India’s First Overseas Jan Aushadi Kendra Inaugurated in Mauritius

|

About Jan Aushadi Kendras:

Benefits of Jan Aushadhi Kendras:

About Mauritius:

|

Cryptocurrency Firm WazirX Suffered Major Security Breach.

|

About Cryptocurrency:

Terminologies to be remembered:

|

A glitch in the software update of CrowdStrike’s Falcon Sensor knocked out several Windows computers and servers around the world, sending them through a bootloop featuring a blue screen of death.

Downdetector recorded spiking outage reports from different parts of the world, with complaints surrounding Microsoft’s login, outlook, server, and app experiences.

Causes:

Causes:

Indigenous rights NGO Survival International has released rare photographs of the Mashco Piro tribespeople.

Uncontacted Tribe in India

|

|---|

About Peru

Other important points

|

|---|

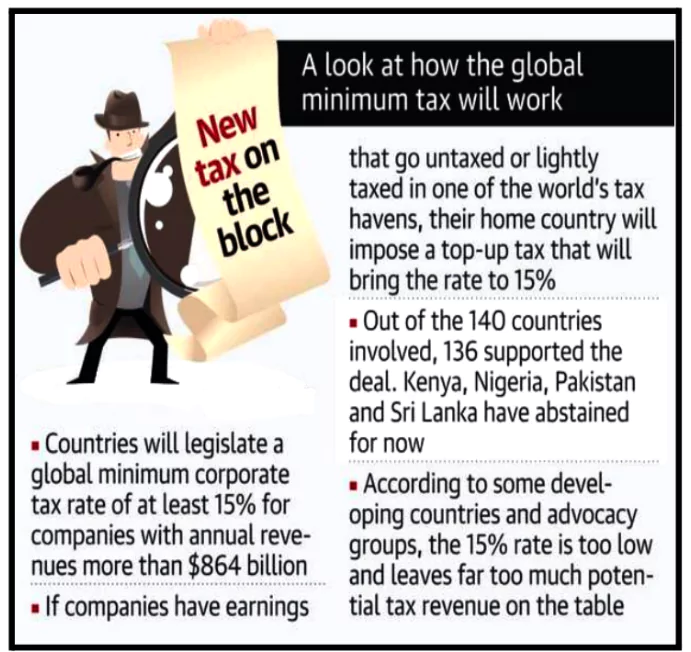

There is high anticipation among the Multi-National Enterprises (MNE’s) and tax professionals of a roadmap for India’s approach to adopting the Global Minimum Tax, also known as the ‘Pillar Two’ global tax in the upcoming Budget.

Need for GMT: The need for GMT arises from financial diversion to tax havens and the desire to mobilise financial resources.

Need for GMT: The need for GMT arises from financial diversion to tax havens and the desire to mobilise financial resources.

India’s adoption of Pillar Two is imminent; it’s a question of when, not if. The countdown has begun, and the focus is now on how the government will implement these global tax reforms effectively.

Organisation for Economic Cooperation and Development (OECD), Base Erosion and Profit Shifting (BEPS) and OECD G20 ProjectOrganisation for Economic Cooperation and Development (OECD)

Base Erosion and Profit Shifting (BEPS) and OECD G20 Project:

|

|---|

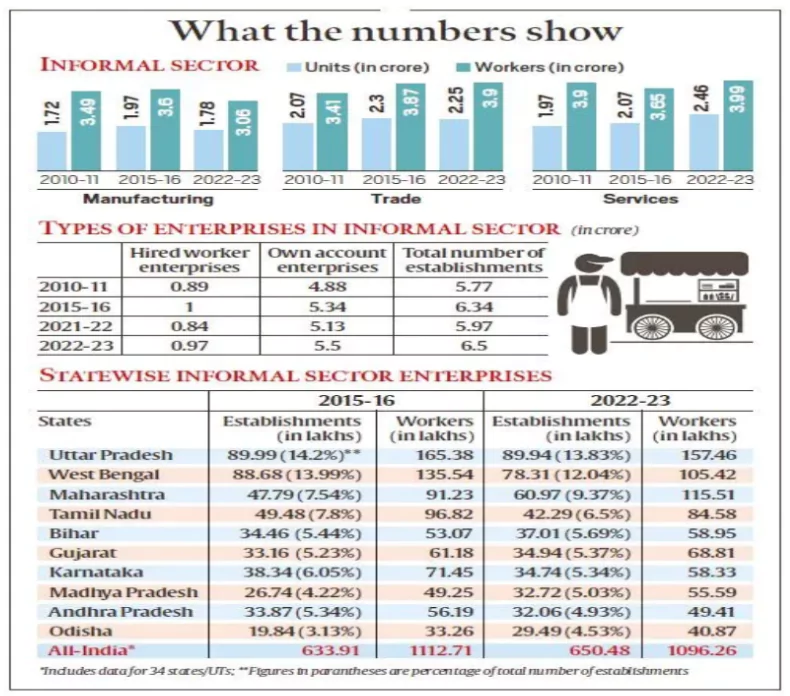

As per the recently released ‘Outcomes of the 2021-22 and 2022-23 surveys released by the National Sample Survey Office (NSSO)’, Informal economy was the worst affected due to three significant economic shocks: Demonetisation (November 2016), GST implementation (July 2017), and the Covid-19 pandemic (since March 2020).

Unincorporated Enterprises

|

|---|

Recent Government Initiatives Related to the Informal Sector

|

|---|

Periodic Labour Force Survey (PLFS)

|

|---|

Recently, the Assam government asked the Border wing of the State’s police not to forward cases of non-Muslims who entered India illegally before 2014 to the Foreigners Tribunals (FTs).

