Answer:

| Approach:

Introduction

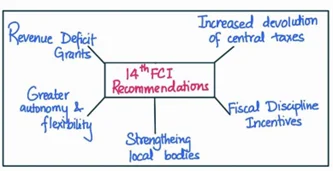

- Introduce the 14th Finance Commission of India and its role in fiscal federalism.

Body

- Discuss how the recommendations of the 14th Finance Commission have enabled states to improve their fiscal position:

- Increased devolution of central taxes

- Revenue deficit grants

- Fiscal discipline incentives

- Greater autonomy and flexibility

- Strengthening local bodies

Conclusion

- Conclude, emphasizing the role of these recommendations in strengthening fiscal federalism and encouraging prudent fiscal policies and efficient resource allocation.

|

Introduction:

The recommendations by the 14th Finance Commission of India aimed at increasing the share of resources transferred to states, enabling them to have more financial autonomy and flexibility to address their specific needs. These recommendations marked a significant shift in India’s fiscal federalism, leading to several changes in the states’ fiscal positions.

Body:

Increased devolution of central taxes:

- The 14th Finance Commission recommended increasing the share of states in the divisible pool of central taxes from 32% to 42%, the highest ever increase in vertical devolution.

- This increased devolution allowed states to have more resources at their disposal, enabling them to address their developmental needs and improve their fiscal position.

Revenue deficit grants:

- The Commission identified states with revenue deficits and recommended revenue deficit grants to bridge the gap, ensuring fiscal stability for these states.

- These grants helped the states maintain their expenditure commitments without resorting to excessive borrowing, thus contributing to their fiscal stability.

Fiscal discipline incentives:

- The 14th Finance Commission recommended that states adhering to fiscal discipline should be incentivized, encouraging them to maintain a healthy fiscal position.

- This incentivization encouraged states to pursue prudent fiscal policies and better expenditure management, improving their fiscal health.

Greater autonomy and flexibility:

- The Commission emphasized greater autonomy and flexibility for states in designing and implementing their schemes and programs.

- This allowed states to allocate resources according to their priorities, ensuring more efficient utilization and better outcomes, ultimately strengthening their fiscal position.

Strengthening local bodies:

- The 14th Finance Commission increased grants for both urban and rural local bodies, ensuring that they had adequate resources to provide essential public services.

- By strengthening local bodies, the Commission indirectly reduced the financial burden on states, contributing to their overall fiscal stability.

Conclusion:

These recommendations have not only strengthened fiscal federalism in India but also encouraged states to pursue prudent fiscal policies and efficient resource allocation, addressing their developmental priorities.