![]() March 27, 2024

March 27, 2024

![]() 5400

5400

![]() 0

0

Tax evasion and tax avoidance might sound similar, but they’re worlds apart when it comes to the law. Tax evasion and tax avoidance are two distinct practices that undermine the integrity of a tax system and impact government revenue. Tax evasion involves illegal activities aimed at intentionally misrepresenting or concealing taxable income to evade paying taxes owed.

On the other hand, tax avoidance refers to legally exploiting loopholes or ambiguities in tax law to minimize tax liability. Both practices pose challenges for tax authorities, necessitating robust enforcement mechanisms and continual efforts to close loopholes and improve tax compliance.

| Criteria | Tax Evasion | Tax Avoidance |

| Definition | The illegal practice of not paying taxes that are legally due. | Utilizing legal methods to minimize tax liability within the framework of Indian tax laws. |

| Legality | Illegal and subject to legal penalties. | Legal and complies with the law. |

| Methods | Underreporting income, inflating expenses, concealing assets, or using false documents. | Utilizing deductions, exemptions, and incentives provided under the Income Tax Act |

| Consequences | Leads to penalties, fines, and possible imprisonment. | No legal consequences, but might face ethical scrutiny if it involves aggressive tax planning. |

| Intent | Deliberate intention to deceive tax authorities and reduce tax liability unlawfully. | Using the tax system legally to reduce tax burden without deceit. |

| Example | Not reporting cash transactions or income from property or business. | Investing in tax-saving schemes like Public Provident Fund (PPF), National Pension System (NPS), or utilizing home loan interest deductions. |

| Government

Response |

Enforcement through audits, investigations, and legal action by the Income Tax Department. | Periodic amendments to tax laws to close loopholes and discourage aggressive tax planning. |

| Perception | Viewed as unethical and harmful to the country’s fiscal health. | Generally seen as smart financial planning, but can be controversial if it involves very aggressive strategies. |

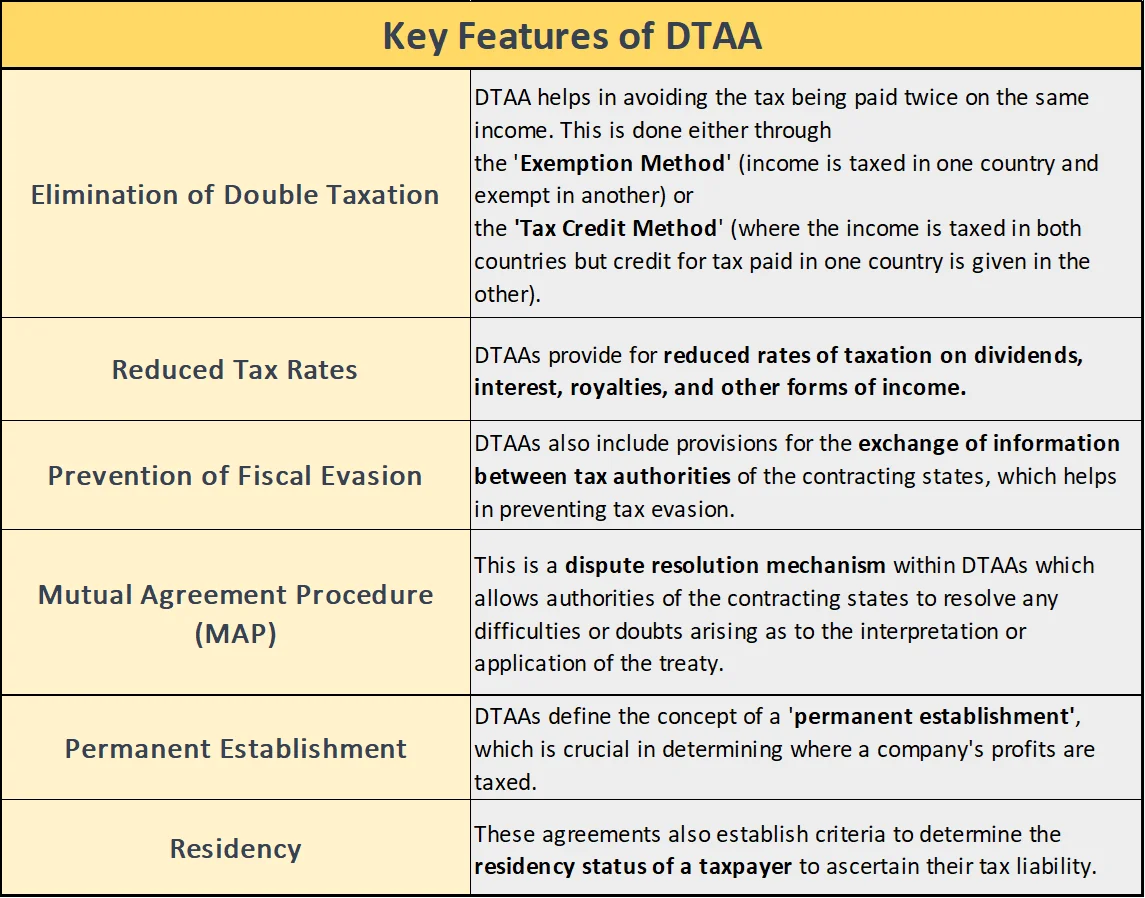

Double Taxation Avoidance Agreement (DTAA)

Base Erosion & Profit Shifting and OECD Framework

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

Authority for Advance Rulings

General Anti-Avoidance Rules (GAAR)

Conclusion

<div class="new-fform">

</div>

Latest Comments