![]() 29 Nov 2023

29 Nov 2023

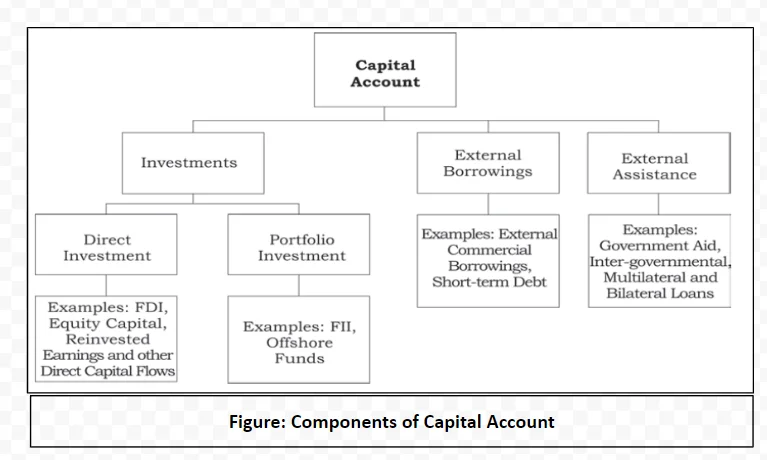

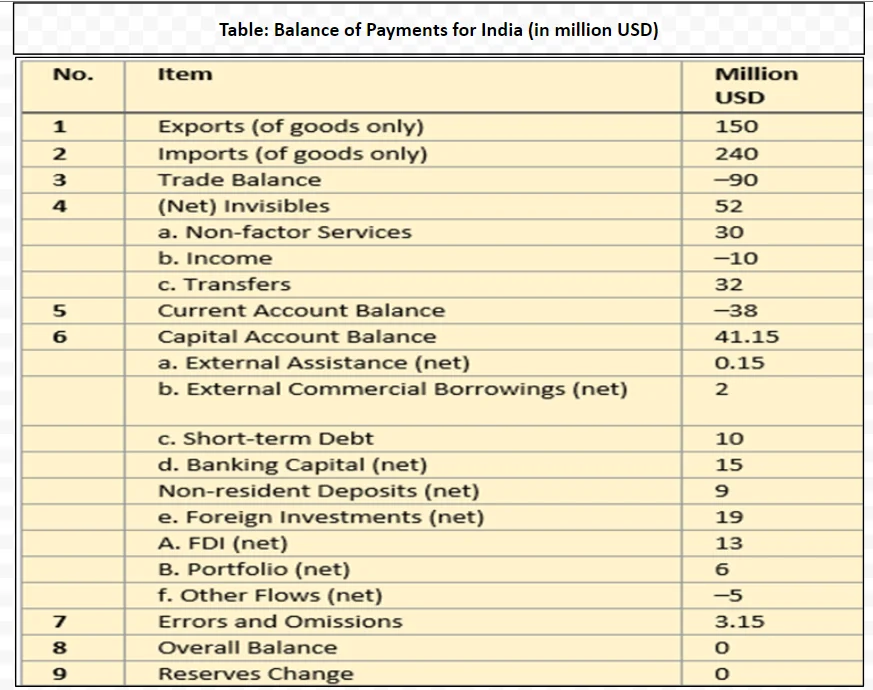

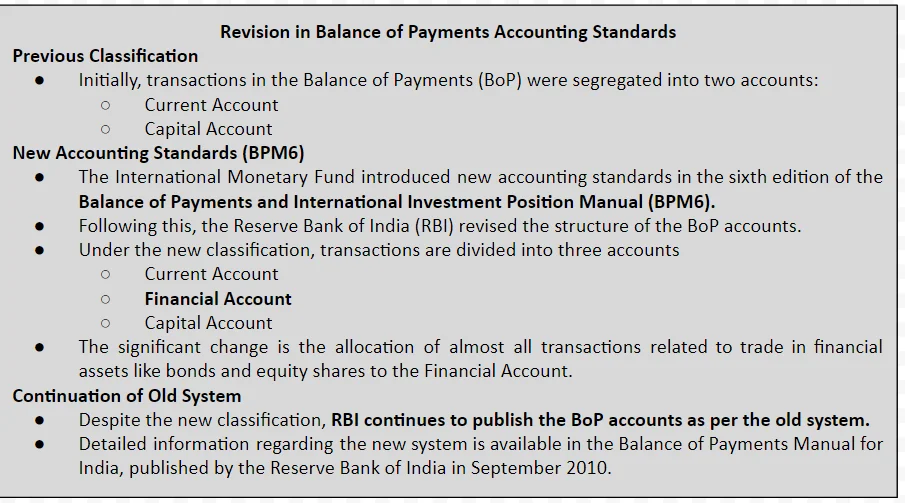

The Capital Account is a record of all international transactions of assets, where assets are various forms of wealth such as money, stocks, bonds, and government debt.

Key Components of Capital Account Transactions

Understanding Financial Health:

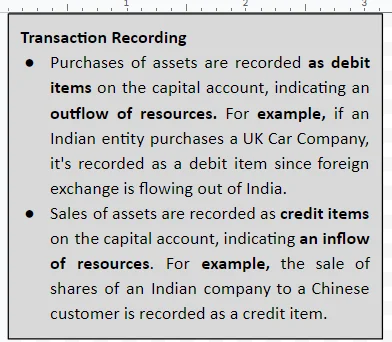

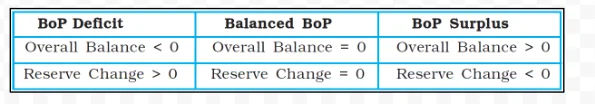

Balance on Capital Account

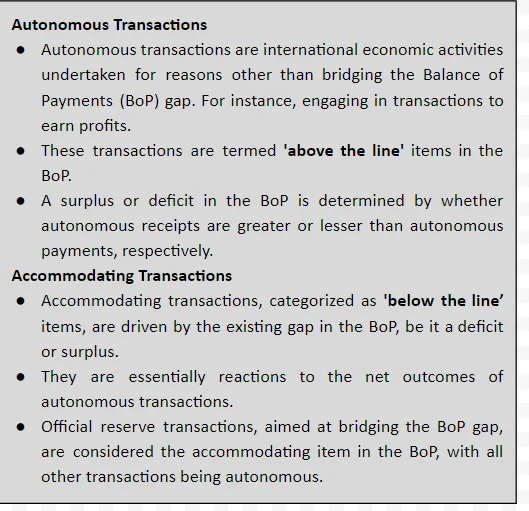

How is the balancing of payments mechanism executed?

Understanding Errors and Omissions in Balance of Payments:

<div class="new-fform">

</div>