Context:

- The Government recently granted approval to 27 companies, including Dell, HP, and Foxconn, under the new PLI scheme for IT hardware.

PLI Scheme for IT Hardware – Key Highlights

- Scheme coverage: The PLI scheme covers laptops, tablets, all-in-one PCs, Servers, and Ultra Small Form Factor devices.

- Manufacturing Companies: Companies including Dell, HP, Acer, Asus, Lenovo, Benq, ViewSonic, and Foxconn will now manufacture components in India under the PLI scheme.

- Employment potential: The PLI scheme creates around 200,000 jobs. This comprises 50,000 direct employment opportunities and 150,000 indirect employment opportunities.

- Boosting IT hardware production: The IT hardware manufacturing sector in India is expected to grow from $15.52 billion in 2022 to $22.77 billion in 2027.

Ultra Small Form Factor devices:

- They are tiny versions of their traditional desktop counterparts.

- Small form factor (SFF) is an umbrella term for technologies designed to be smaller versions of similar devices within a respective field.

- Though SFF are much tinier devices than standard-sized ones, they don’t sacrifice any of the performance quality or functionality.

|

What is the PLI Scheme?

- Objective: To attract investments in key sectors and cutting-edge technology; ensure efficiency and bring economies of size and scale in the manufacturing sector and make Indian companies and manufacturers globally competitive.

- Reliance on import substitution: It also aims to generate more employment and cut down the country’s reliance on imports from other countries.

- Incentives for production: The PLI scheme aims to give companies incentives on incremental sales from products manufactured in domestic units.

- The PLI scheme provides a subsidy of 4% to 6% on the value of the additional production the firms generate.

- PLI incentives are based on incremental sales of products manufactured domestically and are disbursed over a specified period.

- Incentives are not guaranteed and are released based on annual performance and meeting stipulated criteria in the respective PLI Scheme Guidelines.

Which sectors are targeted under the PLI Scheme?

- Mobile Manufacturing and Specified Electronic Components

- Critical Key Starting Materials/Drug Intermediaries & Active Pharmaceutical Ingredients

- Manufacturing of Medical Devices

- Automobiles and Auto Components

- Pharmaceuticals Drugs

- Specialty Steel

- Telecom & Networking Products

- Electronic/Technology Products

- White Goods (ACs and LEDs)

- Food Products

- Textile Products: MMF segment and technical textiles

- High efficiency solar PV modules

- Advanced Chemistry Cell (ACC) Battery

- Drones and Drone Components.

|

What is the need for the PLI Scheme?

- Structural challenge of Indian Economy: India has faced challenges in increasing the share of the secondary sector, including manufacturing, in its GDP.

- Limited growth: Despite the introduction of pro-business reforms under the New Economic Policies in 1991, the growth has been limited. The manufacturing sector has remained at around 17% of the GDP.

Success of PLI Scheme

- Increase in FDI: There has been an increase of 76% in Foreign Direct Investment (FDI) in the manufacturing sector in FY2022 ($21.34 bills compared to the previous FY2021 ($12.09 billion).

- PLI Sectors that have seen an increase in FDI inflows in the last year are Drugs and Pharmaceuticals (+46 per cent), Food Processing Industries (+26 per cent) and Medical Appliances (+91 per cent).