Foreigners (Tribunals) Order, 1964

|

|---|

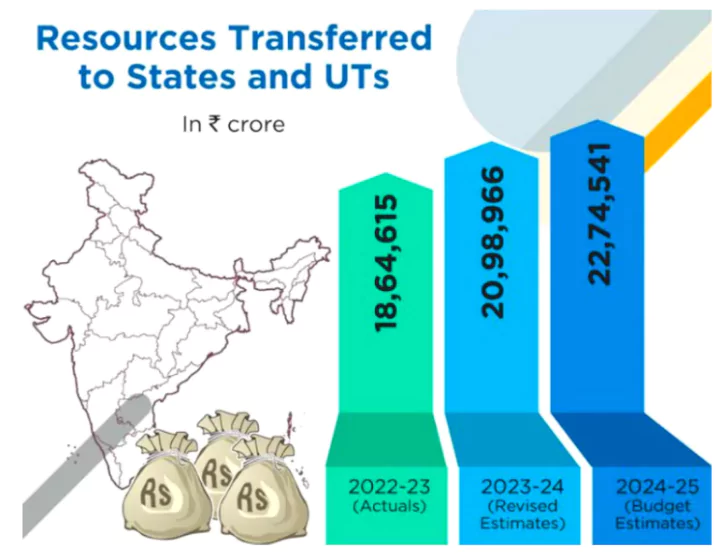

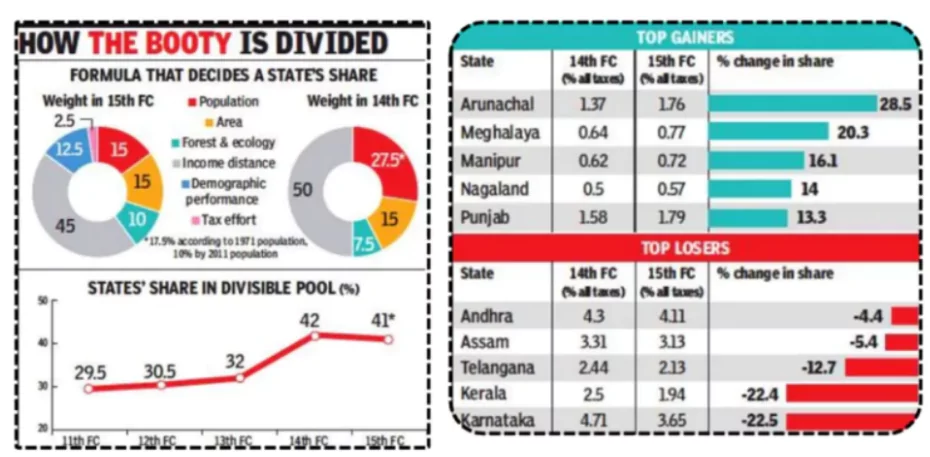

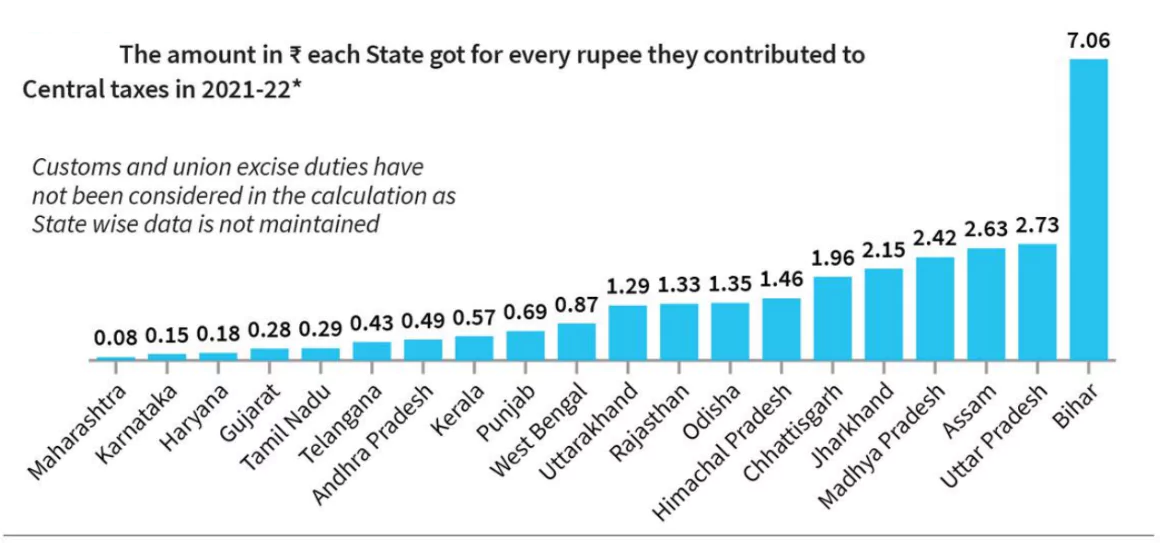

The devolution of Union tax revenue to States is significant in India’s fiscal federalism.

It entails the division of responsibilities and resources between the central and state governments, with the Finance Commission playing a key role in recommending tax proceeds distribution.

Following are the three main broad principles associated with Fiscal Federalism:

The Sixteenth Finance Commission has begun its work, which was constituted in December last year and is expected to submit its recommendations by October, 2025 that will be valid for five years starting from April 1, 2026.

Financial devolution refers to the transfer of financial resources and decision-making powers from the central government to the states.

