![]() March 30, 2024

March 30, 2024

![]() 7245

7245

![]() 0

0

|

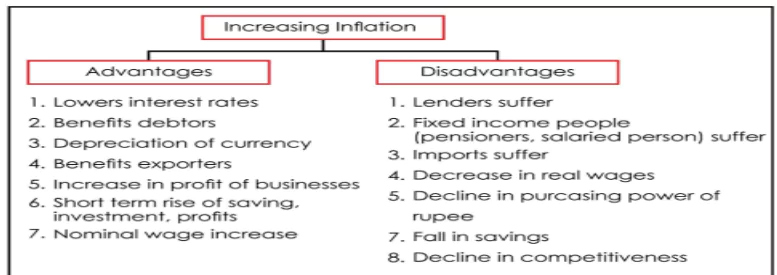

Effect of Inflation on Economy

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

| Related Articles | |

| Budget And Taxation | Balance of Payment |

| Banks in India | Financial Market |

| Indian Insurance Sector | Exchange Rate Systems |

<div class="new-fform">

</div>

Latest Comments