: A Study of Budgets of 2023-24 report, due to increase in cesses and surcharges, the divisible pool has shrunk from 88.6% of gross tax revenue in 2011-12 to 78.9% in 2021-22 despite the 10-percentage point increase in tax devolution recommended by the 15th finance panel.

- Issues with GST: Goods and Services Tax (GST) subsumes the majority of the indirect taxes viz. excise, services tax, sales tax, octroi etc., and the GST Council decides the central and state GST rates.

- However, states have lost the autonomy to decide the tax rates of subjects that fall within the State List and the inability of states to fix tax rates to match their development requirements implies greater dependence on the centre for funds.

- Issues in Finances of the Third Tier of Government: The persistent failure to place the third tier properly on the fiscal federal map of India is a serious issue.

- For example, the 73rd and 74th Constitutional Amendments introduced the XI and XII Schedule, which, respectively, list out the subject matter for the Panchayati Raj Institutions and Municipalities by simply lifting items from the State list and Concurrent list lack operational meaning.

- Limits State’s Borrowings: The Net Borrowing Ceiling (NBC) limits the borrowings of States from all sources including open market borrowings.

- For example, Kerala has moved the Supreme Court contending that the Centre’s imposition of a NBC on the State, violates Article 293 (borrowing by states) of the Constitution.

- Determining State Finances: According to Article 293 of the Constitution, the State has to obtain the consent of the Centre to raise any loan, if any part of the previous loan extended by the Centre is outstanding.

- Parliament does not have the power to legislate upon the ‘Public Debt of the State’ as this finds place in the State List of the Constitution.

Enroll now for UPSC Online Classes

Way Forward

To combat the arising challenges, following measures need to be considered:

- Weighted Indicators: Variables such as tax effort and fiscal discipline carry smaller weight in the distribution formula to reward the fiscal efficiency of States. It would encourage states to improve fiscal management and revenue collection, and hence would help in ensuring more sustainable finances.

- Inclusion of More Fiscal Variables: It would be appropriate to include more fiscal variables in the tax devolution criterion such that the Union financial transfers change the fiscal behaviour of the States in the desired direction.

- Incentivise Fiscal Responsibility: The FC should assign a larger weight to fiscal indicators and incentivise tax effort and expenditure efficiency through larger Union financial transfers. This will automatically ensure intergenerational fiscal equity and sustainable debt management by States.

- Provide Support for High-Income States: States like Maharashtra, which financed 59.3% of their expenditure through their own revenues, should receive fairer Union transfers to acknowledge their contribution and prevent fiscal imbalances.

- Policy Reforms: There is a need to implement such fiscal policies that prevent excessive borrowing and ensure intergenerational equity.

- Example: Enforcing Fiscal Responsibility Acts strictly and adjusting policies to avoid future generations being burdened by current fiscal decisions.

Conclusion

Balancing both intragenerational and intergenerational equity is important, and it reiterates the need to balance equity and efficiency in the distribution formula for tax devolution to States. This squarely falls under the purview of the FC to have a fair mechanism to address the conflicting equity issues.

![]() 20 Jul 2024

20 Jul 2024

Horizontal Devolution: This devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc.

Horizontal Devolution: This devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc.