![]() December 2, 2023

December 2, 2023

![]() 406

406

![]() 0

0

Since money is globally accepted and hence easily exchangeable for other goods, it is the most liquid of all assets. However, there is an opportunity cost involved. You can earn interest on money by putting it in a fixed deposit at a bank rather than keeping it in a specific cash balance.

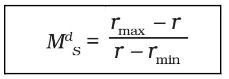

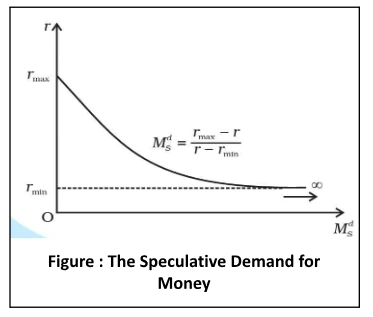

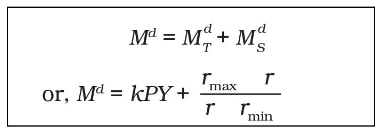

One must weigh the benefits of liquidity against the drawbacks of missing out on interest when determining how much money to hold at any given time. As a result, demand for cash balance is frequently referred to as liquidity preference. People desire to hold money balance for transactions and precautionary motives, showcasing the dual facets of the demand for money.

MdT = k.T

Where T is the total value of (nominal) transactions in the economy over a unit period and k is a positive fraction.

(1/ k).MdT = T, or v.MdT= T

MdT =kPY

Where Y is the real GDP and P is the general price level or the GDP deflator.

<div class="new-fform">

</div>

Latest Comments