Get the CPI Full Form, base year (2012), release authority, and understand how CPI measures retail inflation in India. Know the difference between CPI and WPI and explore recent inflation trends.

CPI Full Form stands for Consumer Price Index, a critical economic indicator that measures the average change in the prices of goods and services consumed by households over time. It is an essential tool for understanding inflation trends and the cost of living in a country. In India, Retail Inflation in India is measured by the Consumer Price Index, which serves as a barometer of the economy’s health and the effectiveness of fiscal and monetary policies.

The CPI Full Form is Consumer Price Index, which is a macroeconomic indicator that measures the change in the general price level of goods and services purchased by households. It directly reflects retail inflation in India measured by changes in consumer spending patterns and prices. CPI’s meaning is therefore associated with inflation from a consumer’s point of view.

The CPI basket includes goods and services such as:

These categories are assigned specific weights based on household consumption patterns. The index compares the current prices of this basket with the CPI base year prices to determine inflation.

The Consumer Price Index India released by the Ministry of Statistics and Programme Implementation (MoSPI) through its National Statistical Office (NSO). The CPI is released by MoSPI on the 12th of every month at 4:00 PM. This timing aligns with the closure of major financial markets in India to avoid volatility and ensure greater transparency.

CPI is calculated using the Laspeyres formula, which compares the cost of a fixed basket of goods and services in the current period to the base year. The formula is:

CPI = (Cost of Basket in Current Year / Cost of Basket in Base Year) × 100

The items in the CPI basket are categorised and assigned weights. The CPI base year is currently 2012, updated from 2010. The price data is collected from 1181 village markets and 1114 urban markets spread across 310 towns/cities.

The CPI base year is the reference year against which current price levels are compared. In India, the base year was updated from 2010 to 2012 and is used as the benchmark for all CPI computations since January 2015. The Central Statistics Office (CSO), under the Ministry of Statistics and Programme Implementation (MoSPI), is responsible for managing the base year and updating it periodically.

CPI serves several important roles:

The CPI basket contains 299 items, which are broadly divided into:

Each category has a specific weight, and price changes are monitored monthly.

India publishes four main variants of CPI:

The RBI uses CPI as the primary metric to manage inflation under the inflation targeting framework adopted in 2016. The central bank aims to keep inflation within a target band of 4% ±2%. The Monetary Policy Committee (MPC) considers CPI data when deciding repo rates.

For instance, a rise in CPI indicates increasing inflation, prompting the RBI to raise repo rates to control the money supply. Conversely, a fall in CPI could lead the RBI to lower rates to stimulate economic growth.

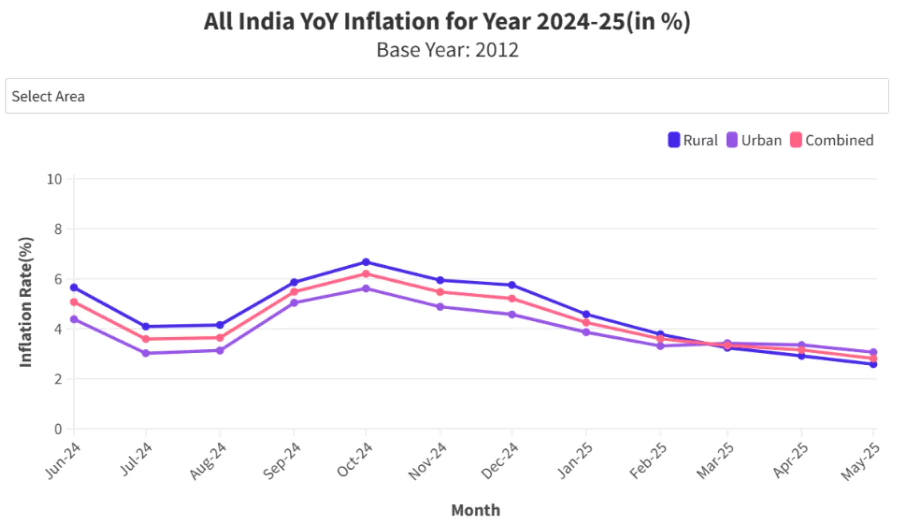

Retail inflation in India has shown considerable improvement. As of FY 2024–25, retail inflation fell to 4.6%, the lowest since 2018–19. The year-on-year CPI inflation for March 2025 dropped to 3.34%, marking the lowest since August 2019. This moderation is attributed to:

To understand the full scope of inflation measurement in India, it’s important to differentiate between the two main indices used—CPI and WPI. While both aim to capture price movement, their approach, components, and policy relevance vary significantly.

| CPI vs WPI Key Differences | ||

| Aspect | Consumer Price Index (CPI) | Wholesale Price Index (WPI) |

| Full Form | Consumer Price Index | Wholesale Price Index |

| Focus Area | Retail price to consumers | Wholesale prices at the bulk level |

| Covers | Both goods and services | Only goods |

| Calculated By | NSO under MoSPI | Office of the Economic Advisor, Ministry of Commerce |

| Base Year | 2012 (for CPI) | 2011–12 |

| Items Tracked | 448 (rural) + 460 (urban) | 697 items |

| Frequency | Monthly | Weekly for primary/fuel, monthly for others |

| Relevance | Reflects consumer cost of living | Tracks business input cost trends |

| Inflation Stage | Final stage (consumer level) | Early stage (production level) |

India’s inflationary trends, as captured by the CPI, have undergone notable changes in recent years. The fiscal year 2024–25 reflects a steady moderation in retail inflation, showcasing the impact of macroeconomic stability measures and monetary policy.

The government has played a proactive role in stabilising CPI-driven inflation through strategic policies and market interventions. These efforts are targeted at ensuring affordability for the masses while maintaining the momentum of economic growth.

The Government of India has implemented several measures to moderate CPI levels:

These efforts have successfully curbed retail inflation, improving affordability and supporting economic growth.

The CPI Full Form, or Consumer Price Index, serves as a crucial indicator of economic health in India. By capturing price movements of essential goods and services, it provides a comprehensive view of inflation. From influencing the RBI’s monetary policy to guiding household consumption patterns, CPI plays a foundational role. As India progresses toward a more transparent and data-driven economy, the significance of the Consumer Price Index will only deepen in shaping fiscal, monetary, and social welfare policies.

Understanding the CPI full form and its role is thus essential for anyone who wants to stay informed about India’s inflation trends and economic outlook.

Ready to boost your UPSC 2025 preparation? Join PW’s UPSC online courses today!

The CPI Full Form is Consumer Price Index. It measures retail inflation in India and reflects changes in prices paid by consumers for goods and services.

The Consumer Price Index is used to measure inflation, adjust dearness allowance, and help in monetary policy formulation by the Reserve Bank of India.

The current CPI base year is 2012, adopted from January 2015, as released by the Ministry of Statistics and Programme Implementation (MoSPI).

The consumer price index India released by the National Statistical Office (NSO) under the MoSPI, every month on the 12th at 4:00 PM.

Higher CPI may lead the RBI to increase repo rates to control inflation. Thus, retail inflation in India measured by CPI directly impacts interest rate decisions.

WPI vs CPI differ mainly in scope—WPI tracks wholesale prices of goods, while CPI covers retail prices of both goods and services for end consumers.

<div class="new-fform">

</div>