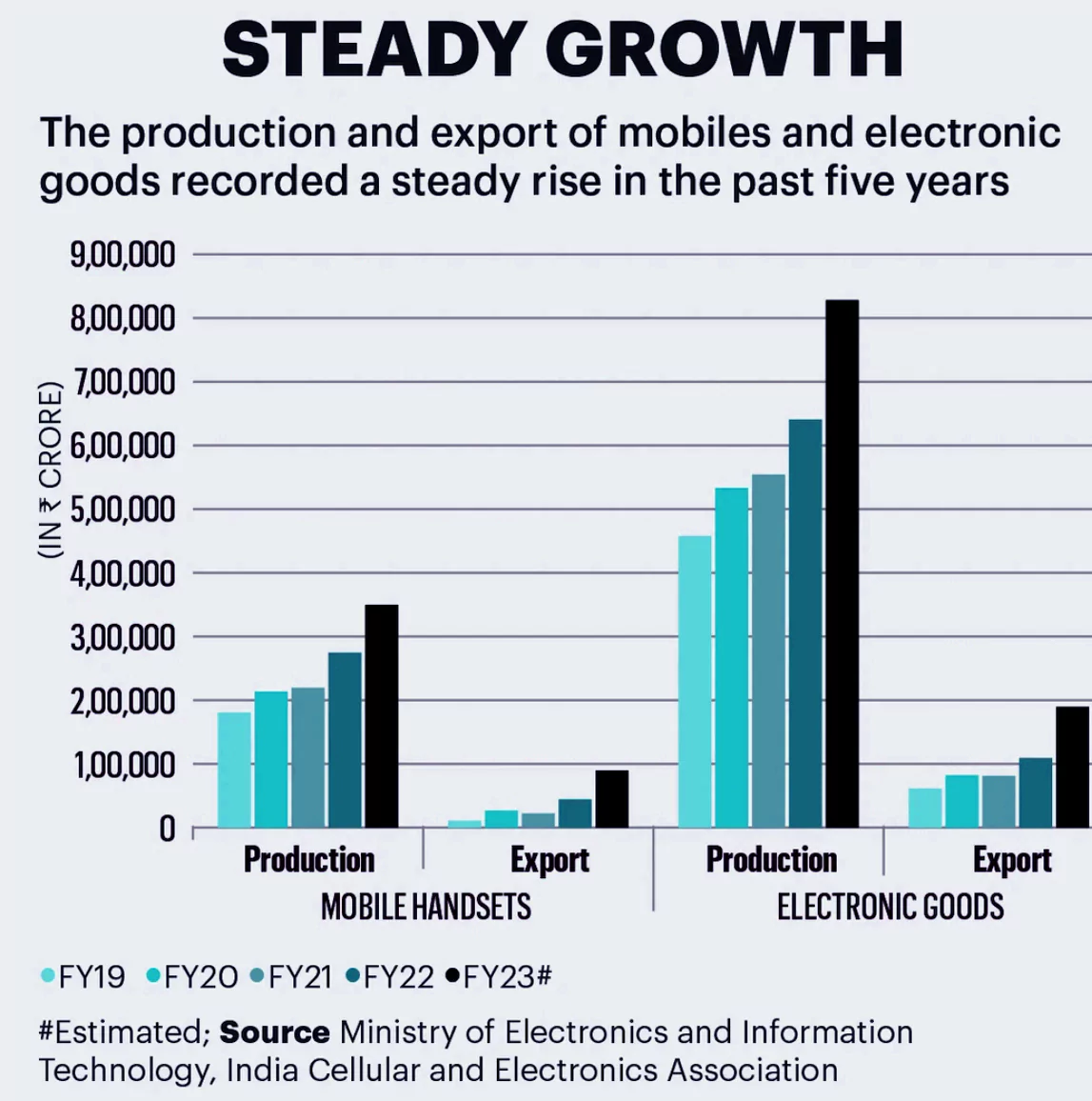

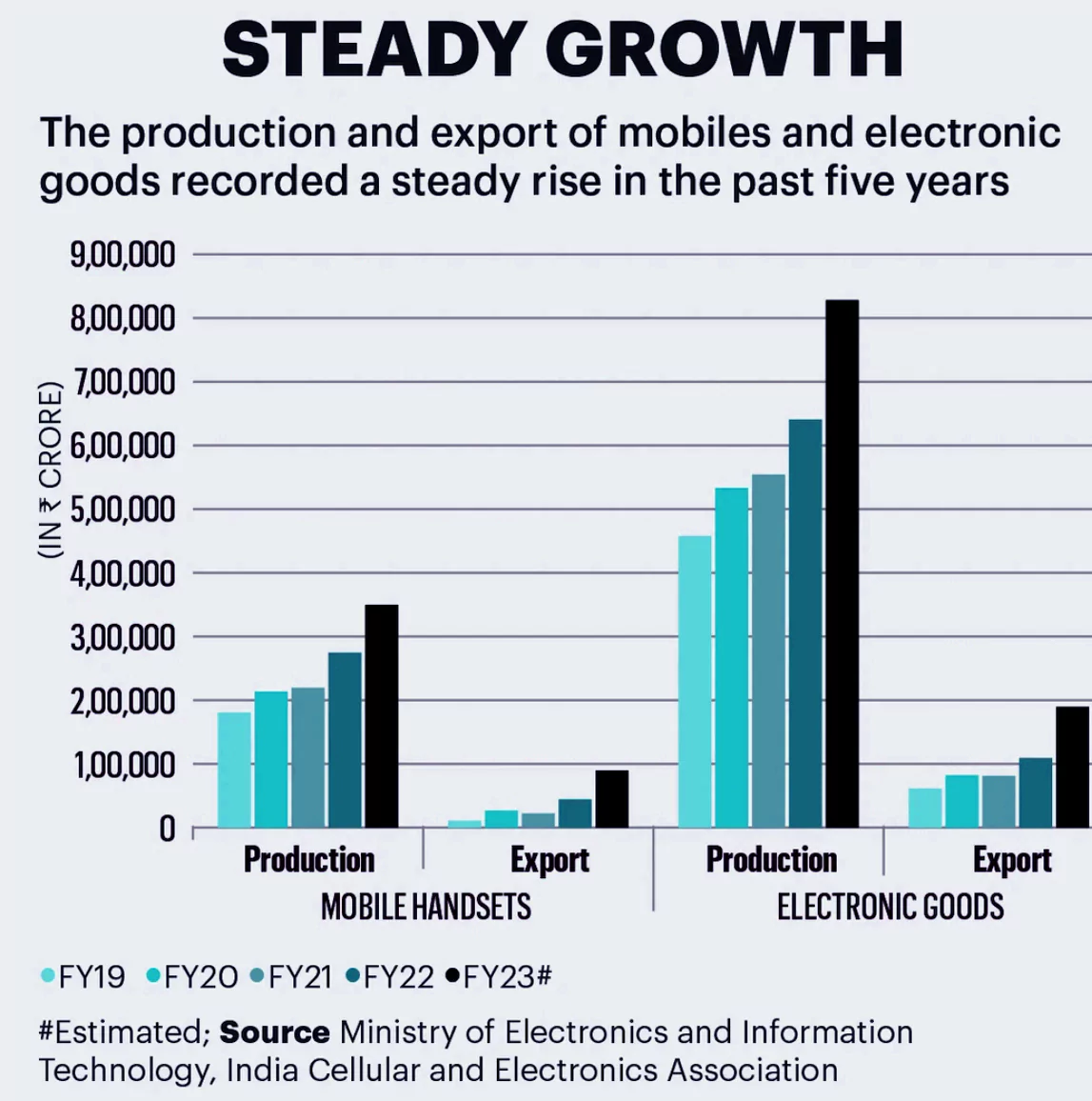

- Smartphones: India started at the bottom of the value chain with the assembly of smartphones, and has expanded its presence to manufacturing of casing and sub-components of a smartphone.

- This increased presence has led India’s value addition in manufacturing of smartphones to grow from just 2% in 2015 to about 15% in 2022.

- Localised manufacturing: The PLI Scheme is increasing the localisation of manufacturing, with major smartphone companies shifting their bases to India.

- As per a recent report by Bank of America, the PLI scheme may drive Apple to shift at least 18% of its global iPhone production to India by FY2025.

- Currently, India contributes 7% to Apple’s total smartphone production.

- Import substitution in telecom sector: It has been able to achieve import substitution of 60 per cent with increased self-reliance in Antennae, GPON (Gigabit Passive Optical Network) & CPE (Customer Premises Equipment).

- Drones manufacturing: It has seen significant momentum post PLI, particularly in the growing number of promising start-ups in drone manufacturing.

- For example, there are 333 drone startups in India, according to a 16 June note by Tracxn. These include Garuda Aerospace, General Aeronautics, Tata Advanced Systems, Adani Defence & Aerospace, Skylark Drones, and Skye Air Mobility.

- Electronics manufacturing services (EMS): Dixon Technologies, the country’s largest home-grown EMS player, has committed a cumulative production value of Rs 48,000 crore in six years.

What challenges are associated with the PLI scheme?

- Subsidy for finishing rather than value addition: Under the PLI scheme, the subsidy is paid only for finishing the product in India, not on how much value is added by manufacturing in India.

- Due to this, despite assembly work shifting to India, the import of components still persists, raising uncertainty about the scheme’s impact on shifting the value chain to the country.

- For Example; If an Indian firm produces for a large Chinese company, it is likely to import most of the components from China and assemble them here.

- It is thus plausible that even if some assembly work shifts to India, the level of imports in the category would not come down significantly.

- Lack of clarity b

- Complex nature of application: Since the start of the PLI scheme, only Rs 2,900 crore of incentives have been disbursed. Outlay for incentives has been kept at `1.97 trillion.

- The slow offtake is due to the complicated nature of filing an application where the investor has to fulfill many criteria to qualify for inclusion under the PLI scheme and claim incentives.

- Lack of defined criteria for fund disbursal: The Empowered Committee has been established to oversee the implementation of the PLI scheme as well as disbursing funds in each sector.

- However, the method for granting these incentives lacks clarity.

- There are no standardized parameters for ministries and departments to consider when awarding these incentives.

