![]() March 30, 2024

March 30, 2024

![]() 12059

12059

![]() 0

0

Tax is a financial charge or levy imposed by a government on individuals, businesses, or other entities to fund public expenditures and government functions. It is a compulsory contribution that citizens and businesses are required to pay, and it is a crucial source of revenue for the government.

| Tax GDP Ratio: Tax-GDP ratio is an indicator of fiscal performance. The higher the ratio, the better is the tax collection, the higher the tax revenue. |

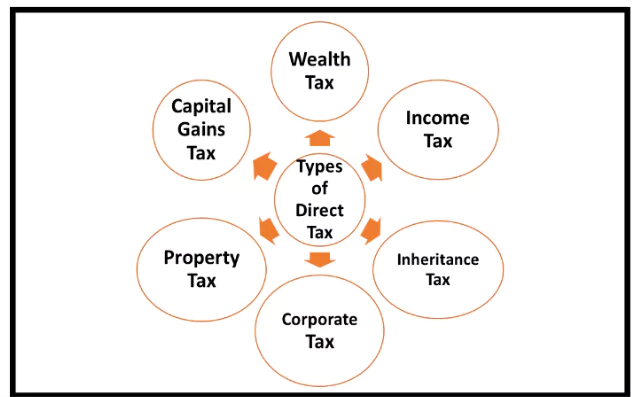

Wealth Tax: Imposed on the property of individuals depending upon the value of property.

Wealth Tax: Imposed on the property of individuals depending upon the value of property.

Based on tax rate, taxes can be classified into the following types:

|

|

The administrative structure for direct taxation in India Central Board of Direct Taxes (CBDT), which operates under the Ministry of Finance. The CBDT is responsible for the administration of direct taxation laws through the Income Tax Department. Here’s an overview of the structure: Central Board of Direct Taxes (CBDT)

Income Tax Department

|

| Point of difference | GAFA Tax

(Global Tax on Digital Giants) |

Equalisation Levy |

| Definition | GAFA Tax refers to taxation types specifically designed to target major digital corporations like Google, Apple, Facebook, and Amazon (hence GAFA). | The Equalisation Levy is a taxation imposed on non-resident e-commerce operators for digital services provided in a country. |

| Purpose/

Objective |

Aims to ensure that tech giants pay a fair share of taxation in the countries where they have significant user bases but may not have a physical presence. | Intended to equalize the tax situation between foreign and domestic e-commerce companies and capture taxation on digital transactions. |

| Primary Focus | Primarily focused on large technology companies with significant digital revenues. | Targets a broader range of digital services and e-commerce transactions. |

| Geographical Origin | Initiated by individual countries like France, aiming to tax profits made in their jurisdictions by large multinational tech companies. | Originating in India, it is designed to tax digital transactions involving foreign e-commerce companies. |

| Tax Base | Based on the revenues generated from digital services in a specific country. | Levied on the gross revenue from digital services provided by non-resident companies. |

| Rate of Taxation | Varies depending on the country implementing it.

Example: France proposed a 3% tax rate. |

In India, the rate is 2% (as of my last update) on the revenues of select digital services. |

| Implementation | Implemented by individual countries according to their tax laws and regulations. | Implemented as part of the broader tax code of the country, like India’s Finance Act. |

| Global Acceptance | The concept has faced opposition from some countries and tech companies, leading to discussions for a broader global solution under the OECD. | Mainly a country-specific measure, it has not been widely adopted or discussed in global tax reform debates like the OECD’s initiatives. |

| RATE OF GROWTH OF TAXES (%) VS GROWTH IN NOMINAL GDP | ||||

| Nominal GDP | Corporate Tax Growth | Growth in Income Tax | Tax Buoyancy | |

| 2021-22 | 19.5 | 55.6 | 43 | 2.52 |

| 2022-23 | 15.4 | 16 | 20 | 1.1 |

| 2023-24(Apr-Aug ) | 8 | 15 | 35.7 | – |

| India’s direct tax to GDP ratio has been slowly crawling up from an average of 5.5% from

FY12 to FY21, to a high of 5.97% in FY22 and 6.08% in the last fiscal. But this is still lower than the 6.3% direct tax-to-GDP ratio that the country achieved in 2007-08. |

| Must Read | |

| Current Affairs | Editorial Analysis |

| Upsc Notes | Upsc Blogs |

| NCERT Notes | Free Main Answer Writing |

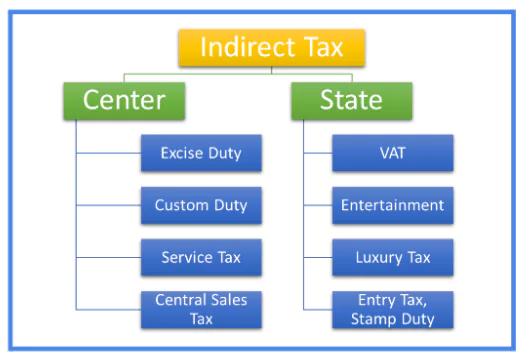

Central Sales Tax (CST): This was imposed by the Central government on the sale of products between different states.

Central Sales Tax (CST): This was imposed by the Central government on the sale of products between different states.

<div class="new-fform">

</div>

Latest Comments