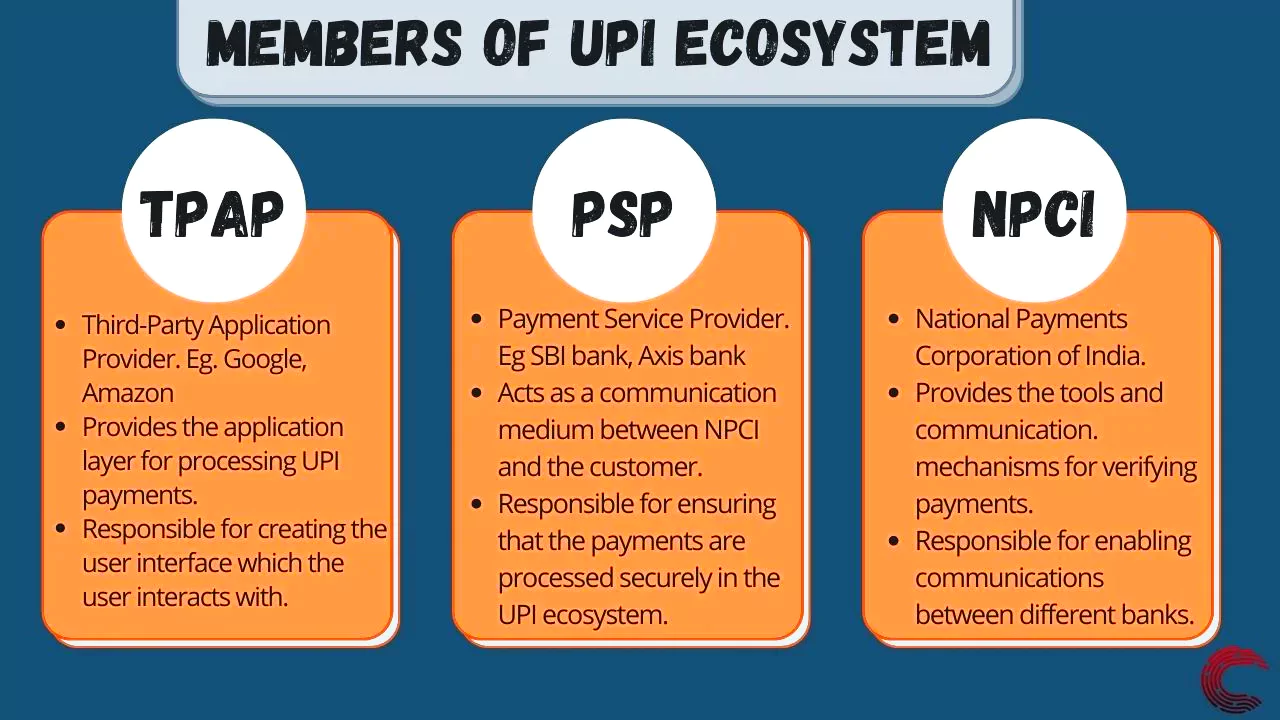

The Reserve Bank of India (RBI) has asked the National Payment Council of India (NPCI) to become a Third-Party Application Provider (TPAP) for continued Unified Payments Interface (UPI) operation of the Paytm application.

Existing Paytm UPI transactions were routed through PPBL which will be ceased now.

Existing Paytm UPI transactions were routed through PPBL which will be ceased now.

The new banks must have the capability to process high-volume UPI transactions.

The new banks must have the capability to process high-volume UPI transactions.News Source: Indianexpress

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

To get PDF version, Please click on "Print PDF" button.

SC Verdict on Newsclick Shows Adherence to Due Pro...

Stay Invested: On Chabahar and India-Iran Relation...

Credit Rating Agencies, Impact on India’s De...

Catapulting Indian Biopharma Industry

Globalisation Under Threat, US Import Tariffs Have...

Global Report on Hypertension, Global Insights and...

<div class="new-fform">

</div>