Context: Governance of Urban Cooperative Banks, Recently, the Reserve Bank of India (RBI) took over the board of Mumbai-based Abhyudaya Cooperative Bank Ltd for a year due to poor governance standards.

| Relevancy for Prelims: Cooperative Banks in India.

Relevancy for Mains: Challenges of Urban Cooperative Banks and Way Forward. |

What are Cooperative Banks?

- Financial Institutions: Owned and controlled by their members, who are also its customers.

- Establishment: To deal with the ordinary banking business.

- Cooperative banks are founded by collecting funds through shares, accepting deposits, and granting loans.

- Registration: Under the Cooperative Societies Act of the State concerned or the Multi-State Cooperative Societies Act, of 2002.

- Governing Provisions: Banking Regulations Act, 1949 and Banking Laws (Co-operative Societies) Act, 1955.

- Profit Sharing: The profits are distributed among the members in the form of dividends.

- Providing Services: They offer a range of banking and financial services to their members, including savings accounts, loans, and insurance.

- Focus On: Serving their local communities’ needs and promoting economic development.

- Guiding Values: Democracy, equality, and solidarity and aim to operate ethically and sustainably.

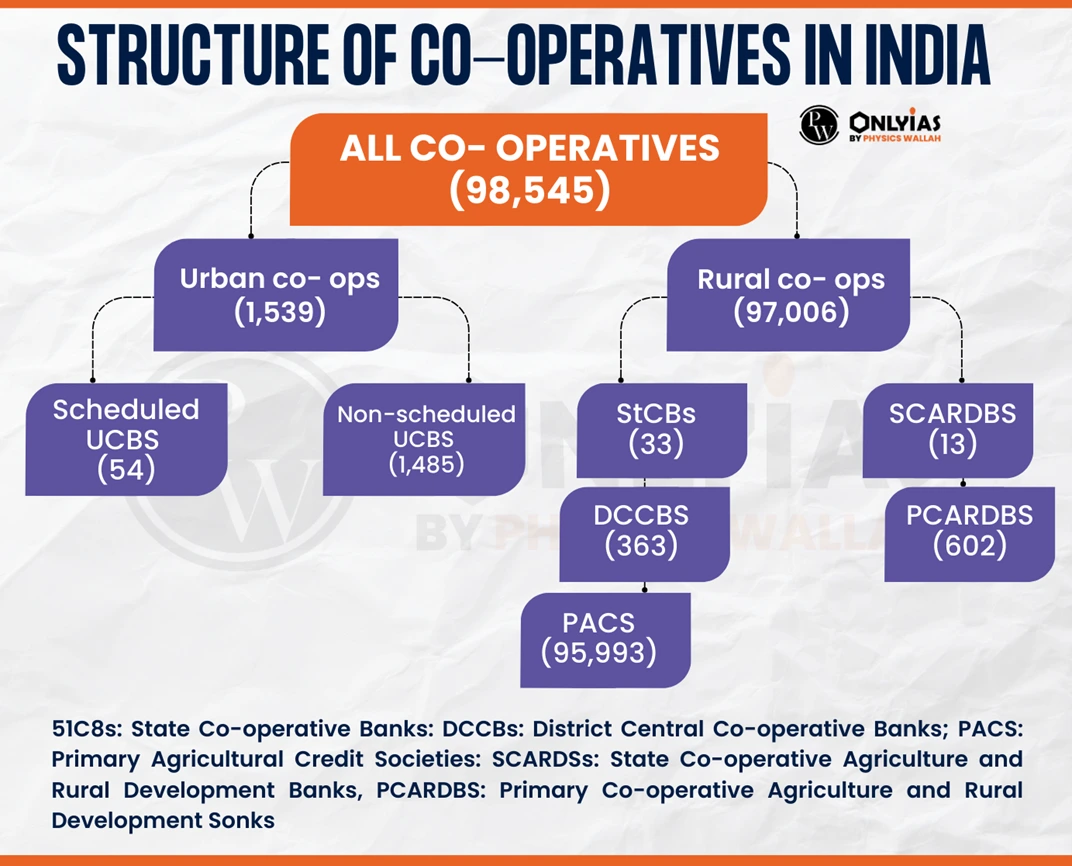

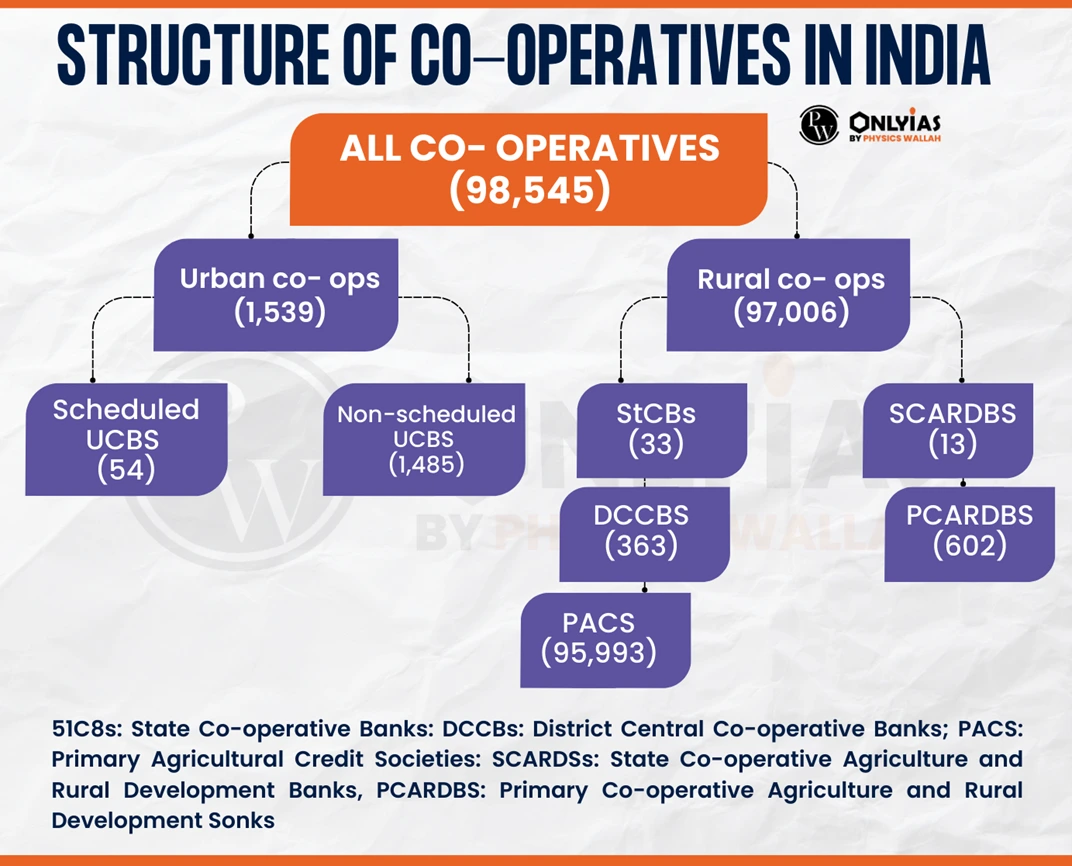

- Classification: They are broadly divided into Urban and Rural Cooperative Banks.

Also Read: Banking Sector of India

What are Urban Cooperative Banks?

- Availability: These are organized and operated cooperatively in urban and semi-urban areas. Currently, there are 1,514 Urban Cooperative Banks in India.

- Division on the basis of Tiers: N S Vishwanathan Committee (2021) suggested a 4-tier structure.

- Tier 1 with deposits up to Rs 100 crore,

- Tier 2 deposits between Rs 100 crore and Rs 1,000 crore,

- Tier 3 with deposits between Rs 1,000 crore and Rs 10,000 crore, and

- Tier 4 with deposits more than Rs 10,000 crore.

- Significance of Urban Cooperative Banks:

- Credit to Agriculture Contribution: Contributing 11% of the total credit to the sector.

- Prevalency: As of March 31, 2020, an estimated 94% of entities in the banking sector were Urban Cooperative Banks, showcasing their prevalence.

