Introduction

The implementation of GST has brought about a fundamental shift in the financial relations between the Central Government and the State Governments in India. GST is a unified tax system that replaced multiple indirect taxes levied by both the Central and State Governments.

Under GST, both the Central Government and State Government share the authority to levy and collect taxes on goods and services. This has led to greater harmonization and uniformity in the tax structure across States, promoting economic integration.

Essential Features of GST

- One Nation, One Tax: Goods and Services Tax (GST) was introduced on July 1, 2017, based on the principles of value-added tax and applies to the supply of goods and services across the nation.

- It brought uniformity in the tax structure across India, eliminating the cascading effect of taxes.

- Multiple Tax Levels: India’s GST system consists of multiple tax rates, with four primary tax rates (5%, 12%, 18%, and 28%).

- Additionally, there is a “zero rate” for certain essential goods and services.

- Dual Structure: GST operates under a dual structure, comprising the Central GST (CGST) levied by the Central Government and the State GST (SGST) levied by the State Governments.

- In the case of Inter-state transactions, Integrated GST (IGST) is applicable, which is collected by the Central Government and apportioned to the respective State.

- Destination-Based Tax: This means that the revenue generated from GST is collected by the state where the goods or services are consumed, rather than where they are produced.

- Exports are Zero-rated: Goods or services that are exported would not suffer input taxes or taxes on finished products.

- Input Tax Credit: Under the Indian GST system, businesses can claim input tax credit for the GST they paid on their purchases.

- This helps eliminate the cascading effect of taxation and ensures that taxes are levied only on the value added at each stage of the supply chain.

- Composition Scheme: The composition scheme is available for small taxpayers with a turnover below a prescribed limit (currently 1.5 crores and 75 lakhs for special category state).

- Businesses are required to pay a fixed percentage of their turnover as GST and have simplified compliance requirements.

- Threshold Exemption: Small businesses with a turnover below a specified threshold (currently, it is 20 lakhs: supplier of both goods & services and 40 lakhs: for supplier of goods (Intra–State) in India) are exempt from GST.

- Some special category states, the threshold varies between 10-20 lakhs for suppliers of goods and/or services except for Jammu & Kashmir, Himachal Pradesh and Assam where the threshold is 20 lakhs for supplier of services/both goods & services and 40 lakhs for supplier of goods (Intra–State).

- This threshold helps in reducing the compliance burden on small-scale businesses.

- Compliance and Reporting: Registered businesses in India are required to file regular GST returns, including details of their sales, purchases, and tax liabilities, through an online portal provided by the Goods and Services Tax Network (GSTN).

- Goods and Services Categorization: GST in India classifies goods and services into various tax slabs based on their nature and essentiality.

- This categorization is periodically reviewed and updated by the GST Council, a body consisting of representatives from both the central and state governments.

- Anti-Profiteering Authority: India also has an Anti-Profiteering Authority in place to ensure that businesses pass on the benefit of reduced tax rates or input tax credits to consumers by reducing prices.

- Sector-specific Exemptions: Certain sectors, such as healthcare, education, and basic necessities like food grains, are either exempted from GST or have reduced tax rates to ensure affordability and accessibility.

