![]() 2 Dec 2023

2 Dec 2023

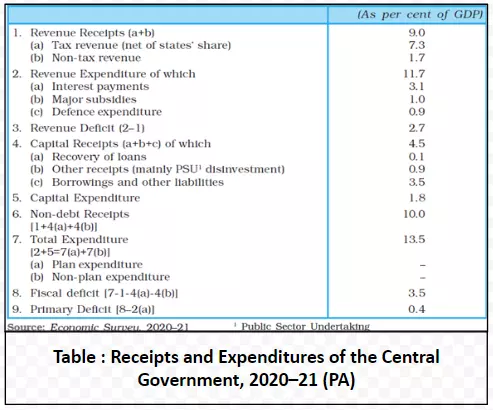

Revenue Receipts are defined as those receipts that do not create a claim on the government and, hence are termed as non-redeemable. They are broadly categorized into Tax Revenues and Non-Tax Revenues.

The taxation system is primarily categorized into two types:

Following are the capital receipts:

Understanding Revenue Expenditure: Plan vs. Non-Plan and Its Link to Government Receipts

Revenue Expenditure is classified into plan and Non-Plan Expenditure (Refer to Table ) as per budget documents:

Non-Plan Revenue Expenditure insights have an impact on government finances by directing governance and economic policies in relation to Government receipts.

<div class="new-fform">

</div>