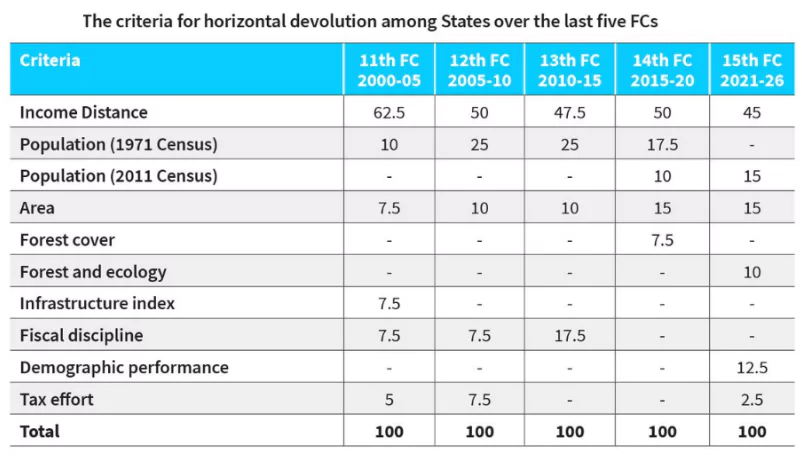

Horizontal Devolution: This devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc.

Horizontal Devolution: This devolution of funds between States is usually decided based on a formula created by the Commission that takes into account a State’s population, fertility level, income level, geography, etc.

In general, intergenerational equity is the principle of providing equal opportunities and outcomes to every generation.

It focuses on fair distribution of resources among different states within the same generation.

There are following challenges associated with present federal finances in India:

To combat the arising challenges, following measures need to be considered:

Balancing both intragenerational and intergenerational equity is important, and it reiterates the need to balance equity and efficiency in the distribution formula for tax devolution to States. This squarely falls under the purview of the FC to have a fair mechanism to address the conflicting equity issues.

The Centre is likely to introduce six new bills during the upcoming monsoon session of the parliament scheduled to begin on July 22.

List of Six Bills

|

|---|

Business Advisory CommitteeMeanwhile, Lok Sabha Speaker Om Birla also constituted the Business Advisory Committee (BAC), which decides the parliamentary agenda. About Business Advisory Committee

|

|---|

Summoning

|

|---|

Adjournment

Adjournment Sine Die

Dissolution

Prorogation

|

|---|

Joint Session

Special Session

Lame Duck Session

|

|---|

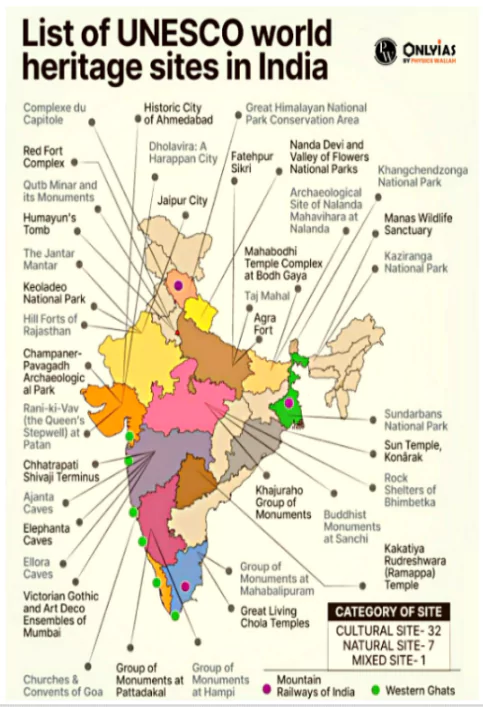

Recently, International Council on Monuments and Sites (ICOMOS) has prepared a report ‘Evaluations of Nominations of Cultural and Mixed Properties’ for the 46th ordinary session of the World Heritage Committee to be held in New Delhi

ICOMOS

|

|---|

Ahom Kingdom

|

|---|

Tentative UNESCO list of World Heritage Sites: These are identified by individual countries that they consider to have “outstanding universal value” and may be suitable for inscription on the World Heritage List. It is published by the World Heritage Centre.

Tentative UNESCO list of World Heritage Sites: These are identified by individual countries that they consider to have “outstanding universal value” and may be suitable for inscription on the World Heritage List. It is published by the World Heritage Centre.

United Nations Educational, Scientific and Cultural Organization (UNESCO)

|

|---|

<div class="new-fform">

</div>