Context

The NPCI has given permission to One97 Communications Limited (OCL), which owns Paytm, to work as a Third Party Application Provider (TPAP) under the multi-bank model for Unified Payments Interface (UPI) services.

Paytm Receives Third Party Application Provider Licence From NPCI

- Under this new model, Paytm has partnered with four banks – Axis Bank, HDFC Bank, State Bank of India, and YES Bank.

- These banks will act as Payment System Providers (PSP) to enable Paytm’s payment service.

What is TPAP (Third Party Application Provider)?

- Third Party Application Provider (TPAP) offer UPI-compatible apps for payments.

- These apps can be mobile wallets, merchant apps, or any platform using UPI.

- TPAPs use NPCI’s UPI infrastructure and work with PSPs and banks for transactions.

- TPAPs must ensure their apps meet NPCI’s security standards and compliance guidelines.

|

Significance of the NPCI granting approval to Paytm as a Third Party Application Provider (TPAP) for UPI services

-

Continuity of UPI Services:

-

Operational Transition:

- Transitioning to the TPAP model: As PPBL faces regulatory action, Paytm is transitioning to the TPAP model.

- Collaboration with banks; Paytm will collaborate with multiple banks, including Axis Bank, HDFC Bank, State Bank of India, and Yes Bank, as Payment System Providers (PSPs).

- These banks will facilitate UPI transactions, ensuring a smooth operational shift for Paytm.

-

Market Competition:

- Increased market Competition: Paytm’s approval as a TPAP intensifies competition in the digital payment space.

- This move encourages innovation, better services, and competitive offerings, ultimately benefiting consumers.

