Context:

This article is based on the news “Our Panchayati Raj system is in need of funding empowerment” which was published in the Live Mint. Recently, the Reserve Bank of India (RBI) released its report titled “Finances of Panchayati Raj Institutions” for the years 2020-21 to 2022-23.

- It presents an assessment of their finances and their role in India’s socio-economic development.

RBI Report on Panchayati Raj Finance: Key Highlights

- Panchayats’ Own Sources of Revenue: They are limited, mainly property taxes, fees, and fines.

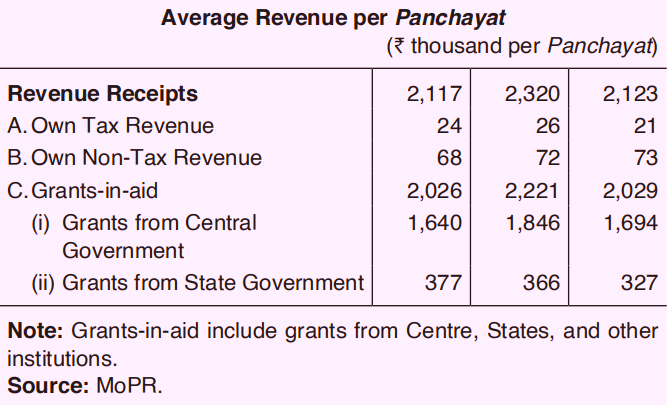

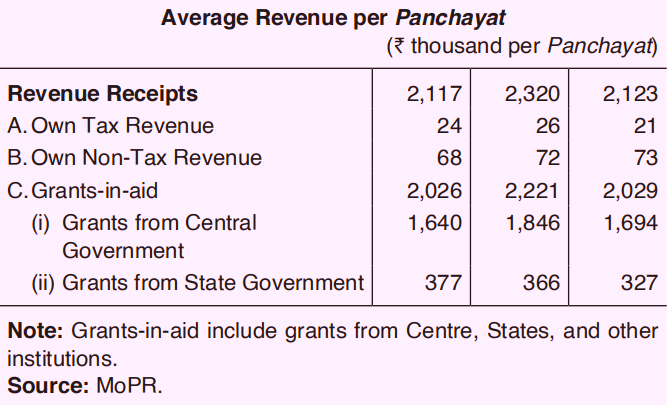

- Average Revenue of Panchayats: According to the report, the average revenue per Panchayat, encompassing taxes, non-taxes, and grants, was at 21.2 lakh in 2020-21, 23.2 lakh in 2021-22, and experienced a slight dip to 21.23 lakh in 2022-23.

- The own revenues of the Panchayats were only 1.1 per cent of their total revenue during the study period.

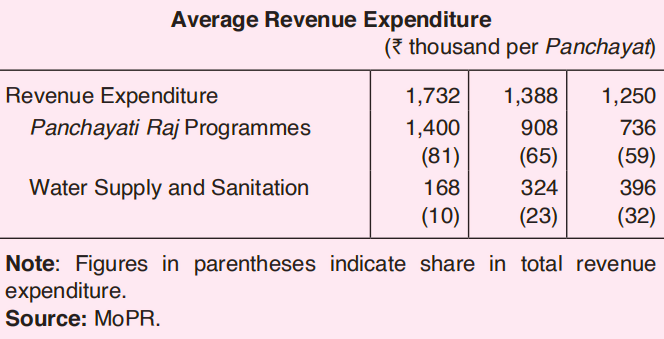

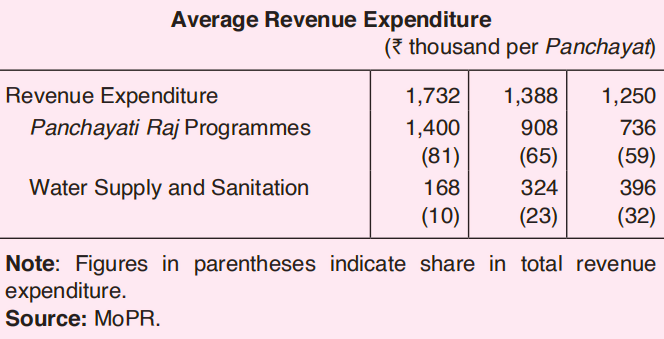

- Average Expenditure: Panchayat witnessed a decline from 17.3 lakh in 2020-21 to 12.5 lakh in 2022-23, attributed to elevated spending during the pandemic year.