Constitutional and Legislative Framework of GST

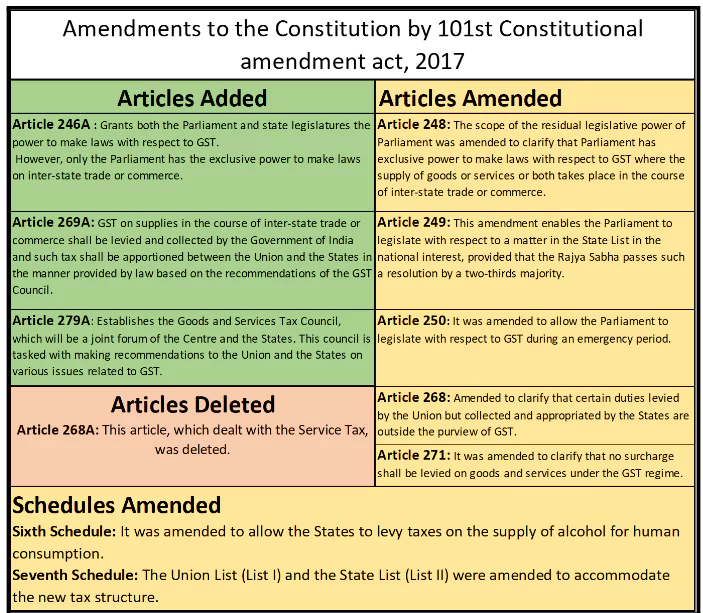

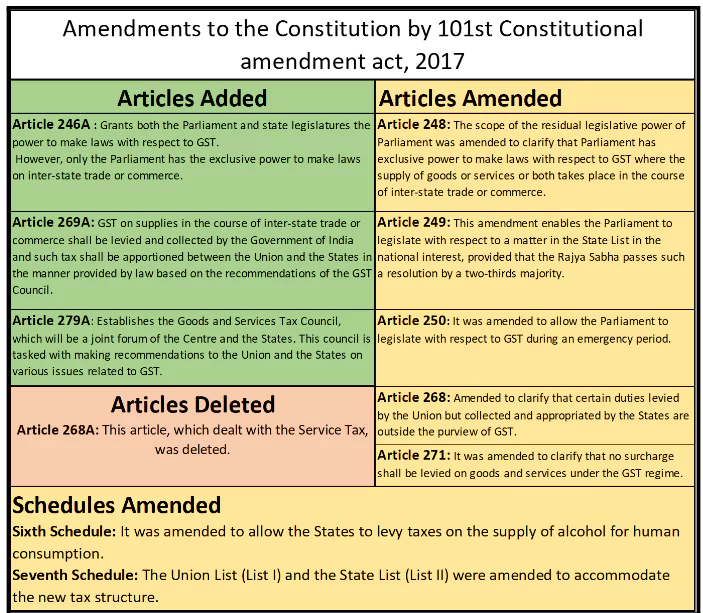

- The Constitution (One Hundred and First Amendment) Act, 2017, is a significant reform in the Indian taxation system.

- This amendment introduced the Goods and Services Tax (GST) in India.

The key highlights of the 101st Constitutional Amendment Act are:

- Introduction of GST: The act brought in a uniform tax system by subsuming various central and state taxes into a single GST.

- Dual GST Model: It implemented a dual GST model, which means that both the Centre and the States will simultaneously levy GST on a common tax base.

- GST Council: The amendment led to the formation of the GST Council, a joint forum of the Centre and the States. This council is tasked with making recommendations on various issues related to GST, such as the tax rate, exemption list, and threshold limit.

- Integrated GST (IGST): The act also introduced the concept of Integrated GST, which is levied on inter-state transactions of goods and services and is shared by both the Centre and the States.

- Compensation to States: It provided for compensation to states for any revenue loss due to the implementation of GST for a period of five years.

Functions of the GST Council

- Recommendations on GST Laws: The Council makes recommendations to the Union and the States on various aspects of GST, such as the goods and services that may be subjected or exempted from GST.

- GST Rate Structure: It decides the rate structure of GST, which includes the rates of GST, the threshold limit for exemption, and the limits for turnover for availing the composition scheme.

- Special Provisions for States: The Council recommends special provisions for certain states, mainly the North-Eastern States, Jammu & Kashmir, Himachal Pradesh, and Uttarakhand.

- Model GST Laws: The drafting of model GST laws, the principles of levy, apportionment of IGST (Integrated Goods and Services Tax), and the principles that govern the place of supply fall under the purview of the Council.

- Dispute Resolution: It also functions as a dispute resolution mechanism, resolving any disputes arising out of its recommendations.

- Other Recommendations: The Council also makes recommendations on various other aspects related to GST, such as the date on which GST will be levied on petroleum crude, high-speed diesel, motor spirit (petrol), natural gas, and aviation turbine fuel.

- Periodic Review: The Council periodically reviews the tax regime to make it more efficient and to meet the changing economic needs.

Quorum, Decision-Making Process, Weightage of Votes, and Validity of Acts

- Quorum Requirement: A minimum of 50% of the total members of the GST Council must be present to constitute a valid meeting.

- Decision-Making Majority: For any decision to be passed during the meeting, it must be supported by at least a 75% majority of the weighted votes of the members who are present and voting.

- Weightage of Votes:

- Central Government: Carries a weight of one-third of the total votes.

- State Governments: Carry a weight of two-thirds of the total votes.

- Validity of Acts:

- The validity of any act, decision, or proceeding of the GST Council is not affected by any vacancy within the Council.

- Any defects in the Council’s constitution or in the appointment of its members do not invalidate its decisions.