-

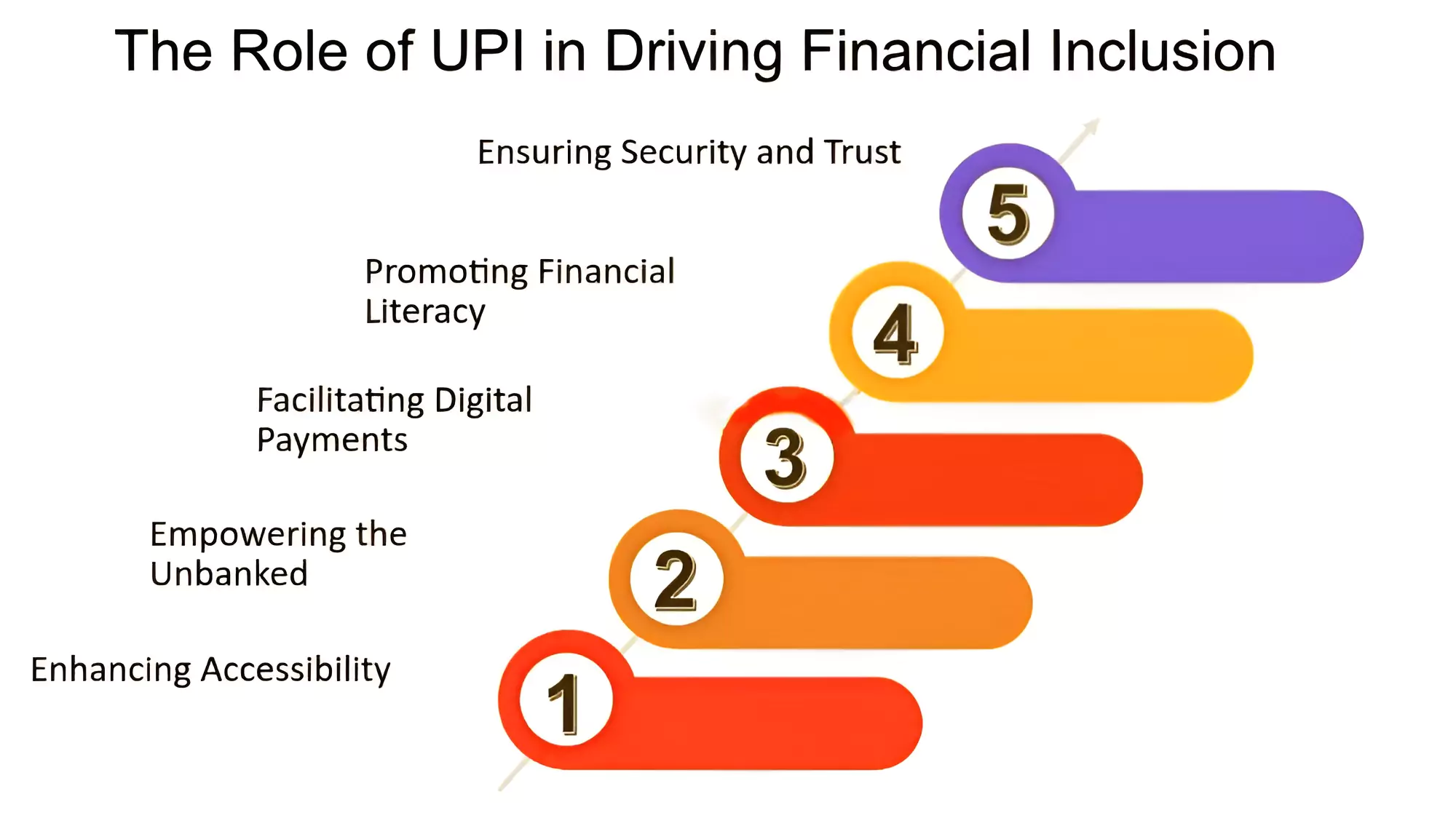

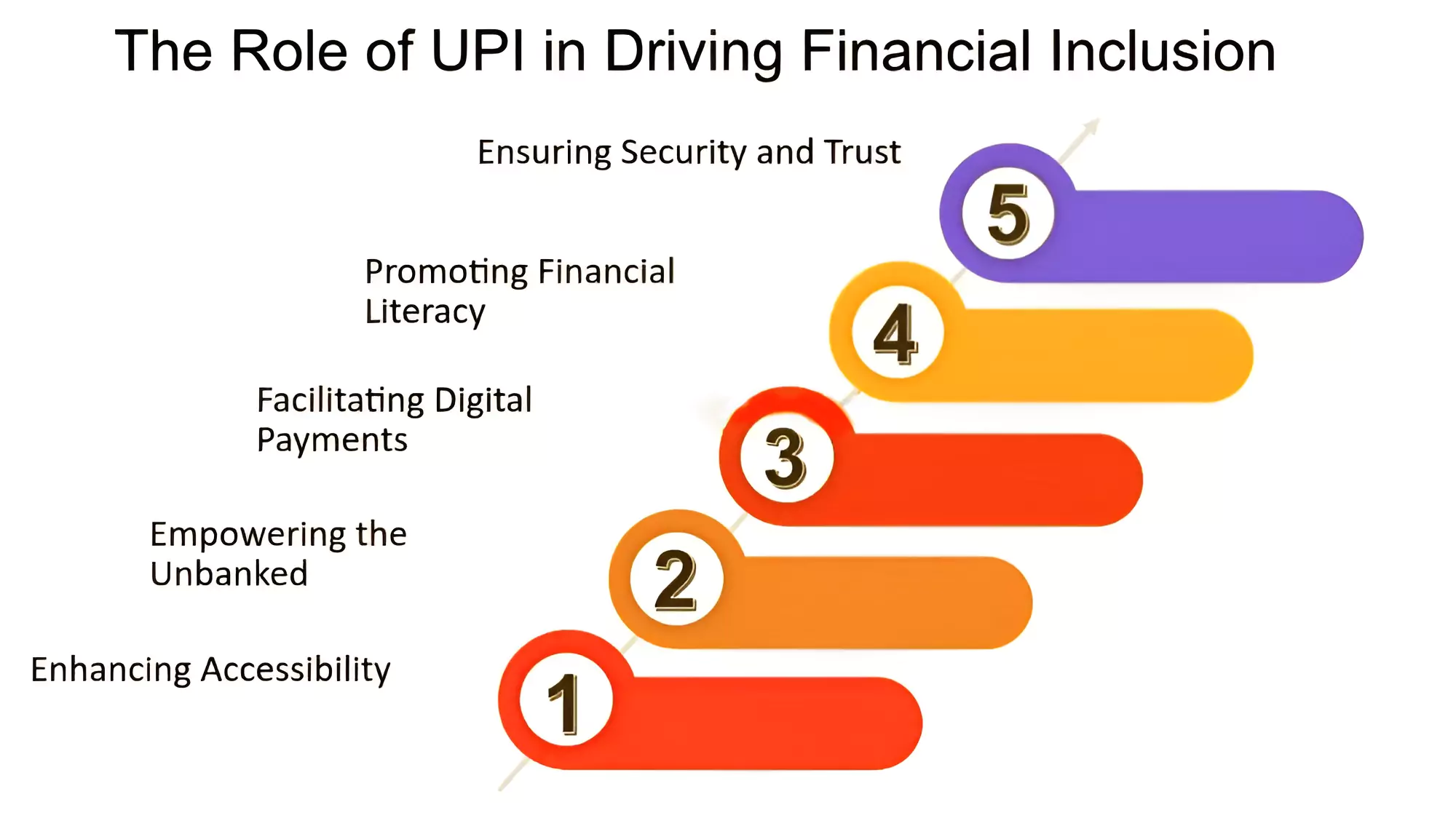

Digital Inclusion:

- UPI services are crucial for financial inclusion, especially in rural and underserved areas.

- Wider access to digital payments: NPCI’s decision to allow Paytm to operate as a TPAP promotes wider access to digital payments, contributing to digital inclusion efforts.

-

Economic Growth:

- A strong UPI ecosystem contributes significantly to India’s economic growth.

- Facilitates transitions: It makes transactions easier, encourages businesses to grow, and creates more opportunities for people to start their own businesses.

What is Role of Payment System Providers (PSPs) in the UPI Ecosystem?

Payment System Providers (PSPs) play a very important role in the Unified Payments Interface (UPI) ecosystem.

-

Intermediaries Between Stakeholders:

- PSPs role as middlemen: Payment Service Providers (PSPs) act as middlemen between customers, banks, and other service providers in the UPI system.

- They facilitate smooth and secure payment processing by establishing connections among the various entities involved in transactions.

-

Integration with Payment Gateway:

- Reliable payment gateway: PSPs set up a safe and reliable payment gateway that links the UPI platform with banks.

- This setup ensures that money moves securely from the payer’s bank account to the recipient’s bank account.

-

Enabling Transactions:

- Smooth UPI transactions: PSPs enable users to start and complete UPI transactions.

- They provide the necessary tools for users to send money, pay bills, and make purchases using UPI.

-

Security and Fraud Prevention:

- Strong security measures: PSPs use strong security measures to protect against fraud.

- They keep transactions safe, verify identities, and maintain the trustworthiness of the payment system.

Role of Multi-Bank Model in Enhancing the Efficiency and Accessibility of UPI Services

-

Broader the Accessibility of UPI services:

- Multiple Bank Model: Fintech companies like Paytm have joined hands with multiple banks under the multi-bank model, where these banks act as Payment System Providers (PSPs).

- This collaboration can broaden the accessibility of UPI services since various banks are part of the system.

-

Redundancy and Reliability:

- Shift of transactions: Involving multiple banks ensures redundancy, meaning if one bank faces technical glitches or downtime, transactions seamlessly shift to another bank.

- Therefore, Users can rely on uninterrupted services, even during peak times or unexpected disruptions.

-

Reduced Latency:

- Efficient Distribution of workload: When multiple banks handle UPI transactions, the system efficiently distributes the workload, resulting in reduced latency.

- This leads to quicker transaction processing, enhancing the overall user experience.

Also Read: Cyber Frauds And Crimes In India

News Source: Moneycontrol.com

![]() 15 Mar 2024

15 Mar 2024