- Devolution of Power: There are sharp inter-state variations in the devolution of powers and functions to Panchayats.

- States having higher devolution levels exhibit better outcomes in health, education, infrastructure development, water supply and sanitation.

- Uneven Fiscal Data Availability: An assessment of the fiscal health of Panchayati Raj Institutions (PRIs) is challenging due to the uneven availability of data on their revenues and expenditures.

Enroll now for UPSC Online Course

About Panchayati Raj

- Self Government: The term Panchayati Raj in India signifies the system of rural local self government.

- Grass Root Level Democracy: It has been established in all the states of India by the Acts of the state legislatures to build democracy at the grass root level.

Mahatma Gandhi advocated Gram Swaraj or village self-governance as a decentralised form of governance in which villages would be responsible for their own affairs, serving as cornerstones of India’s political system.

Mahatma Gandhi advocated Gram Swaraj or village self-governance as a decentralised form of governance in which villages would be responsible for their own affairs, serving as cornerstones of India’s political system.

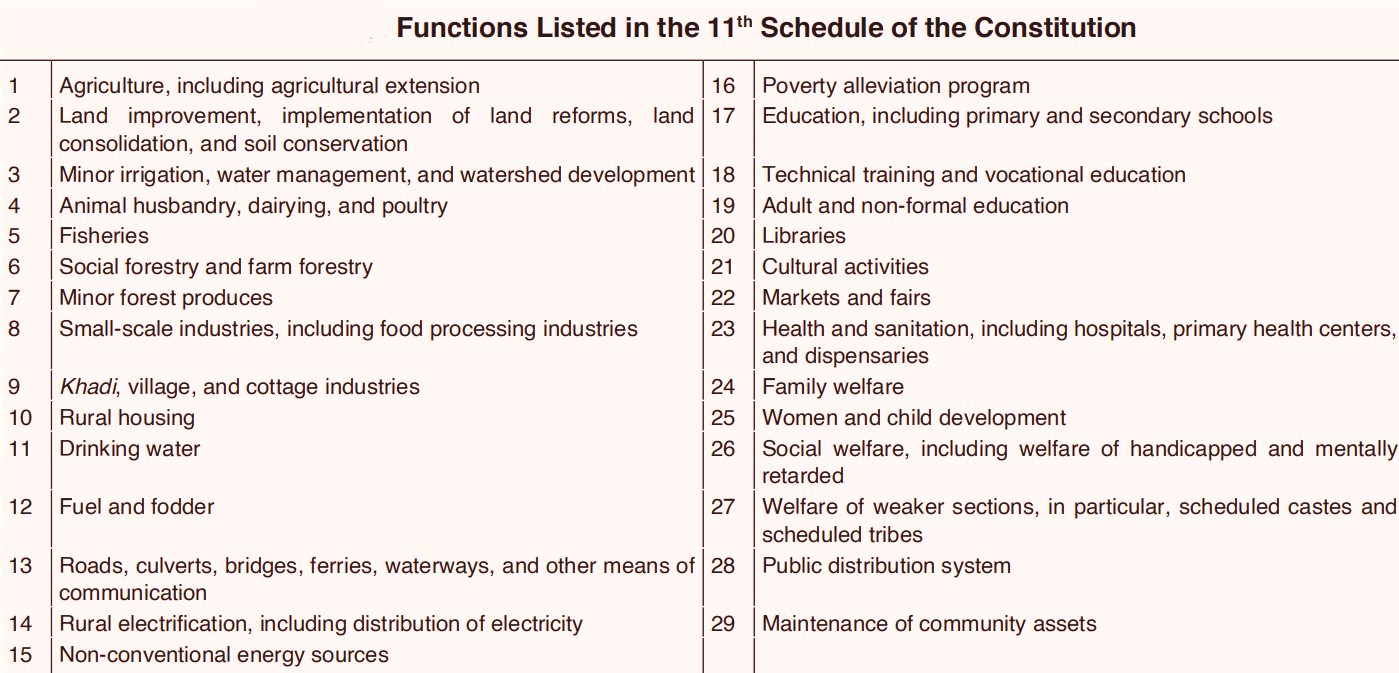

- 73rd Constitutional Amendment Act (CAA): It was constitutionalised through the 73rd CAA of 1992. The act has given a practical shape to Article 40 of the Constitution.

- This act has added a new Part-IX to the Constitution of India entitled as ‘The Panchayats’ and consists of provisions from Articles 243 to 243 O.