- Lack of centralised database: The absence of a database that records information such as production growth, export figures, and the creation of new jobs complicates the evaluation process creating an administrative challenge.

- Poor Employment generation: According to former CEO of NITI Aayog, against the projected 6 million new jobs over seven years, only 300,000 jobs (or 5 per cent of the total) have been created between 2020 and early-2023 through the various PLI schemes.

- Biases towards large firms: Most of the industries under the PLI scheme are either large or medium-sized units. The scheme’s focus on providing subsidies to selected large and medium-scale industries is a sub-optimal policy.

- This is not representative of the actual configuration of the Indian industrial structure, which is largely composed of Micro, Small & Medium Enterprises (MSMEs).

- These MSMEs not only contribute to a bulk of the manufacturing output and exports but generate much of the employment in the manufacturing sector.

- One size fits all approach: The PLI scheme lacks sector-specific considerations neglecting the diverse needs and complexities of industries, and thus, inadequately addressing the inefficiencies and limitations of different industries.

- For example, the pharmaceutical sector requires more resources for Research and Development (R&D), and innovation infrastructure to sustain manufacturing at the optimum level.

- The PLI scheme for textiles rightly acknowledges the importance of boosting the production of man-made fibers (MMF) and technical textiles.

- However, it does not cover fabrics which are in a highly imported category and also excludes from its scope synthetic fabrics such as viscose, polyester, and nylon, which are major inputs for apparel.

- Overlooking global dynamics: The efficacy of production subsidies to galvanize sector-specific manufacturing depends on a combination of factors. Ex- Steady stock of raw materials available at competitive prices, size of the domestic market, and relationship between upstream and downstream manufacturers, among others.

- PLI scheme extension to the container manufacturing industry neglected the prevailing dynamics in India and that of the global container manufacturing business.

- Around 80 per cent of the total cost of production of these containers is composed of a single raw material called Corten steel the price of which is ₹120-130 per kg in India, as compared to ₹80-90 in China.

- The high cost of primary input makes the sector uncompetitive, limiting its ability to compete in the global market.

Way Forward

- Value addition as a condition for incentives: Incentivising local production of components and not the final product is needed for the effectiveness of the PLI scheme.

- In order to shift actual manufacturing to India, the condition of value-addition needs to be added to be eligible for incentives under the PLI scheme.

- Diversification of Sectors: Expanding the scope of the PLI scheme to encompass more industries, including sunrise sectors and technology-driven fields, can further boost domestic manufacturing and innovation.

- Diversion of funds to new sectors: Recently the government is planning to add six new sectors in the PLI scheme including toys, bicycles, leather, and footwear. These sectors will also share the 180-billion-rupee allocation that is taken out from the scheme’s original outlay.

- Removing Investment criteria: The companies argue that the investment criteria have acted as a barrier to entry into the PLI scheme.

- Global IT hardware firms have requested that the government remove the minimum investment requirement for eligibility to receive incentives and linking the incentives to production from existing manufacturing facilities.

- Framework for assessment: The government should formulate a framework to assess the effectiveness of these PLI schemes.

- Reviewing the performance of the PLI schemes can be an effective way as it will allow the government to measure the intended and actual objectives.

- The government can evaluate if there is an increase in domestic manufacturing, foreign investment, number of jobs and identify the sectors that need any improvements.

- Monitoring and Evaluation: Continuous monitoring and evaluation of the scheme’s impact on job creation, export promotion, and manufacturing growth are crucial. This data can be used to make necessary adjustments and improvements.

- Periodic reviews can help ministries make necessary policy changes/adjustments based on the changing market dynamics, trends, and global competitiveness.

- Public access will help stakeholders, investors, and experts to understand the criteria, application/evaluation process, and outcomes of these PLI schemes, which can help gain confidence in the initiatives and increase participation.

- Infrastructure Development: To support the manufacturing sectors, the government should invest in infrastructure development, including transportation, logistics, and energy supply.

-

- Industrial labs for reverse engineering should be encouraged to reduce the dependence on imported machinery and enhance production quality.

- This initiative would allow India to replicate advanced machinery used in textiles, mining, metalwork, and agriculture sectors.

- Skill Development: This will ensure a trained and adaptable workforce that can meet the needs of modern manufacturing.

Conclusion:

The PLI scheme has boosted sectors like IT hardware and smartphones, but challenges like limited focus on value addition and complexity in implementation need attention for sustained success in India’s manufacturing growth.

![]() 21 Nov 2023

21 Nov 2023