Answer:

| Approach:

Introduction

- Briefly mention the role of Self Help Groups (SHGs) in providing microfinance services in rural India, with a focus on empowering women.

Body

- Discuss the role of SHGs in asset creation and income security for the rural poor in India, providing examples of successful initiatives.

- Explain how SHGs contribute to women empowerment, skill development, and social capital formation in rural India, giving examples of successful programs.

- Highlight the importance of linkages between SHGs and formal financial institutions, and provide examples of successful partnerships.

Conclusion

- Write a relevant conclusion, mentioning the challenges and the probable way forward.

|

Introduction:

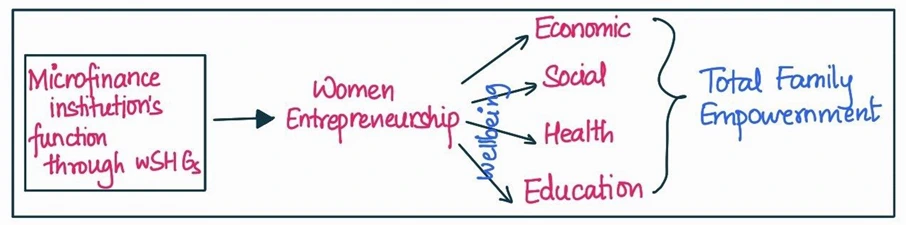

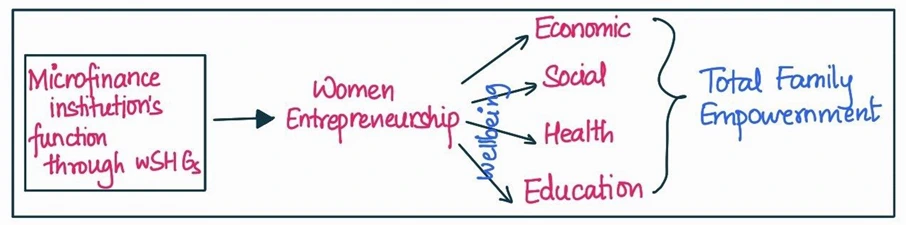

Micro-finance has emerged as a powerful instrument for poverty reduction, asset creation, and income security in developing countries, including India. Self Help Groups (SHGs) have been instrumental in providing microfinance services to rural poor, especially women.

Body:

These groups have played a significant role in achieving the twin objectives of asset creation and income security, along with empowering women in rural India.

- Asset Creation: SHGs have facilitated access to credit for the rural poor by pooling their savings and providing loans to members. For instance, the Kudumbashree program in Kerala has helped women invest in assets like dairy farming, poultry, and organic farming, leading to income generation and improved living standards.

- Income Security: SHGs promote income-generating activities by providing affordable credit, which helps improve the economic stability of the rural poor. For example, in Tamil Nadu, the Mahalir Thittam program has supported thousands of women entrepreneurs in establishing micro-enterprises, providing them with a steady income and financial security.

- Women Empowerment: By providing financial services and access to credit, SHGs enable women to gain control over resources, make decisions, and engage in income-generating activities. The Self Employed Women’s Association (SEWA) in Gujarat is a prime example of how SHGs have empowered women by providing financial and social support, leading to enhanced self-esteem, confidence, and social status.

- Skill Development and Capacity Building: Capacity-building programs and training sessions organized by SHGs focus on developing skills such as financial management, record-keeping, and decision-making. For instance, the National Rural Livelihoods Mission (NRLM) offers training and capacity building programs to SHG members, helping them manage their enterprises effectively.

- Social Capital Formation: SHGs foster a sense of unity and cooperation among members, encouraging them to work collectively towards common goals. This social capital can then be leveraged to address various social and economic issues faced by the community. For example, the Mann Deshi Mahila Sahakari Bank in Maharashtra, founded by an SHG, has effectively utilized social capital to improve financial inclusion and livelihood opportunities for rural women.

- Linkages with Formal Financial Institutions: SHGs have established vital linkages between the rural poor and formal financial institutions, which has helped integrate the rural poor into the mainstream economy, reducing their dependence on informal sources of credit. The partnership between SHGs and banks under the SHG-Bank Linkage Program in India is a testament to the success of such linkages.

Conclusion:

Despite challenges like inadequate credit, limited capacity-building, and weak formal financial linkages, Self Help Groups have been remarkably effective. However, their impact can be enhanced through targeted interventions and policies. Strengthening institutional support, promoting financial inclusion, and fostering collaborations among stakeholders will be key to ensuring SHGs’ continued role in poverty alleviation and rural women empowerment.