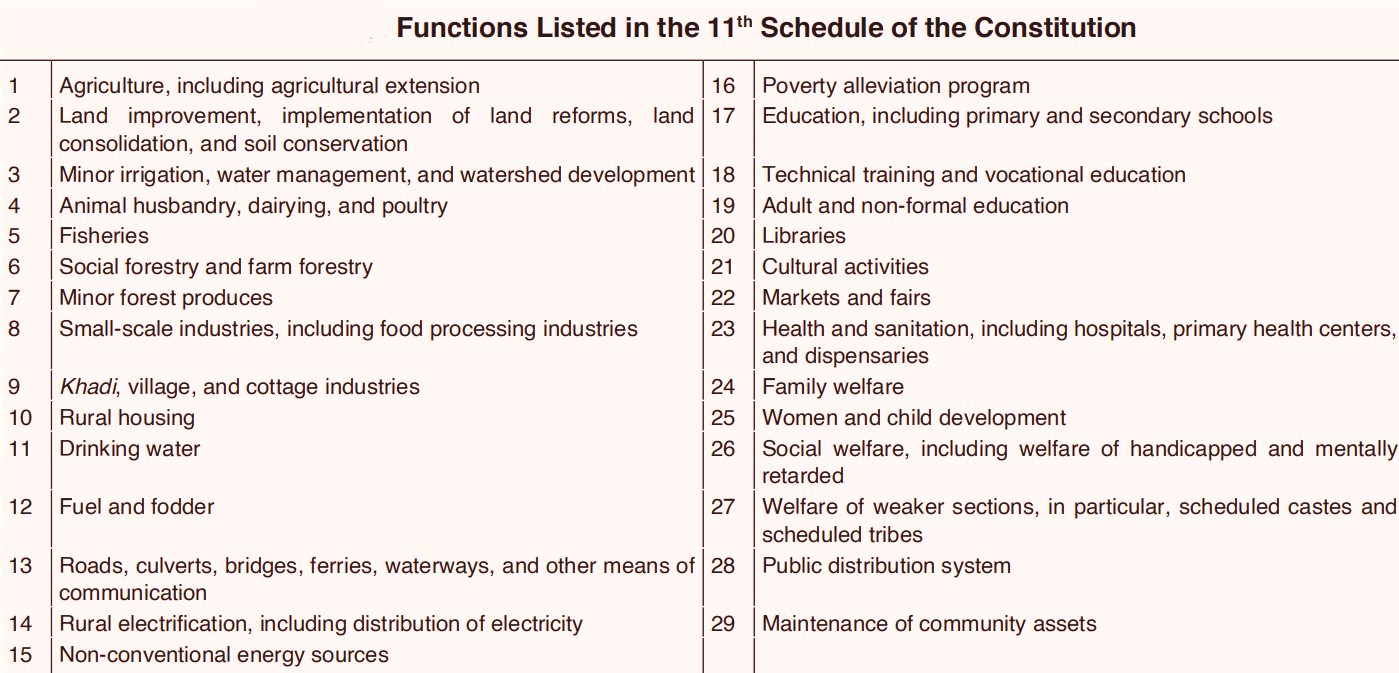

- The act has also added a new Eleventh Schedule to the Constitution. This schedule contains 29 functional items of the panchayats.

