![]() 1 Dec 2023

1 Dec 2023

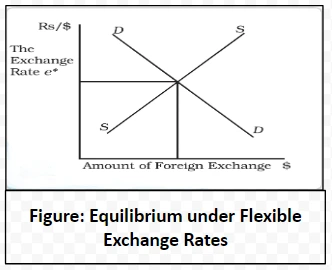

The Foreign Exchange Market, often referred to as the Forex or FX market, is the global marketplace where currencies are bought and sold. It serves as the cornerstone of international trade and finance, enabling the exchange of one currency for another.

Participants in the Forex market include governments, banks, corporations, and individual traders, making it the largest and most liquid financial market in the world.

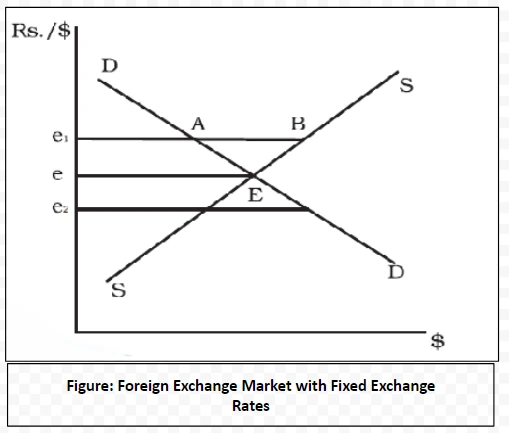

In the realm of global economics, exchange rate systems play a pivotal role in shaping trade and financial interactions among nations.

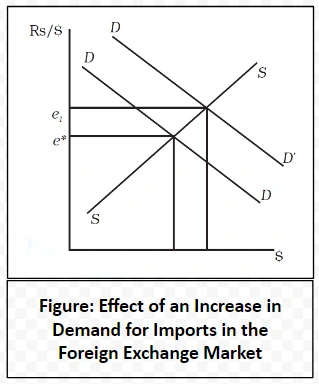

The supply of foreign exchange in a home country originates from various channels including exports, which entail

It involves holding foreign exchange with the expectation of making gains from the appreciation of the currency. Money in any country is considered an asset, and exchange rates can be affected by speculative activities.

The theory stipulates that barring any trade restrictions like tariffs (trade taxes) and quotas (import quantity limits), exchange rates should stabilize such that a particular product bears the same cost, whether priced in rupees in India, dollars in the US, or yen in Japan, with the only exception being transportation cost variances.

<div class="new-fform">

</div>