What are the issues with Urban Cooperative Banks?

- Weak Governance led to financial mismanagement and fraud in some cases.

- Lack of Professional Management and may not have the skills to manage the bank effectively.

- Lack of Compliance with Regulatory Norms

- Limited access to Capital to expand and modernize their operations. Due to their structure, they cannot raise capital from any other except their members.

- Competition from Other Banks that have better access to resources like private banks.

- Lack of Clarity over the oversight mechanism between the RBI and the state government.

- High Non-Performing Assets (NPA) Ratio.

Also Read: NPA in India

Way Forward:

- Strengthening Governance and ensuring trained and professional management teams.

- Need for strengthened and efficient Credit Risk Management.

- Enhancing compliance with regulations such as capital adequacy, asset classification, etc.

- Exploration of ways for improving access to capital.

- Establishment of IT and Cybersecurity Infrastructure.

- Collaborating with other banks to leverage resources and expertise and expand their reach.

- Need to work on the Recommendations of RBI for Cooperative Banks, such as:

- Governance Focus: Emphasizes that cooperative banks should prioritize the quality of governance, focusing on the three pillars of compliance, risk management, and internal audit.

- Risk Analysis Report: Urges Urban Cooperative Banks (UCBs) to submit a quarterly risk analysis report before the board to enhance transparency and risk management.

Conclusion:

To thrive, Urban Cooperative Banks in India need better management, careful risk handling, and more ways to get money, focusing on growth and stability.

| Prelims Question (2021)

With reference to ‘Urban Cooperative banks’ in India consider the following statements:

1. They are supervised and regulated by local boards set up by the State Governments.

2. They can issue equity shares and preference shares.

3. They were brought under the purview of the Banking Regulation Act, 1949 through an Amendment in 1966.

Which of the statements given above is/are correct?

(a) 1 only

(b) 2 and 3 only

(c) 1 and 3 only

(d) 1, 2 and 3

Ans: (b) |

![]() 27 Nov 2023

27 Nov 2023