Assessment of Panchayati Raj Finance

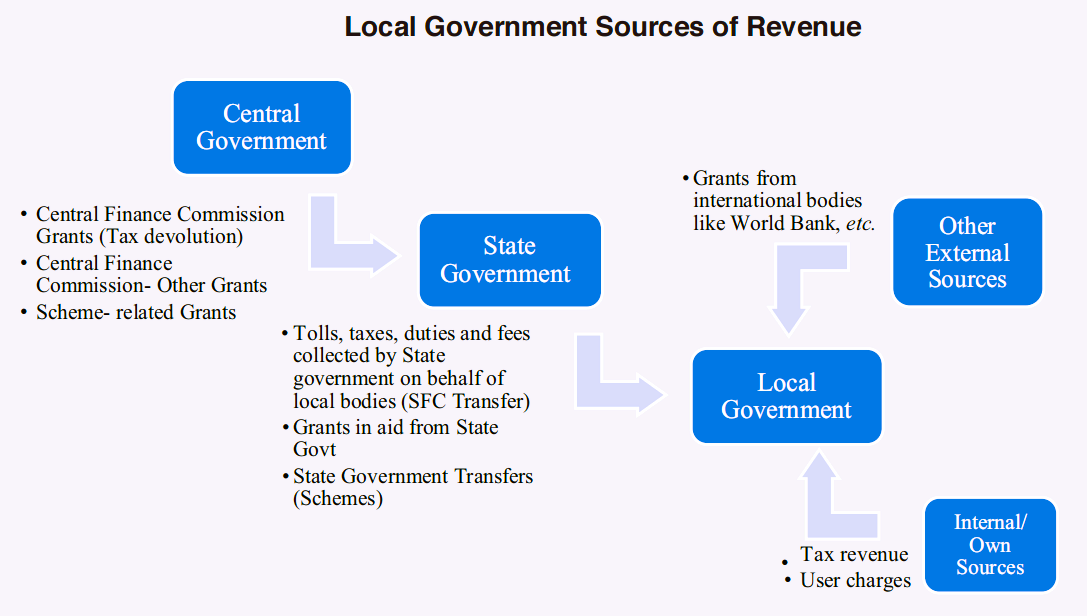

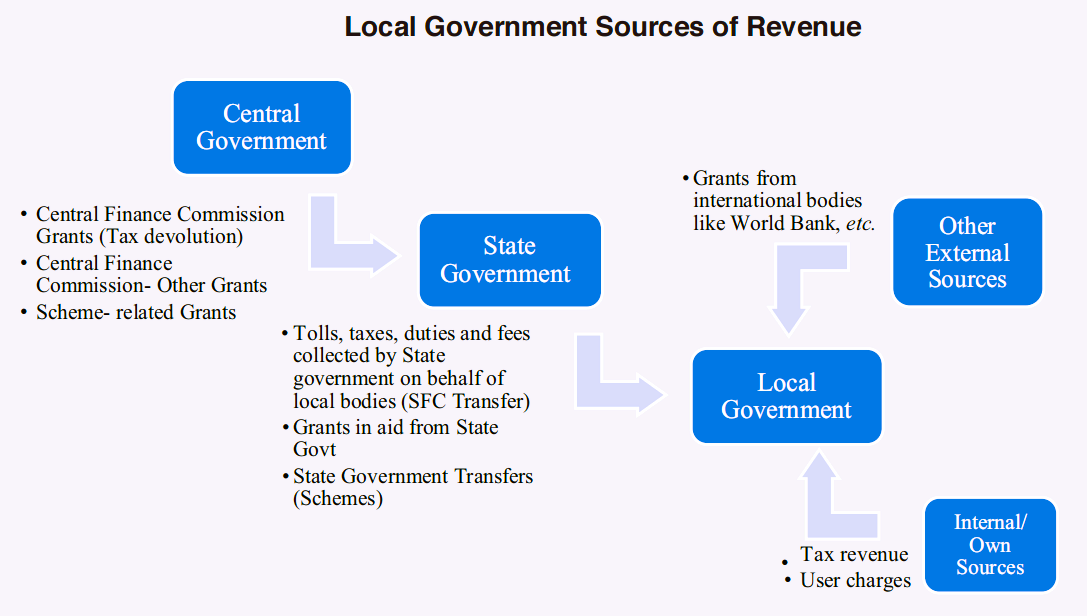

- Central Finance Commissions (CFCs): Successive CFC have recommended a consistent increase in grants to PRIs, from 4,381 crore by the Tenth CFC to 2.37 lakh crore by the Fifteenth CFC.

- State Finance Commission (SFC): Article 243-I of the Constitution stipulates the establishment of a SFC every five years to assess the financial status of Panchayats and propose a framework for sharing taxes between the State and Panchayats.

- The formation of these SFCs has, however, not been consistent across different States.

- Revenue Collection: Article 243-H of the Constitution empowers Panchayats to impose, collect, and allocate taxes, duties, tolls, and fees.

The decisions regarding taxes to be decentralised to local governments are, however, mainly at the discretion of State legislatures.

The decisions regarding taxes to be decentralised to local governments are, however, mainly at the discretion of State legislatures.

- Other Funding Sources: In addition to these revenue sources, Panchayats also receive grants from international organisations and funds for executing Centrally Sponsored Schemes (CSSs) like the Rashtriya Gram Swaraj Abhiyan, the SVAMITVA, the National Horticulture Mission, etc.

Role of Panchayati Raj in India’s Socio-Economic Development

- Rural Development: It encompasses various sectors including agriculture, rural industries, and essential social infrastructure, such as schools, clinics, roads, communication networks, water supply systems, etc.

