Answer:

| Approach:

Introduction

- Define financial inclusion.

Body

- Mention about PMJDY and the reason why financial inclusion is focused upon. Then talk about how PMJDY brings about financial inclusion.

Conclusion

- Conclude stating that PMJDY has helped achieve some milestones but there’s more to go till financial inclusion is achieved in its true sense.

|

Introduction:

Financial inclusion is defined by GoI as “the process of ensuring access to financial services and timely adequate credit when needed by vulnerable groups such as weaker sections and low-income groups at an affordable cost”.

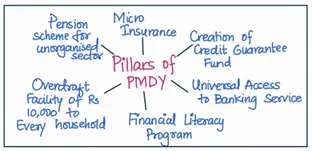

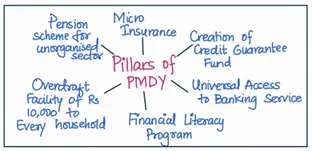

Dimensions of financial inclusion are bank penetration, credit penetration, deposit penetration for which Pradhan Mantri Jan-Dhan Yojana (PMJDY) is a major initiative. More than 46.25 crore beneficiaries have banked under PMJDY since inception.

Body:

It ensures financial inclusion by:

- Providing universal access to banking facilities: It envisages universal access to banking facilities with at least one basic banking account for every household, financial literacy, access to credit, insurance and pension facility basically through zero balance accounts.

- Facilitates people to get used to banking services: It involves transfer of Government benefits via DBT for Kerosene, LPG, and fertilizer subsidy.

- Furthers credit penetration: By providing a zero-balance account, it allows for greater credit penetration to hitherto unbanked individuals. Use of Kisan Credit Card shall facilitate credit and loan facility at affordable cost. Also crediting pension to account will further help in inclusion of financial services for poor.

- Formalisation of Financial System: It provides an avenue for the poor to bring their savings into the formal financial system, an avenue to remit money to their families in villages besides taking them out of the clutches of the usurious money lenders.

But financial inclusion is not achieved simply by opening accounts. This can be seen as follows:

- World Bank study points to the fact that more than 43% of bank account in Indian Banking system are dormant. There is low deposit penetration as well. Thus, apart from opening of accounts, there is a need to ensure that such accounts don’t become dormant with time.

- Ensuring DBT through Jan Dhan account, promoting cashless payment system, increasing financial literacy, promoting awareness through civil society participation to inculcate banking habits, would help in achieving the desired outcome of PMJDY.

Conclusion:

PMJDY has achieved milestones and is truly a step in the right direction toward attaining financial inclusion. However further action is necessary to ensure that these accounts do not turn dormant in the time to come. A proactive effort by the government and other stakeholders holds the key to its success.