- Non-compliance with procedural aspects does not render the Council’s decisions or proceedings invalid.

| Taxes Subsumed Under GST |

| Central Taxes |

State Taxes |

Taxes Not Covered by GST |

- Central Excise Duty (CENVAT)

- Additional Excise Duties

- Duties of Excise (Toilet and Medicinal Preparations)

- Additional Duties of Excise (Goods of Special Importance)

- Additional Duties of Excise (Textiles and Textile Products)

- Additional Duties of Custom (CVD)

- Service Tax

- Central Surcharge and Cesses

|

- State VAT

- Central Sales Tax

- Luxury Tax

- Entry Tax of all Types

- Entertainment and Amusement Tax

- Taxes on Advertisements

- State Surcharges and Cesses

|

- Property Tax & Stamp Duty

- Electricity Duty

- Excise Duty on Alcohol

- Basic Custom Duty

- Petroleum crude, Diesel, Petrol, ATF & Natural Gas

- Entertainment Tax (Levied by Local Bodies)

- Road Tax

|

Recent GST Rate Structure in India

| GST Tax Rate |

Products Covered |

| 0% |

Milk, Kajal, Eggs, Lassi, Curd, Unpacked Foodgrains, Unpacked Paneer, Unbranded Maida, Gur, Besan Unbranded Natural Honey, Prasad, education services, Health Services, Fresh Vegetables, Palmyra Jaggery, Salt, Phool Bhari Jhadoo etc. |

| 5% |

Sugar, Packed Paneer, Tea, Coal, Edible Oils, Raisins, Domestic LPG, Roasted Coffee Beans, PDS Kerosene, Skimmed Milk Powder, Cashew Nuts, Footwear (costing less than Rs. 500), Milk Food for Babies, Apparels (costing less than Rs. 1000), Fabric, Coir Mats, Matting & Floor Covering, Spices, Agarbatti, Coal, Mishti/Mithai (Indian Sweets), Life-saving drugs, and Coffee (except instant) |

| 12% |

butter, ghee, processed food, almonds, fruit juice, preparations of vegetables, fruits, nuts, pickles, murabba, chutney, jam, jelly, packed coconut water, mobiles, computers, and even umbrellas |

| 18% |

Hair Oil, Toothpaste, Soap, Ice-cream, Pasta, Toiletries, Corn Flakes, Capital goods like Computers, and Printers |

| 28% |

Small cars (+1% or 3% cess), High-end motorcycles (+15% cess), Consumer durables such as AC and fridge, Luxury & sin items like BMWs, cigarettes and aerated drinks (+15% cess) Note:Beedis are NOT included here |

| Supreme Court judgment of May 2022 regarding the GST Council:

- Nature of GST Council’s Recommendations: GST Council’s recommendations are advisory and are not obligatory for the Union and the State governments.

- Legislative Authority on GST: Both the Parliament and the State Legislatures hold concurrent powers to legislate on matters related to GST.

- Scope of Binding Recommendations: The GST Council‘s recommendations are binding on the government only for secondary or subordinate legislation, such as modifications in tax rates or the formulation of rules under the CGST, SGST, and IGST Acts.

- However, for primary legislation (like amendments to the CGST, SGST Acts), these recommendations are merely influential and not mandatory.

|

The Electronic Way Bill (E-Way Bill)

- The Electronic Way Bill (E-Way Bill) is an important component of the Goods and Services Tax (GST) system in India.

- It’s a digital document generated on the GST portal, evidencing the movement of goods.

- Here are the key aspects of the E-Way Bill under GST:

- Purpose: To Track the Movement of Goods as it is primarily used to monitor the movement of goods from one place to another.

- Value Threshold: An E-Way Bill is required when the value of the consignment of goods transported exceeds ₹50,000 (although this threshold can vary in some states).

- Interstate and Intrastate Movement: It’s necessary for both interstate and intrastate movement of goods.

- The validity of an E-Way Bill: Depends on the distance the goods have to travel. For example, for every 100 km or part thereof, the E-Way Bill is valid for one day in case of regular cargo, and for 15 km in case of Over Dimensional Cargo (ODC).

Goods and Services Tax Network (GSTN)

- The Goods and Services Tax Network (GSTN) is a digital and technological backbone that facilitates the implementation and monitoring of the Goods and Services Tax (GST) in India.

- GSTN provides a shared IT infrastructure and services to central and state governments, taxpayers, and other stakeholders, helping in the efficient and transparent administration of GST.

Assessment and Evaluation of 6 years of GST

- GST completed 6 years on 1st of July 2023.

- The growth of GST has been phenomenal in terms of collection which have grown from Rs. 7.19 lakh crore in FY 2017-18 (from July 2017) to Rs. 18.10 lakhs crore in FY 2022-23.

- The collection for FY 2022-23 was 22% higher than that of FY 2021-22.

Conclusion

- Goods and Services Tax (GST) in India represents a significant overhaul of the indirect tax system, aiming to streamline taxation, enhance compliance, and foster a unified market.

- Implemented in 2017, GST has simplified the tax structure by subsuming various central and state taxes into a single unified tax, promoting ease of doing business and reducing tax evasion.

- Despite initial challenges, GST has emerged as a cornerstone of India’s economic reforms, contributing to increased transparency and efficiency in the tax regime.

![]() March 30, 2024

March 30, 2024

![]() 8423

8423

![]() 0

0