Answer:

|

How to approach the question

- Introduction

- Write about the PPP investment model briefly

- Body

- Write how the PPP investment model has been a revolutionary step in making Indian ports globally competitive

- Write ways in which this strategy can be adapted and applied for progress in other infrastructure sectors.

- Conclusion

- Give appropriate conclusion in this regard

|

Introduction:

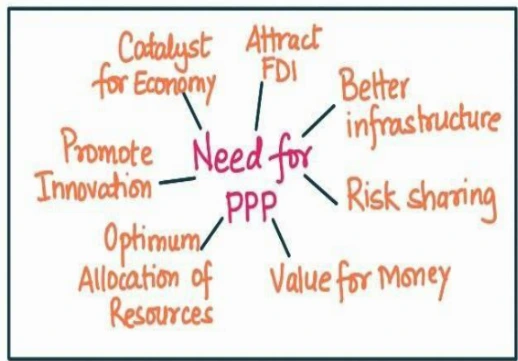

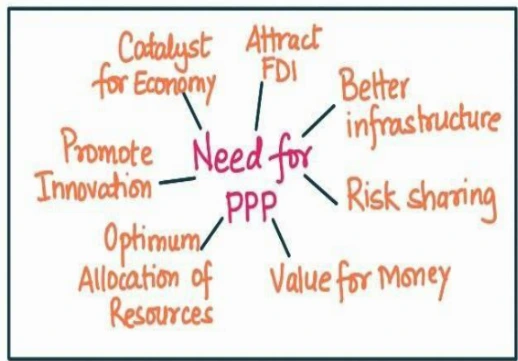

The Public-Private Partnership (PPP) model is a collaborative investment framework between government and private entities. The aim is to fund, build, and operate public infrastructure or services. This model combines public oversight with private sector efficiency, risk-sharing, and mobilization of private capital.

Body

PPP investment model has been a revolutionary step in making Indian ports globally competitive in the following ways

- Infrastructure Development: PPP has facilitated significant infrastructure development in ports. For example, the Mundra Port, developed by Adani Ports, has become India’s largest private port with state-of-the-art facilities, thanks to PPP.

- Improved Efficiency: PPP has brought private sector efficiency into port operations. For instance, Jawaharlal Nehru Port Trust (JNPT) saw operational efficiency increase after partnering with private players like DP World and APM Terminals.

- Technological Advancements: Private players have brought in advanced technologies for port operations. For instance, ICTT Vallarpadam, operated by DP World, is India’s first transshipment terminal and employs advanced container handling equipment.

- Capacity Augmentation: The capacity of Indian ports has increased significantly due to investments by private players. For example, the capacity of the Krishnapatnam Port has grown exponentially after its development under the PPP model.

- Job Creation: The growth and development of ports under PPP have led to job creation and regional development. Mundra port, for instance, has generated direct and indirect employment opportunities in the region.

- Port-led Industrialization: The PPP model has enabled port-led industrialization. For example, the Kandla Port has attracted various industries in its vicinity due to the improved facilities and connectivity, stimulating economic growth in the region.

- Enhanced Connectivity: Private players have also invested in enhancing port connectivity with hinterland through rail and road networks. For instance, Pipavav Port has a dedicated freight corridor connecting it with northern India, boosting the port’s competitiveness.

- Reduced Congestion and Turnaround Times: Improved infrastructure and management under the PPP model lead to reduced congestion and faster vessel turnaround times. This boosts the attractiveness of Indian ports, making them more competitive. As per LPI Report, 2023,World Bank, JNPA has improved its turnaround time (TAT) to just 22 hours from 3 days few years back.

Ways in which this strategy can be adapted and applied for progress in other infrastructure sectors like roadways, railways, or power generation

- Incentivizing Investment: Like in ports, PPP can attract private investments in roadways, railways, or power generation. The success of the Golden Quadrilateral highway project shows how private investment can expedite infrastructure development.

- Improving Efficiency: Private sector participation can improve operational efficiency, as seen in the operations of private trains by companies like IRCTC in the Indian Railways.

- Technological Advancements: Private players can bring in advanced technologies, similar to how Tata Power and Reliance Power have introduced cutting-edge technologies in power generation.

- Reduced Public Financial Burden: PPP can reduce the financial burden on the government, freeing up public funds for other uses, as seen in the power sector where private players now generate a significant portion of India’s electricity.

- Industrialization: PPP can stimulate industrialization by enhancing infrastructure, as seen in the case of Delhi-Mumbai Industrial Corridor, a PPP project aimed at developing industrial zones.

- Enhanced Connectivity: Private players can invest in enhancing connectivity, as seen in the case of the development of highway networks by private players like IRB Infrastructure.

- Promotion of Green Infrastructure: Private players can also play a key role in promoting green infrastructure, similar to the renewable energy projects developed by companies like ReNew Power under the PPP model.

Conclusion:

The PPP investment model is not without its challenges. However, the potential benefits of the PPP model are significant, and the government should continue to explore ways to use this model to finance infrastructure development in India.

To get PDF version, Please click on "Print PDF" button.

https://uploads.disquscdn.com/images/15c02f81ad6006bac27f7d3d5703d842d42e403ef520cc256d53951c4ea0cf47.jpg https://uploads.disquscdn.com/images/38e251cdced948a1c89e6b51c26ae00943aab5f11348ba1d30d1d18a0f1d6830.jpg https://uploads.disquscdn.com/images/d8daa7e7f84ce12a08e6ddccdd138149f107e11a4f77252ee6d82bdec7922a87.jpg