Earlier, market equilibrium was explored with a fixed number of firms. Now market equilibrium price will be delved into when firms can freely enter and exit the market, assuming all firms are identical.

The implication of this entry and exit assumption is that in equilibrium price, no firm will earn a supernormal profit (profits exceeding the normal rate of return) or incur losses while staying in production. The equilibrium price will equal the minimum average cost of the firms.

Hence, with the freedom for firms to enter and exit, each firm in the market will always earn normal profit at the prevailing market price. This dynamic ensures that firms are neither earning excessive profits nor suffering losses in the long run.

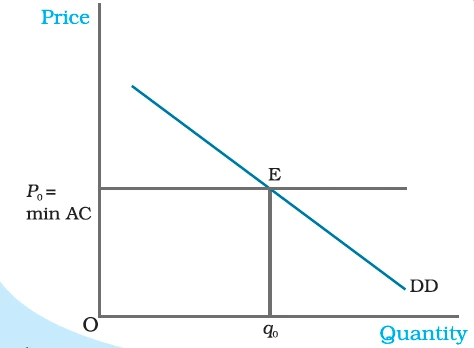

Price Determination with Free Entry and Exit.

With free entry and exit in a perfectly competitive market, the equilibrium price is always equal to min AC and the equilibrium quantity is determined at the intersection of the market demand curve DD with the price line p = min AC.

Equilibrium in a Market: Free Entry and Exit of Firms

p = min AC

p0 = min AC

n0 = q0/q0f

To understand the equilibrium price and quantity determination more clearly, let us look at the following example:

qD = 200 – p for 0 ≤ p ≤ 200 = 0 for p > 200

qfs = 10 + p for p ≥ 20 for 0 ≤ p 20

p0 = 20

q0 = 200 – 20 = 180

q0 = 10 + 20 = 30

n0 = q0/q0f= 180 / 30 = 6

|

|---|

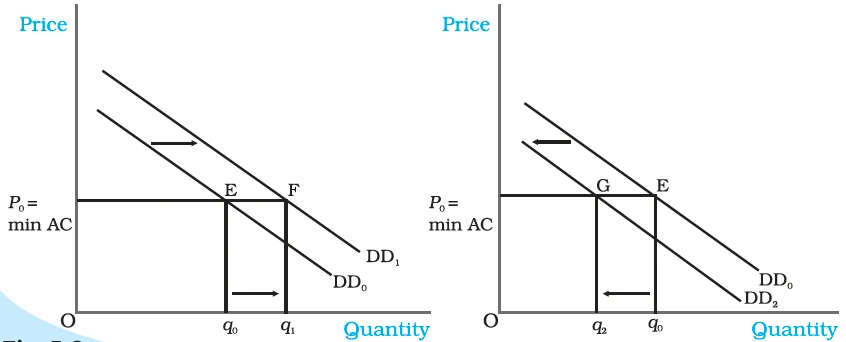

Shifts in Demand: Impact on Price and Quantity in a Flexible Market

Shifts in Demand

Initially, the demand curve was DD0, the equilibrium quantity and price were q0 and p0 respectively. With rightward shift of the demand curve to DD1, as shown in panel (a), the equilibrium quantity increases and with leftward shift of the demand curve to DD2, as shown in panel (b), the equilibrium quantity decreases. In both the cases, the equilibrium price remains unchanged at p0.

Unlike a fixed-firm scenario, shifts in demand have a more significant impact on quantity but no effect on equilibrium price when firms can freely enter and exit.

<div class="new-fform">

</div>