Answer:

|

How to approach the question

- Introduction:

- Write about the Panchayati Raj Institutions (PRI).

- Body

- Highlight the sources of their finance.

- Write about the issues with finances faced by PRI.

- Conclusion

- Conclude by highlighting ways to improve PRI finances.

|

Introduction

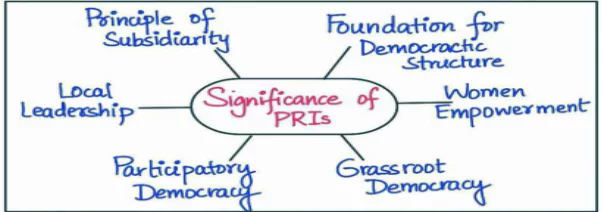

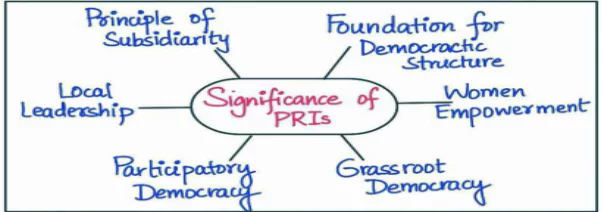

The enactment of the 73rd Amendment Act in 1992 translated the vision of Article 40 of the Indian constitution into a practical framework. Its purpose was to establish a third tier of governance at the grassroots level, empowering villages to operate as self-governing entities.

Sources of Finance available to Panchayats:

- Taxation Authority: The State Government can authorize Panchayats to levy, collect, and appropriate taxes from the local population, generating revenue for their functioning.

- Assignment of State Taxes and Duties: Panchayats can receive a share of taxes and duties collected by the State Government, contributing to their financial resources.

- Grants-in-Aid: State governments have the provision to provide financial assistance in the form of grants to Panchayats, supporting their developmental activities.

- Specific Funds for Panchayat Development: State governments can establish dedicated funds aimed at promoting the development and welfare of Panchayats.

- Recommendations of State Finance Commission: The State Finance Commission recommends measures for enhancing the financial resources of Panchayats, ensuring their financial viability and sustainability.

Issues with Finance faced by Panchayats:

- Insufficient Financial Resources: Panchayats lack adequate funds for their functions and community needs.

- Limited Revenue Generation: Panchayats have limited power to generate revenue, relying heavily on state funding.

- Lack of Financial Management Skills: Panchayats may lack the necessary expertise to explore alternative revenue sources and manage finances effectively.

- Neglect of State Finance Commission Recommendations: Recommendations for enhancing Panchayat finances are often ignored or poorly implemented.

- Delayed Action Taken Reports: Submission of financial reports is often delayed, affecting transparency and accountability.

- Lack of Transparent Devolution Norms: Unclear norms for fund devolution hinder financial autonomy and resource utilization.

As a result, Panchayats have access to diverse sources of financial support. However, the extent of their financial resources ultimately relies on the discretion of the State government.

Suggestions to improve the Finances of Panchayats

- It is necessary to broaden the revenue base of panchayats and to expand the tax domain.

- The share of royalty from minerals needs to be flown into the panchayat treasury.

- The untied funds should form a significant share in transfer of funds from the center. This gives some flexibility to the panchayats.

- The panchayats should be allowed to borrow from the banks and financial institutions.

For effective governance at the grass root level, political and fiscal decentralization should go hand in hand. Mere transfer of power with inadequate funds can cripple the functioning of panchayats.

To get PDF version, Please click on "Print PDF" button.

https://uploads.disquscdn.com/images/f84cf4bbb2701d724d24e880a0a30731dfb0388410dff6225d748b13aa6c405a.jpg https://uploads.disquscdn.com/images/0df1f7b18cf3905da9fabcd67358538d015cf5142724fecdae8359ca63e8bd58.jpg

https://uploads.disquscdn.com/images/0a026a41b087c4d2e2c8287db46c30806c2517196490e2a7aeb0a215c15a4e2f.jpg https://uploads.disquscdn.com/images/85383d017d2ffa86f2ded015897a8b0f9f909c1929a7f603d335bdabffd621e7.jpg