![]() March 30, 2024

March 30, 2024

![]() 12490

12490

![]() 0

0

The implementation of GST has brought about a fundamental shift in the financial relations between the Central Government and the State Governments in India. GST is a unified tax system that replaced multiple indirect taxes levied by both the Central and State Governments.

Under GST, both the Central Government and State Government share the authority to levy and collect taxes on goods and services. This has led to greater harmonization and uniformity in the tax structure across States, promoting economic integration.

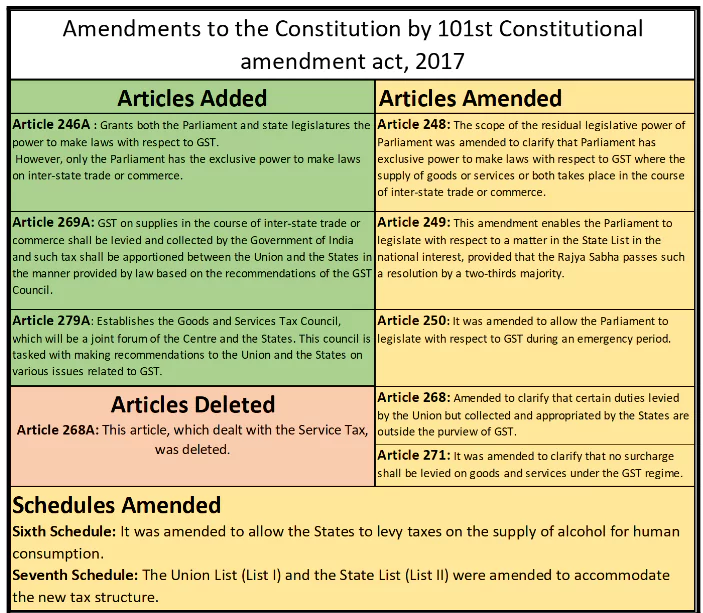

The key highlights of the 101st Constitutional Amendment Act are:

Quorum, Decision-Making Process, Weightage of Votes, and Validity of Acts

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

| Taxes Subsumed Under GST | ||

| Central Taxes | State Taxes | Taxes Not Covered by GST |

|

|

|

| GST Tax Rate | Products Covered |

| 0% | Milk, Kajal, Eggs, Lassi, Curd, Unpacked Foodgrains, Unpacked Paneer, Unbranded Maida, Gur, Besan Unbranded Natural Honey, Prasad, education services, Health Services, Fresh Vegetables, Palmyra Jaggery, Salt, Phool Bhari Jhadoo etc. |

| 5% | Sugar, Packed Paneer, Tea, Coal, Edible Oils, Raisins, Domestic LPG, Roasted Coffee Beans, PDS Kerosene, Skimmed Milk Powder, Cashew Nuts, Footwear (costing less than Rs. 500), Milk Food for Babies, Apparels (costing less than Rs. 1000), Fabric, Coir Mats, Matting & Floor Covering, Spices, Agarbatti, Coal, Mishti/Mithai (Indian Sweets), Life-saving drugs, and Coffee (except instant) |

| 12% | butter, ghee, processed food, almonds, fruit juice, preparations of vegetables, fruits, nuts, pickles, murabba, chutney, jam, jelly, packed coconut water, mobiles, computers, and even umbrellas |

| 18% | Hair Oil, Toothpaste, Soap, Ice-cream, Pasta, Toiletries, Corn Flakes, Capital goods like Computers, and Printers |

| 28% | Small cars (+1% or 3% cess), High-end motorcycles (+15% cess), Consumer durables such as AC and fridge, Luxury & sin items like BMWs, cigarettes and aerated drinks (+15% cess) Note:Beedis are NOT included here |

| Supreme Court judgment of May 2022 regarding the GST Council:

|

Assessment and Evaluation of 6 years of GST

<div class="new-fform">

</div>

Latest Comments