- According to the 2011 Census, almost 69% of India’s population resides in rural areas, thus panchayats are critical to providing local governance and stepping up rural development.

- Further, PRIs prepare Village Development Plans (VDPs) and implement development projects by allocating resources based on local needs to align development initiatives with the priorities of the rural population.

- Panchayats also serve as implementing agencies for various Central and State government programmes and schemes to help in the targeted delivery of these programmes at the grassroots level.

- Agricultural Development: PRIs implement and oversee initiatives that boost agricultural productivity, support sustainable farming practices, and enhance the overall economic resilience of rural areas.

- For instance, cooperative endeavours like Amul have originated at the Panchayat level.

- SDG Localisation: The Ministry of Panchayati Raj (MoPR) is advancing the Sustainable Development Goals (SDGs) in collaboration with PRIs across rural India.

- The Localisation of SDGs (LSDGs) is being actively pursued through 9 themes viz. (i) Poverty-free and enhanced livelihoods Panchayat; (ii) Healthy Panchayat; (iii) Child-Friendly Panchayat; (iv) Water-Sufficient Panchayat; (v) Clean and Green Panchayat; (vi) Panchayat with Self-sufficient Infrastructure; (vii) Socially Just and Socially Secured Panchayat; (viii) Panchayat with Good Governance; and (ix) Women-Friendly Panchayat.

- Providing Healthcare Facilities: Panchayats play a significant role in providing basic healthcare facilities through establishing and maintaining health centres, clinics, and dispensaries.

- Gram Panchayats contribute to improving maternal and child health by promoting institutional deliveries, encouraging prenatal and postnatal care, and reducing maternal and infant mortality rates.

- From 2021-22 to 2025-26, around 0.70 lakh crore was allocated for local governments for health, with 0.44 lakh crore specified for Rural Local Bodies (RLBs).

- Education: In rural areas, village Panchayats are responsible for constructing, maintaining and enhancing educational institutions, primary schools and community learning centres.

- Panchayats collaborate with schools and parents to encourage enrolment, minimise drop-out rates, and actively monitor school operations, teacher attendance, and educational quality.

- Between 2018 and 2022, the enrolment of children aged 6-14 years in government schools in rural areas increased in all States, with Odisha, Gujarat and West Bengal recording more than 90 per cent of enrolment in government schools

- Women Empowerment: There is a positive and significant correlation between increased women’s participation and improved outcomes in local governance.

- For instance, E. Duflo and R. Chattopadhyay, in a study involving the working of PRIs in West Bengal and Rajasthan observed that women’s representation has had a net positive impact on the delivery of local public goods to marginalised communities.

- Article 243D of the Constitution guarantees women’s involvement in PRIs by stipulating a minimum one-third reservation for women in both the total seats filled by direct election and the positions of Panchayat Chairpersons.

Challenges Associated with Panchayati Raj in India

-

Funds:

- Article 243G of the Constitution allows discretion to the States Governments in the matter of devolution of powers (funds, functions and functionaries) to Panchayats.

- Inadequate Financial Resources: The challenges faced by PRIs in raising local tax revenue include a limited tax base, shortage of administrative infrastructure and adequately trained staff for tax collection and lack of clear guidelines for introducing new taxes.

- None of the available tax sources is particularly substantial in revenue generation, except for the property tax.

- Consequently, some local bodies refrain from imposing and collecting taxes that they can levy.

- Heavy reliance on Grants: Around 95 per cent of their revenues take the form of grants from higher levels of government, restricting their spending ability that is already hampered by delays in the constitution of State Finance Commissions.

- Discrepancies in Revenue Generation: According to the RBI report on the Finances of Panchayati Raj Institutions, States like Tamil Nadu, Himachal Pradesh, Maharashtra, and Telangana reported higher non-tax revenue than others.

-

Functions:

- Lack of Effective Devolution of Power: Since the 73rd CAA does not mandate devolution of functions, local bodies have limited functional capacities, as the devolution of power and authority to panchayats has been left to the discretion of states.

- According to the Standing Committee on Rural Development Report on ‘Improvement in the functioning of Panchayats’, the mandatory meetings of panchayats were not taking place and had poor attendance, especially from women representatives.

Enroll now for UPSC Online Classes

-

- Under-Provision of Basic Human Resources: According to the Standing Committee on Rural Development, there is a severe lack of support staff and personnel in panchayats, such as secretaries, junior engineers, computer operators, and data entry operators. This affects their functioning and delivery of services by them.

