Understanding inflation in India with a clear breakdown of its key causes, economic impact on households and businesses, and practical policy solutions aimed at ensuring price stability and sustainable growth.

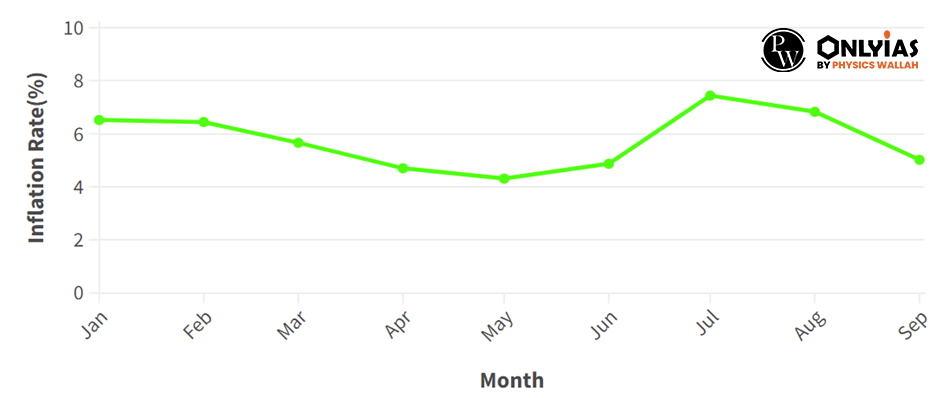

Understanding Inflation in India: Inflation in India, measured by the Consumer Price Index (CPI), has remained subdued at around 0.71% in November 2025, driven by falling food prices amid favorable monsoons and supply chain stability. Persistent pressures from volatile oil imports and wage growth challenge the Reserve Bank of India’s 4% target, influencing monetary policy and economic growth projected at 7.4% for FY26. Understanding its causes like demand-pull factors and supply shocks, alongside impacts on purchasing power and investments, is crucial for policymakers and citizens alike.

| Parameters | CPI | WPI |

| Base Year |

|

|

| Scope |

|

|

| Released by |

|

|

| Major components |

|

|

| Purpose |

|

|

| Uses |

|

|

| Relevance |

|

|

A moderate amount of inflation in India is generally considered to be a sign of a healthy economy because as the economy grows, demand for stuff increases. However persistent high inflation can have many negative consequences like the following:

| Must Read | |

| NCERT Notes For UPSC | UPSC Daily Current Affairs |

| UPSC Blogs | UPSC Daily Editorials |

| Daily Current Affairs Quiz | Daily Main Answer Writing |

| UPSC Mains Previous Year Papers | UPSC Test Series 2024 |

Urijit Panel Committee

Consumer Price Index

It attempts to remove the volatile, transitory movements from the CPI

They better encapsulate the demand side pressures in the economy; monetary policy cannot control food or fuel inflation in India.

<div class="new-fform">

</div>