Answer:

| Approach:

Introduction

- Recognize the connection between emerging technologies, globalization, and the rise in money laundering.

Body

- Discuss the role of various emerging technologies and aspects of globalization in facilitating money laundering.

- Identify and mention measures to counter money laundering.

- Do substantiate with examples.

Conclusion

- Conclude, reiterating the challenges posed by emerging technologies and globalization in money laundering and stress the importance of robust regulations, cooperation, and advanced technology usage in combating this financial crime.

|

Introduction:

Money laundering, the act of making illegal income appear lawful, has intensified with the rise of digital technologies and globalization. These advancements have eased cross-border transactions and enhanced anonymity, boosting such unlawful practices. According to the United Nations Office on Drugs and Crime (UNODC), global money laundering represents 2-5% of the world’s GDP, or around $800 billion to $2 trillion each year, posing a severe global concern.

Body:

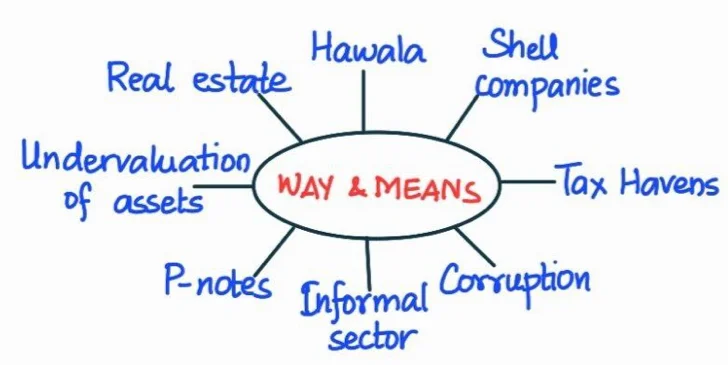

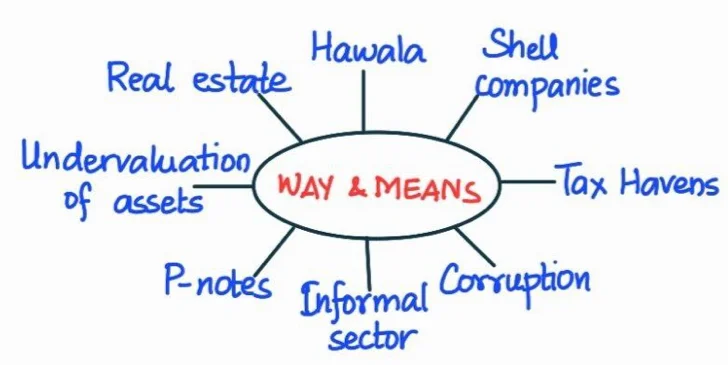

Contribution of Emerging Technologies and Globalization to Money Laundering:

- Cryptocurrency: Anonymity of transactions in cryptocurrencies like Bitcoin is often exploited for money laundering, for example in the 2020 Twitter Bitcoin scam.

- Digital Payment Systems: Globalized digital payment systems can be misused for transferring illicit funds across borders, for example, in the Wirecard scandal.

- Offshore Banking: Globalization has facilitated easier access to offshore banking, often used to hide illicit funds, for example, the revelations from the Panama Papers.

Measures to Tackle Money Laundering:

- Regulation of Cryptocurrencies: Countries like India are considering regulating cryptocurrencies to curb money laundering.

- Strengthening of AML Laws: Anti-money laundering laws are being bolstered globally.

- International Cooperation: Global entities like Financial Action Task Force on Money Laundering (FATF) play a crucial role in setting anti-money laundering standards and promoting cooperation.

- Use of AI: Governments and banks are leveraging AI for real-time fraud detection and risk assessment.

Conclusion:

While emerging technologies and globalization present challenges in the fight against money laundering, adopting stringent regulations, promoting international cooperation, and utilizing advanced technologies like AI can create robust defenses against this financial menace. Proactive and collective action is needed at both national and international levels to curb money laundering.