Government Initiatives to Strengthen Panchayati Raj Institutions (PRIs)

- e-Gram Swaraj e-Financial Management System: It is a Simplified Work Based Accounting Application for Panchayati Raj that assists in enhancing the credibility of Panchayat through inducing greater devolution of funds to PRIs.

- Rashtriya Gram Swaraj Abhiyan (RGSA) Scheme: It integrates various interventions within the Ministry of Panchayati Raj (MoPR) and across sectors, employing participatory local planning at the Gram Panchayat level.

- Saansad Adarsh Gram Yojana: It envisions the holistic development of villages, transforming them into Adarsh Grams.

- As part of the initiative, each Member of Parliament (MP) is tasked with promoting a holistic development of three Gram Panchayats (GPs) by 2019 and another 5 GPs by 2024.

- LSDGs through PRIs: The Ministry has adopted a thematic approach for LSDGs leveraging a wide network of third tier of Government, the goals on these themes to be attained by 2030 in a graduated manner.

- Panchayat Development Index (PDI): To measure the progress on LSDGs and to carry out assessment to prepare evidence-based policy, MoPR constituted a Committee to prepare mechanisms for computation of PDI.

- Gram Urja Swaraj Abhiyaan: MoPR has collaborated with the Ministry of New and Renewable Energy to include the Gram Panchayats under all its schemes focusing on adoption of renewable energy.

- This will enable Gram Panchayats to evolve as self-sufficient in terms of energy and become producers of energy instead of only being consumers.

- National Panchayati Raj Day (NPRD): NPRD is celebrated annually on April 24th by the MoPR to commemorate the 73rd CAA of 1992.

- Theme for 2023: Panchayaton ke Sankalpon ki Siddhi ka Utsav: Celebrated in line with the directives of adopting “whole-of-society” and “whole-of-government” approach.

|

Way Forward to the Panchayati Raj Finance

- Devolving 3Fs: State governments should make adequate efforts to devolve funds, functions, and functionaries to panchayats for them to effectively plan economic development and social justice schemes.

- The Standing Committee on Rural Development recommended that states devolve subjects like fuel and fodder, non-conventional energy sources, small scale industries including food processing industries, technical training, etc. to panchayats.

- Timely Establishment of State FC: The report recommended that prompt establishment of SFCs, avoiding the sizable delays that occur currently, assumes importance.

- SFCs can strengthen the financial position of PRIs and help them in better delivery of their responsibilities for upliftment of the rural economy.

- Local Revenue Generation: PRIs can improve local revenue generation and use their limited resources more efficiently and effectively through measures such as transparent budgeting and fiscal discipline, active involvement of the local community etc.

- According to NIRDPR, the Velpur Gram Panchayat (GP) in the Nizamabad district in Telangana has demonstrated effective revenue generation from internal sources.

- Data Generation: The G20 Data Gaps Initiative has emphasised the necessity of addressing data gaps that are relevant to policy making.

| The Data Gaps Initiative (DGI) was launched in 2009 by the G20 Finance Ministers and Central Bank Governors (FMCBG) to close the policy-relevant data gaps identified following the global financial crisis. |

-

- At present, the primary source of Panchayat budget information on a national scale is eGramSwaraj and the available budget documents vary in terms of content and format across States and districts.

- According to the RBI, as India gradually aligns itself with the G20 Data Gaps Initiative, the need to bridge data disparities concerning local government finances within the country will become crucial.

- Reporting their finances in standardised formats would strengthen fiscal transparency and accountability at the Panchayat level.

- Improving Participation: The Standing Committee on Rural Development recommended that state governments should put a quorum in gram sabha meetings for participation of panchayat representatives, including women.

Enroll now for UPSC Online Course

![]() 29 Jan 2024

29 Jan 2024

Mahatma Gandhi advocated Gram Swaraj or village self-governance as a decentralised form of governance in which villages would be responsible for their own affairs, serving as cornerstones of India’s political system.

Mahatma Gandhi advocated Gram Swaraj or village self-governance as a decentralised form of governance in which villages would be responsible for their own affairs, serving as cornerstones of India’s political system.

The decisions regarding taxes to be decentralised to local governments are, however, mainly at the discretion of State legislatures.

The decisions regarding taxes to be decentralised to local governments are, however, mainly at the discretion of State legislatures.